Often, the phrases tax and fraud conjure up photos of delinquent celebrities like Willie Nelson going again on tour to pay for $16.7 million in taxes he by no means coughed up. Or Martha Stewart sitting in jail as a result of she determined she didn’t must pay taxes in New York as a result of she wasn’t there a lot. We’re used to celebrities committing tax fraud—however this crime can hit so much nearer to residence too. Common, on a regular basis folks generally commit tax fraud—and get harm by it—on a regular basis.

What Is Tax Fraud?

Anytime somebody purposely deceives the federal government to get out of paying taxes, they’re committing tax fraud. It doesn’t must be some man with a bajillion {dollars}. Lots of people suppose fudging on their taxes is regular. Everyone cheats just a little on their taxes, proper? Properly, perhaps, however that’s fraud.

Nevertheless it’s not at all times about avoiding fee. One other facet of tax fraud is submitting pretend returns to get a bogus refund or utilizing another person’s ID to keep away from paying earnings taxes.

Varieties of Tax Fraud

There are a number of alternative ways to deceive the federal government and steal from folks. Let’s check out a number of the methods thieves, scammers and white-collar criminals (and even some in any other case law-abiding folks) skirt the regulation.

Criminals defraud the federal government and all people by:

- Reporting that they had much less earnings than they did

- Mendacity on paperwork to get out of paying taxes

- Purposely refusing to file a tax return or pay their taxes

Criminals defraud people by:

- Utilizing a false Social Safety quantity (SSN) to file

- Pretending to be a legit tax preparer, submitting false returns for unsuspecting prospects and pocketing the refund cash

All a lot of these tax fraud harm sincere folks. However the second group is unquestionably extra painful as a result of these are actual folks typically getting their lives upended.

Tax Identification Theft

Thieves typically use stolen SSNs to file a tax return and run off with a tax refund they didn’t earn. Or they use another person’s SSN on their W-4 type at work, so that they take residence the paycheck and another person will get the tax invoice. That is additionally referred to as tax identification theft.

Typically the criminals utilizing your SSN additionally mess up your taxes, reporting all kinds of pretend info (like you’ve got seven dependents or suffered losses within the inventory market) to get a much bigger refund. Then, as a result of the IRS solely is aware of you by your SSN, they arrive after you when the information doesn’t add up!

With the fraudsters utilizing your SSN for work, they get to keep away from paying taxes on their earnings and also you get the IRS knocking in your door for underreporting your earnings—they usually’ll preserve tacking on charges and curiosity till you show you’re a sufferer of fraud.

IRS scams aren’t technically tax fraud—however they’re scummy all the identical. Fraudsters name, textual content or electronic mail you pretending to be from the IRS. They’ll say you owe the IRS cash to attempt to get you to share your delicate data. Don’t fall for it! When you owe cash, the IRS will contact you thru the mail—typically a number of occasions with what they name notices.1

How Tax Fraud Impacts You

Whether or not it’s tax identification theft or plain previous fraud, tax fraud hurts law-abiding residents. If somebody makes use of your SSN to file a false return or conceal earnings, the implications to you’re fairly apparent. You’ll in all probability be accused of tax fraud your self as an alternative or get in hassle for not paying sufficient! And also you’ll miss out in your refund till the mess will get straightened out—which will likely be a headache-and-a-half as a result of it’s the IRS.

Try 30 days of identity theft protection free from our RamseyTrusted provider.

That each one is smart. However chances are you’ll be questioning, How do the opposite sorts of tax fraud harm me? They’re stealing from Uncle Sam, not me. That’s true, however each taxpayer advantages from the providers their taxes pay for.

In 2022, the federal authorities misplaced out on $5.7 billion from tax fraud.2 If a bunch of crooks don’t pay their taxes and get fraudulent tax refunds as an alternative, the federal government has much less tax income to fund the providers all of us depend on. So IRS fraud may result in underfunding within the navy, training, Social Safety, Medicare, highways and all kinds of different issues taxes pay for.

Evasion or Avoidance?

It’s utterly authorized to keep away from overpaying your taxes, However evading taxes isn’t. The distinction is fairly essential.

U.S. tax legal guidelines supply some ways for taxpayers to decrease their tax payments. For instance, you may donate to a charity, contribute to a retirement plan or declare a toddler tax credit score. But when somebody claims that they had 5 youngsters when all they really had was a Doodleman Pinscher (yep, precise canine breed), that’s evasion and they’ll get slapped with a hefty nice if caught and probably go to jail.

Listed below are a number of the respectable methods you may pay much less in taxes:

- Benefit from the self-employment tax deduction, when you’re self-employed

- Deduct enterprise bills out of your earnings when you personal a enterprise

- Fund a retirement plan (like a tax-deferred 401(okay) or an IRA) or Well being Financial savings Account

- Benefit from the kid tax credit score in case you have qualifying youngsters

- Use an training tax credit score when you’re paying for larger ed

- Declare the earned earnings tax credit score (EITC) in case your earnings is low

Listed below are some illegitimate methods folks evade taxes:

- Declare deductions they don’t qualify for (like deducting the price of air journey as a enterprise expense once they went to Cancun for vacay)

- Falsify paperwork to make it appear like they’ve much less earnings

- Declare credit for one thing they don’t have (like a child) or aren’t doing (like faculty)

- Shifting earnings or property to “hidden” accounts

- Falsely labeling transactions (like calling one thing “curiosity” as an alternative of a dividend) to cover earnings

- Paying staff in money and never reporting them as workers

As you may see, all of the illegitimate evasions contain mendacity or deception—a simple option to inform it’s not okay to do.

Now chances are you’ll be questioning, What if I unintentionally report I had much less earnings or messed one thing else up? Don’t fear, you received’t go to jail. However the IRS doesn’t take kindly to individuals who don’t pay what they owe—even when it’s an accident—so that you will must pay some fines (however the sooner you appropriate your mistake the much less you’ll must pay in penalties and curiosity).

Easy methods to Keep away from Turning into a Sufferer of Tax Fraud

Sure, there are a number of methods somebody can flip you right into a tax fraud sufferer, however there are additionally a number of methods you may forestall it!

If fraudsters can’t discover your SSN, they will’t use it to file a pretend tax return. Hold your tax information and all of your vital paperwork in a secure place. Shred any paperwork with delicate data earlier than throwing them within the trash can.

Utilizing a tax preparation software with multi-factor authentication will assist preserve the information in your return secure. Ramsey SmartTax is a safe option to file your taxes from the comfort of your private home.

When you’re having another person do your tax return, be certain that they’re a good tax preparer. Get in contact with one in all our tax pros—they’re RamseyTrusted so that you might be positive your taxes will likely be accomplished proper.

Keep away from any tax preparer who needs you to signal a clean tax return or signal something with out cautious assessment.

Be cautious about utilizing anybody who will get paid primarily based on the dimensions of a tax refund they are saying they will get you.

When you obtain any notification from the IRS that there’s an issue along with your return, speak to your tax preparer straight away to allow them to straighten it out.

In that very same vein, don’t give your private info out to anybody who calls, texts or emails claiming they’re from the IRS. Scammers typically impersonate IRS brokers to intimidate you into sharing delicate knowledge they will use to steal from you. When you get a name from somebody telling you you’re in hassle with the IRS, hold up and name the IRS your self to double-check.

Early Warning Indicators and Steps to Take

When you do the tax slog and get your tax return filed on time solely to have your return rejected as a result of the IRS already has one utilizing your SSN, that’s a giant purple flag chances are you’ll be a sufferer of tax identity theft. Somebody could have already despatched in a bogus return in your title!

That’s not the one signal you may be in hassle. Take a look at these different indicators you may be a sufferer of IRS identification theft:

- The IRS contacts you thru the mail a few tax return you didn’t file.

- The IRS notifies you an internet account was created in your title—however you didn’t make it.

- Your IRS account is disabled or accessed regardless that you didn’t do something.

- The IRS contacts you saying you owe extra taxes.

- The IRS says you owe for a 12 months you didn’t file a tax return.

- You obtain an employer identification quantity (EIN), however you didn’t ask for one.

- In response to the IRS, you’ve got earned earnings—but it surely’s from an employer you by no means labored for.

6 Steps to Take if You’re a Sufferer of Tax Fraud

If any of these items have occurred to you, there are some things you are able to do instantly.

Report Fraud to the IRS Proper Away

When you’ve obtained a letter from the IRS about exercise you don’t suppose you probably did, get in contact straight away and allow them to know. If the letter says you have been paid by an employer you don’t acknowledge, contact the employer as effectively to allow them to know somebody stole your identification and you aren’t their worker.

Hold Data

Write down the names of all of the folks and companies you contacted and while you reached out. Make a replica of any communication you’ve got with anybody concerned within the fraud (just like the IRS, Federal Commerce Fee, employer you didn’t work for, and many others.).

Submit an IRS Identification Theft Affidavit

When you’re questioning report tax fraud that includes your identification being stolen, that is how: Fill out IRS Kind 14039, Identification Theft Affidavit, and submit it along with your paper tax return. Do that instantly in case your e-file return will get rejected.

Hold Paying Your Taxes

Sadly, simply because another person stole from you doesn’t imply you’re off the hook in your actual tax invoice. When you can’t submit an digital return, file by paper. That method when the mud settles, the IRS can’t penalize you for submitting late or not submitting.

Create a Fraud Alert

Get in contact with one of many three credit score bureaus within the U.S. (TransUnion, Experian and Equifax) and allow them to know your identity has been stolen. They’ll subject a fraud alert. This implies collectors will take additional steps to verify it’s actually you earlier than extending credit score in your title.

File a Grievance With the Federal Commerce Fee (FTC)

The FTC helps with restoration after your identification has been stolen. They’ll create an Identification Theft Report you should use to show to companies your identification was stolen. By way of the FTC, you’ll additionally get a plan to get better your identification.

Don’t Wait Till It’s Too Late

In 2022, 5.15 million instances of identification theft have been reported, and it’s simply getting worse.3 During the last decade, identification theft instances have almost tripled.4 If these stats sound scary, that’s as a result of they’re. Fraud and identification theft are critical issues in our more and more difficult world.

However there’s no must freak out. On high of the steps we talked about to assist preserve your identification secure, identification theft safety can add an additional layer of safety and peace of thoughts.

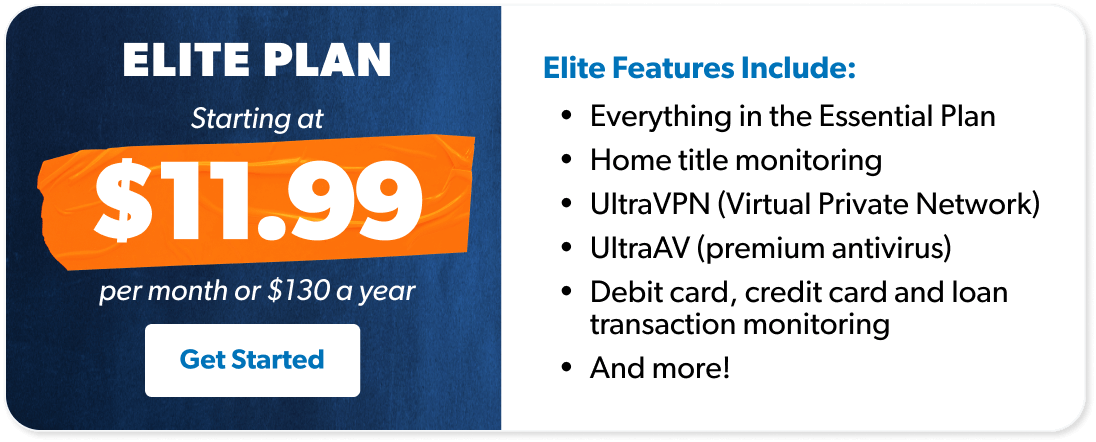

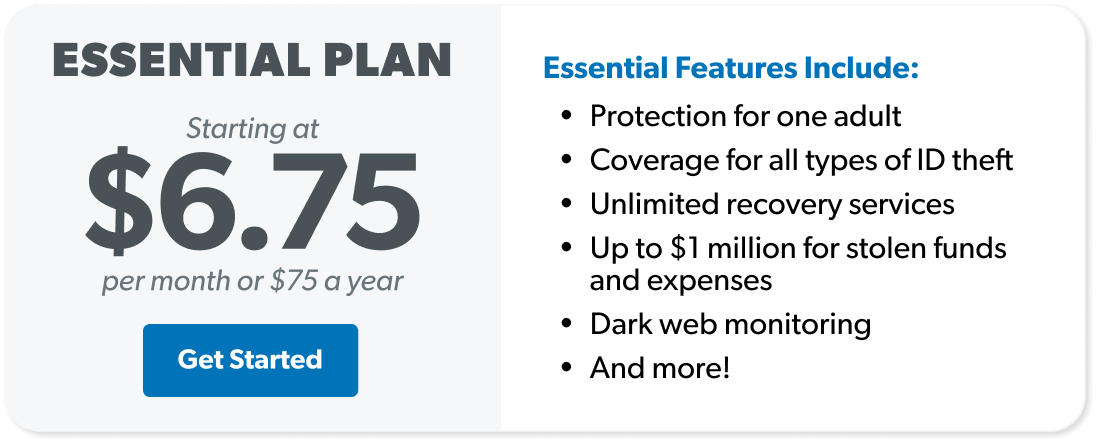

We advocate RamseyTrusted supplier Zander Insurance coverage as a result of they monitor your info in actual time, warn you to dangers, clear up the mess if the worst ought to occur, and canopy as much as $1 million in stolen funds.

Don’t wait till some thief pilfers your tax return to take motion. Get in touch with Zander and put some serious security between you and the bad guys!

Curious about studying extra about identification theft?

Signal as much as obtain useful steering and instruments.