Bitcoin (BTC) has moved to reclaim the $86,000 worth degree following a 2.65% achieve within the final 24 hours. Notably, the premier cryptocurrency has maintained a bullish kind over the previous few rising by over 15% since retesting the $74,000 rice zone. Amid a possible resumption of the broader bull rally, outstanding crypto analyst Burak Kesmeci has highlighted notable developments in Bitcoin short-term holders MVRV (Market Worth to Realized Worth) ratio.

Bitcoin Market Restoration Awaits Closing Sign: Analyst

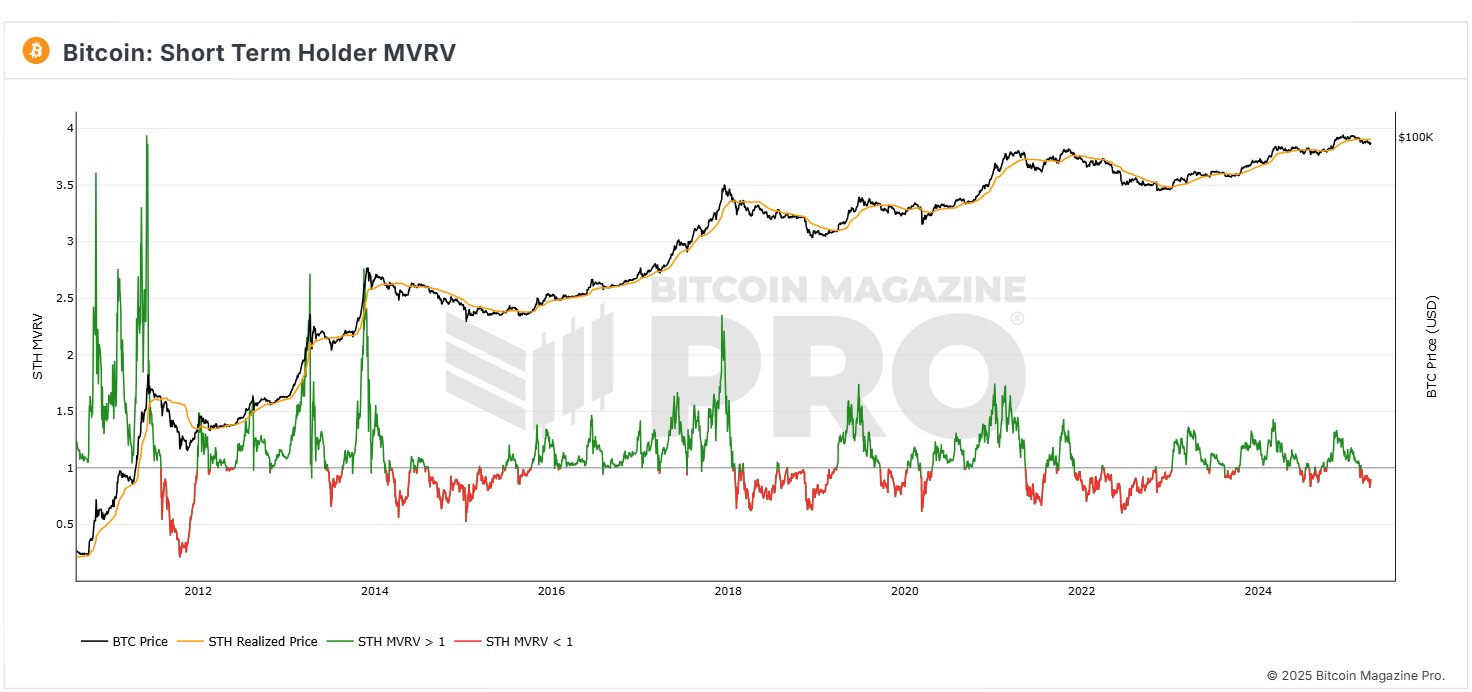

In a new post on X, Kesmeci explains that Bitcoin is exhibiting early indicators of a market restoration following latest developments within the Bitcoin MVRV for short-term buyers. For context, the MVRV measures buyers’ profitability by evaluating the market worth of an asset to the worth at which it was acquired. An MVRV rating beneath 1.00 signifies that the typical holder is at a loss, whereas a rating above 1.00 suggests revenue.

The MVRV for Bitcoin short-term holders i.e. addresses which have held Bitcoin for lower than 155 days, is especially necessary as this cohort of buyers is normally probably the most reactive to cost modifications. Notably, the STH MVRV supplies perception into market sentiment and potential worth path.

In response to Kesmeci, the Bitcoin STH MVRV is now at 0.90, near a revenue degree above 1.00. The STH MVRV had hit 0.82 amidst the recent “tax tariff poker” crisis, ignited by worldwide tariff modifications by the US authorities. Notably, this decline falls decrease than ranges seen throughout the Japan-based carry commerce disaster on August 5, 2024, when STH MVRV dipped to 0.83.

Over the previous few days, the STH MVRV has climbed to 0.90 in keeping with the resurgence of BTC costs Nevertheless, Kesmeci warns that Bitcoin should nonetheless cross 1.00 to verify the potential for any vital worth positive factors for short-term buyers. Albeit, the rise from 0.82 to 0.90 stays a constructive improvement that signifies an ongoing shift in market sentiment.

BTC Value Outlook

At press time, Bitcoin is buying and selling at $85,390 following a slight worth retracement previously few hours. Amidst latest each day positive factors, the premier cryptocurrency is up by 2.11% on its weekly chart and 4.33% on the month-to-month chart as bullish momentum continues to construct amongst buyers. Nevertheless, market bulls should offset the 38.98% decline in each day buying and selling quantity if the current uptrend should persist.

Notably, BTC buyers ought to count on to face ample resistance on the $88,000 worth zone which has acted as a powerful worth barrier in earlier occasions. In the meantime, within the creation of any worth fall, the quick worth help lies round $79,000.

Featured picture from iStock, chart from Tradingview

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our staff of prime expertise specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.