World liquidity has lengthy been one of many cornerstone indicators used to evaluate macroeconomic circumstances, and notably when forecasting Bitcoin’s value trajectory. As liquidity will increase, so does the capital obtainable to circulate into risk-on property, similar to Bitcoin. Nonetheless, on this evolving market panorama, a extra responsive and maybe even extra correct metric has emerged, one which not solely correlates extremely with BTC value motion however can be particular to the ecosystem.

World M2

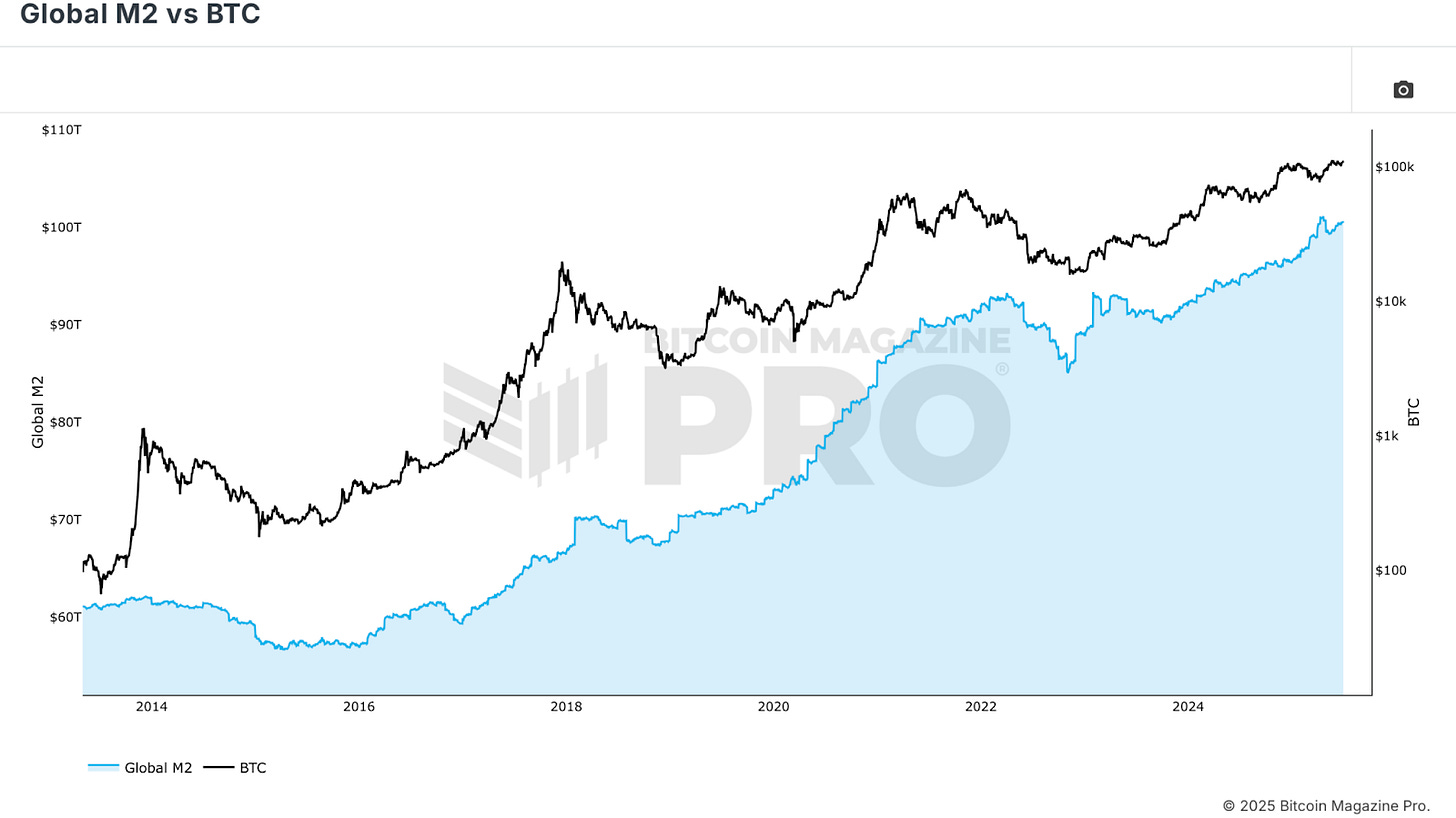

Let’s start with the Global M2 vs BTC chart. This has been probably the most shared and analyzed charts on Bitcoin Journal Professional all through the present bull cycle, and for good cause. The M2 provide encompasses all bodily forex and near-money property in an economic system. When aggregated globally throughout main economies, it paints a transparent image of fiscal stimulus and central financial institution habits.

Traditionally, main expansions in M2, particularly these pushed by cash printing and financial interventions, have coincided with explosive Bitcoin rallies. The 2020 bull run was a textbook instance. Trillions in stimulus flooded world economies, and Bitcoin surged from the low hundreds to over $60,000. The same sample occurred in 2016-2017, and conversely, intervals like 2018-2019 and 2022 noticed M2 contraction aligning with BTC bear markets.

A Stronger Correlation

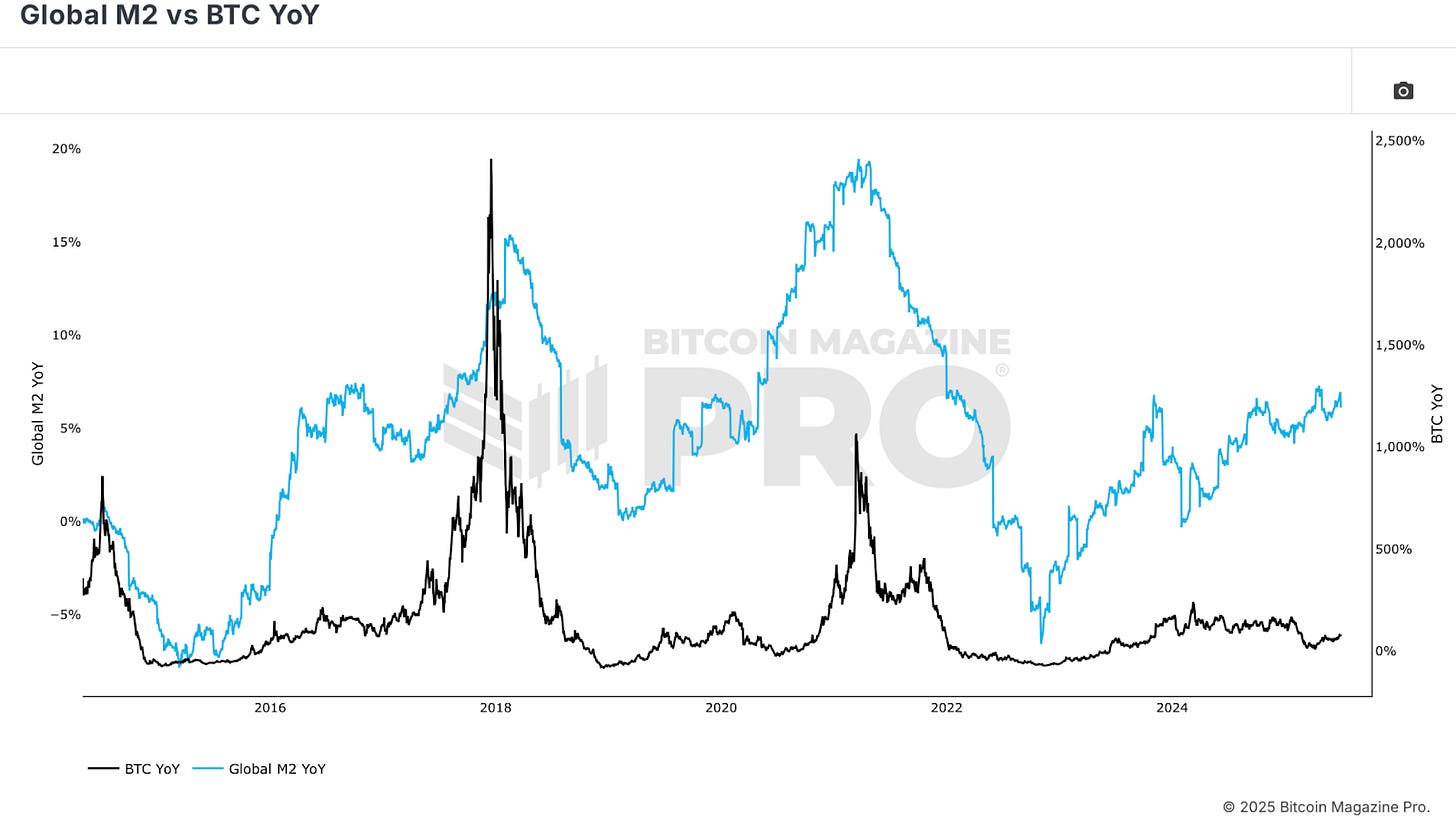

Nonetheless, whereas the uncooked M2 chart is compelling, viewing Global M2 vs BTC Year-on-Year gives a extra actionable view. Governments are likely to all the time print cash, so the bottom M2 provide almost all the time tendencies upward. However the price of acceleration or deceleration tells a unique story. When the year-over-year progress price of M2 is rising, Bitcoin tends to rally. When it’s falling or damaging, Bitcoin sometimes struggles. This pattern, regardless of short-term noise, highlights the deep connection between fiat liquidity growth and Bitcoin’s bullishness.

However there’s a caveat: M2 knowledge is sluggish. It takes time to gather, replace, and mirror throughout economies. And the affect of elevated liquidity doesn’t hit Bitcoin instantly. Initially, new liquidity flows into safer property like bonds and gold, then equities, and solely later into greater volatility, speculative property like BTC. This lag is essential for timing methods. We will add a delay onto this knowledge, however the level stays.

Stablecoins

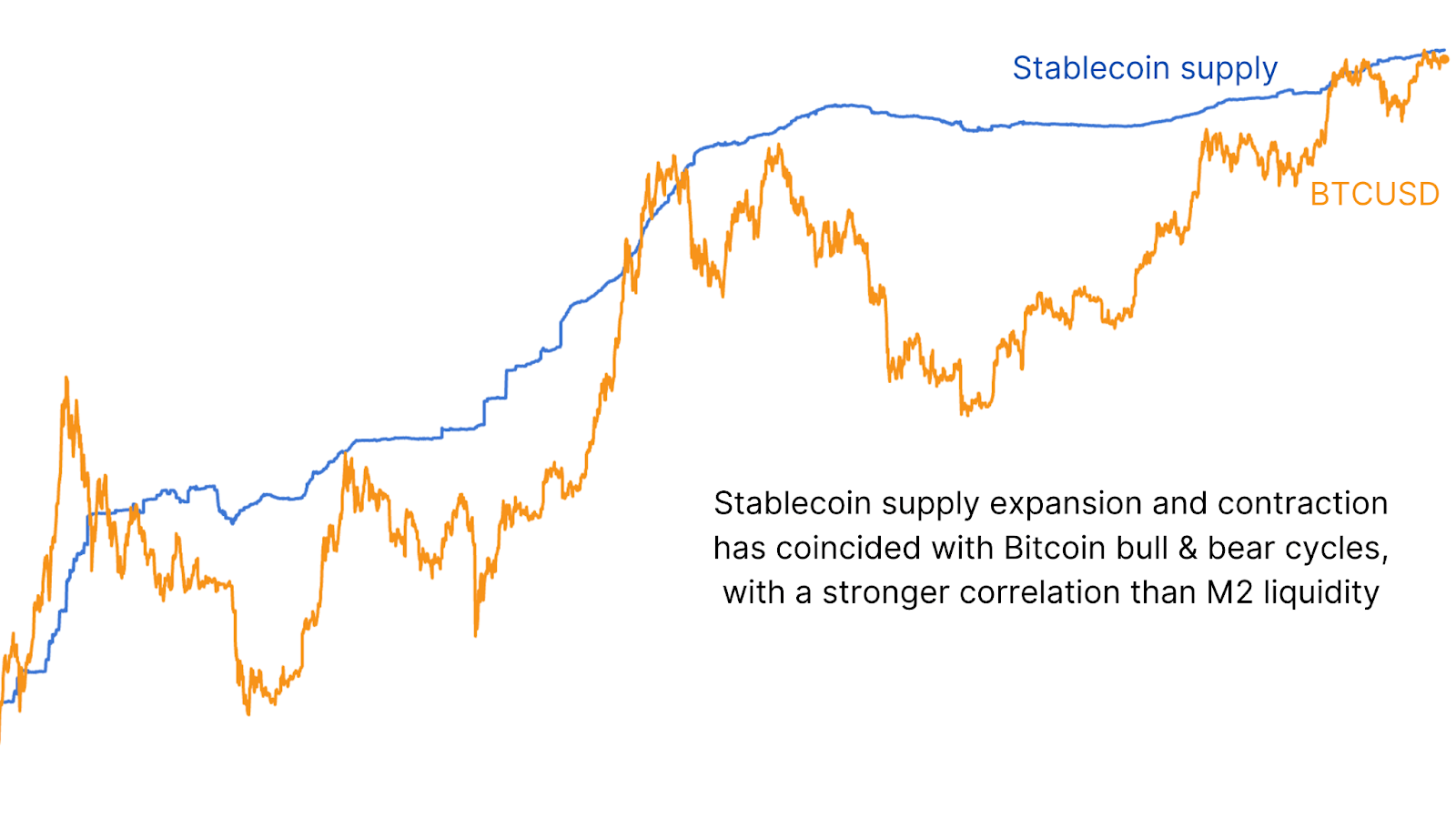

To deal with this latency, we pivot to a extra well timed and crypto-native metric: stablecoin liquidity. Evaluating BTC to the provision of main stablecoins (USDT, USDC, DAI, and many others.) reveals an excellent stronger correlation than with M2.

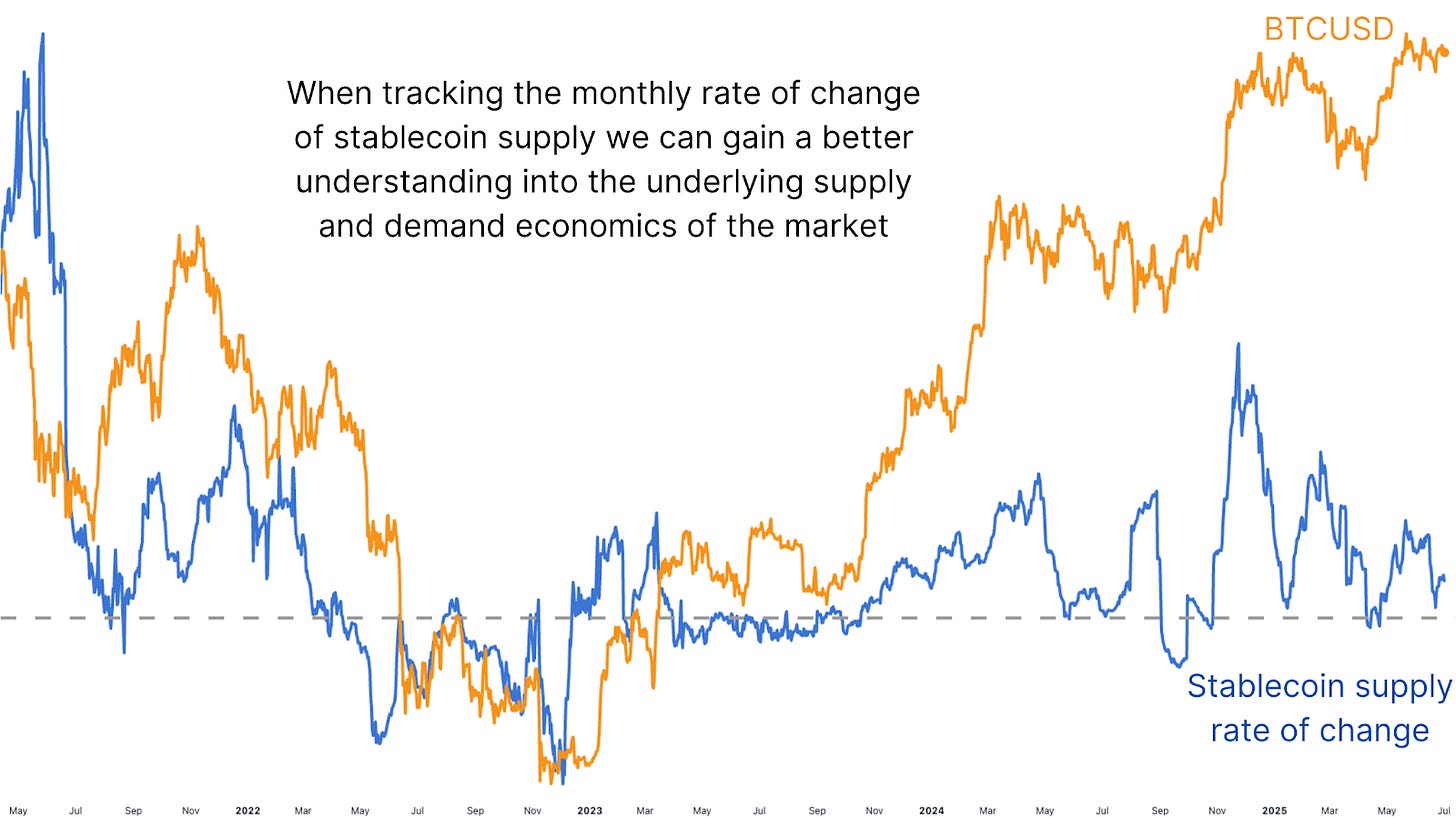

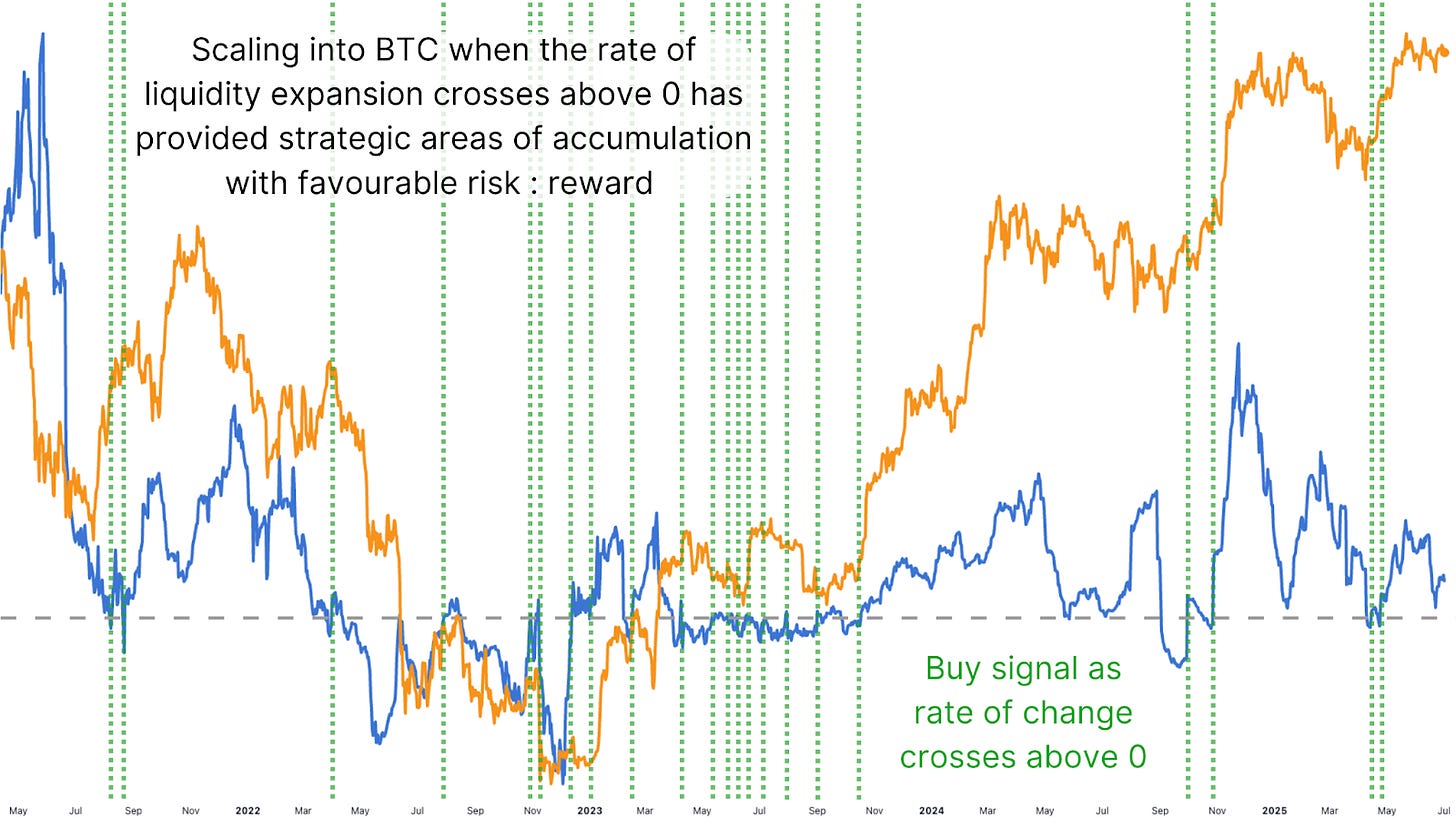

Now, simply monitoring the uncooked worth of stablecoin provide presents some worth, however to actually acquire an edge, we study the speed of change, notably over a 28-day (month-to-month) rolling foundation. This modification in provide is extremely indicative of short-term liquidity tendencies. When the speed turns optimistic, it usually marks the start of latest BTC accumulation phases. When it turns sharply damaging, it aligns with native tops and retracements.

Trying again on the tail finish of 2024, as stablecoin progress spiked, BTC surged from extended consolidation into new highs. Equally, the key 30% drawdown earlier this yr was preceded by a steep damaging flip in stablecoin provide progress. These strikes have been tracked to the day by this metric. Much more latest rebounds in stablecoin provide are beginning to present early indicators of a possible bounce in BTC price, suggesting renewed inflows into the crypto markets.

Determine 5: Up to now, the indicator triggered by the liquidity price crossing above zero has been a dependable purchase sign.

The worth of this knowledge isn’t new. Crypto veterans will keep in mind Tether Printer accounts on Twitter relationship again to 2017, watching each USDT mint as a sign for Bitcoin pumps. The distinction now could be we are able to measure this extra exactly, in real-time, and with the added nuance of rate-of-change evaluation. What makes this much more highly effective is the intracycle and even intraday monitoring capabilities. In contrast to the World M2 chart, which updates occasionally, stablecoin liquidity knowledge might be tracked stay and used on quick timeframes, and when monitoring for optimistic shifts on this change, it might present nice accumulation alternatives.

Conclusion

Whereas World M2 progress aligns with long-term Bitcoin tendencies, the stablecoin rate-of-change metric gives readability for intra-cycle positioning. It deserves a spot in each analyst’s toolkit. Utilizing a easy technique, similar to in search of crossovers above zero within the 28-day price of change for accumulation, and contemplating scaling out when excessive spikes happen, has labored remarkably nicely and can probably proceed to take action.

💡 Liked this deep dive into bitcoin value dynamics? Subscribe to Bitcoin Magazine Pro on YouTube for extra professional market insights and evaluation!

For extra deep-dive analysis, technical indicators, real-time market alerts, and entry to professional evaluation, go to BitcoinMagazinePro.com.

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. All the time do your personal analysis earlier than making any funding choices.