Bitcoin’s company treasuries and bitcoin mining sector have turn into two of the defining narratives of this cycle. From (Micro)Technique’s MSTR billion-dollar stability sheet buys to the rise of MetaPlanet and the explosive development of bitcoin mining corporations, institutional and industrial adoption have emerged as highly effective structural helps for the community. However now, after years of near-constant accumulation and market outperformance, the info suggests we’re coming into a vital inflection level — one that might decide whether or not Bitcoin’s company treasuries and mining equities proceed to guide or start to lag as the subsequent section of the cycle unfolds.

Bitcoin Treasury Accumulation

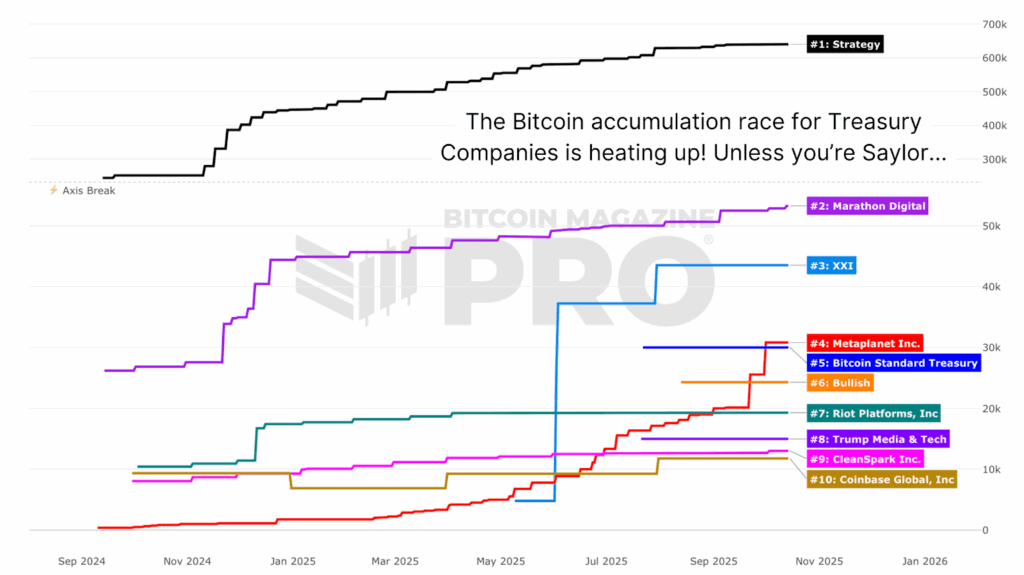

Our new Bitcoin Treasury Tracker offers day-by-day perception into how a lot Bitcoin these main private and non-private treasury corporations maintain, once they’ve accrued, and the way their positions have advanced. These treasuries now collectively maintain over 1 million BTC, a staggering sum representing over 5% of the whole circulating provide.

The size of this accumulation has been a cornerstone of Bitcoin’s present cycle power. Nonetheless, a few of these corporations are going through growing strain as their fairness valuations battle to maintain tempo with the Bitcoin value itself.

Valuation Compression Throughout Bitcoin Treasuries

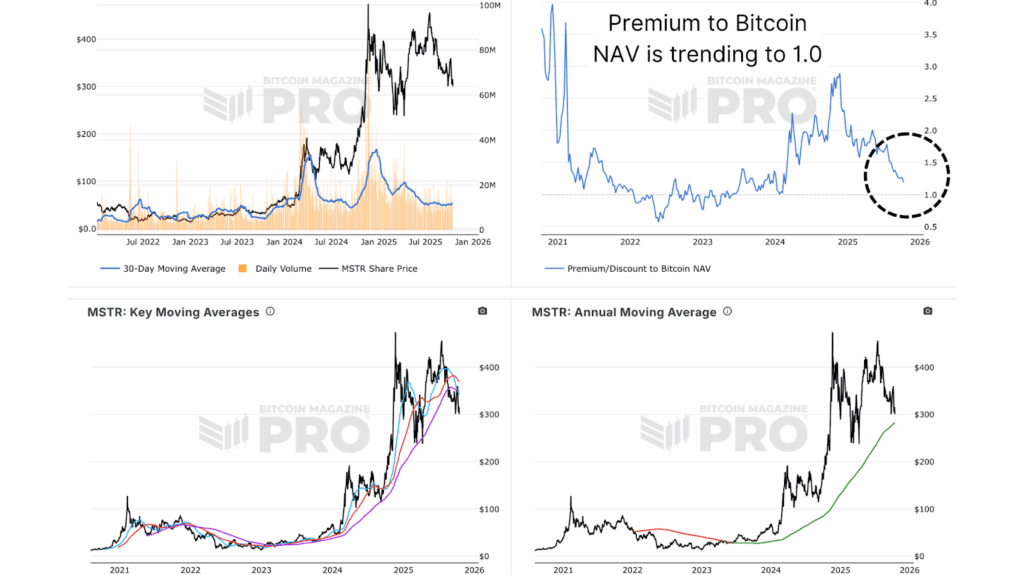

(Micro)Technique / MSTR, the pioneer of company Bitcoin adoption, stays probably the most vital publicly traded Bitcoin holder. But, current months have seen its inventory underperform relative to Bitcoin’s personal value motion. Whereas Bitcoin has consolidated in a broad vary, MSTR’s fairness has fallen extra sharply, pushing its Net Asset Value (NAV) Premium, the ratio between its market valuation and the underlying Bitcoin it holds, nearer to parity at 1.0x.

This compression indicators that buyers are valuing the corporate more and more in keeping with its pure Bitcoin publicity, with little added premium for administration execution, future leverage, or strategic innovation. Final cycle and earlier this cycle, MSTR traded with a major premium as markets rewarded its leveraged publicity. The pattern towards parity suggests waning speculative urge for food and highlights simply how intently this cycle’s market psychology mirrors prior late-stage expansions.

A Cycle-Defining Inflection for Bitcoin and Bitcoin Mining Shares

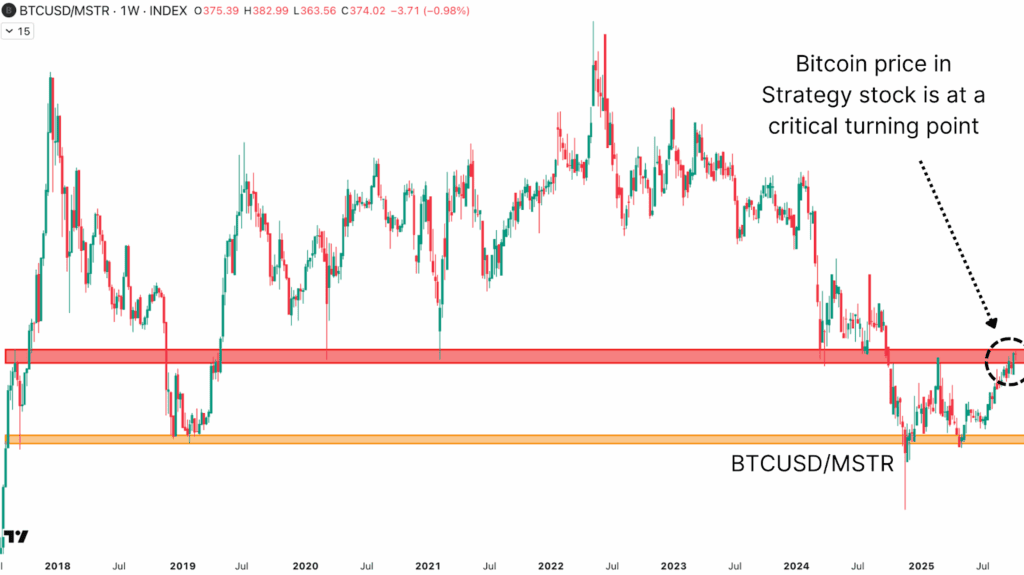

Essentially the most revealing view comes from the BTCUSD to MSTR ratio, primarily measuring what number of MSTR shares may be bought with one Bitcoin. At current, the ratio sits round 350 shares per BTC, putting it squarely at a significant historic degree of help turned resistance that has outlined value motion turning factors.

Proper now, this chart is sitting at a make-or-break area. A sustained transfer above the 380–400 zone would indicate renewed Bitcoin dominance and potential underperformance in MSTR. Conversely, a reversal decrease, particularly under 330, would counsel that MSTR may reassert itself as a leveraged chief heading into the subsequent leg of the bull market.

Bitcoin Mining Shares Take the Lead

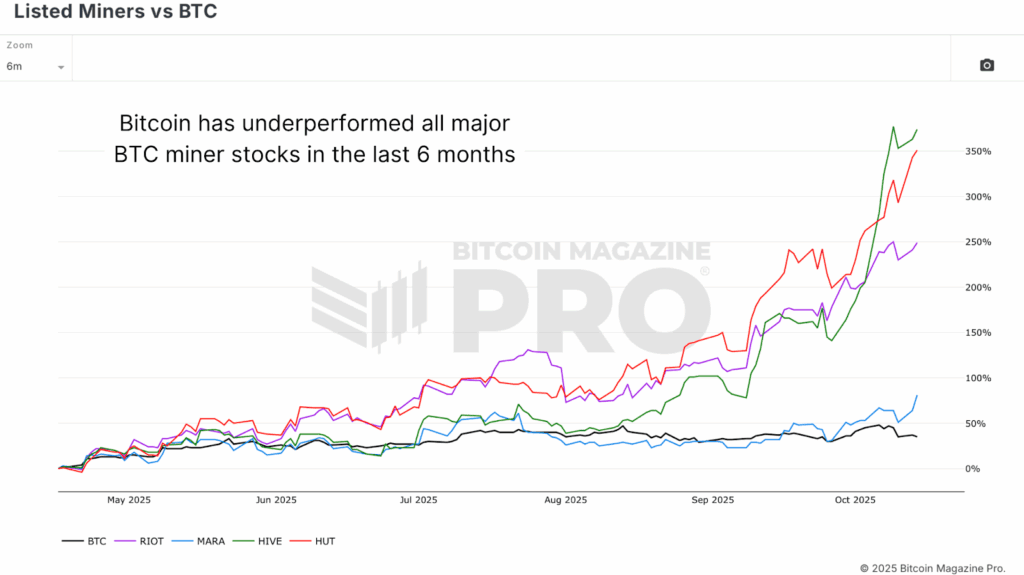

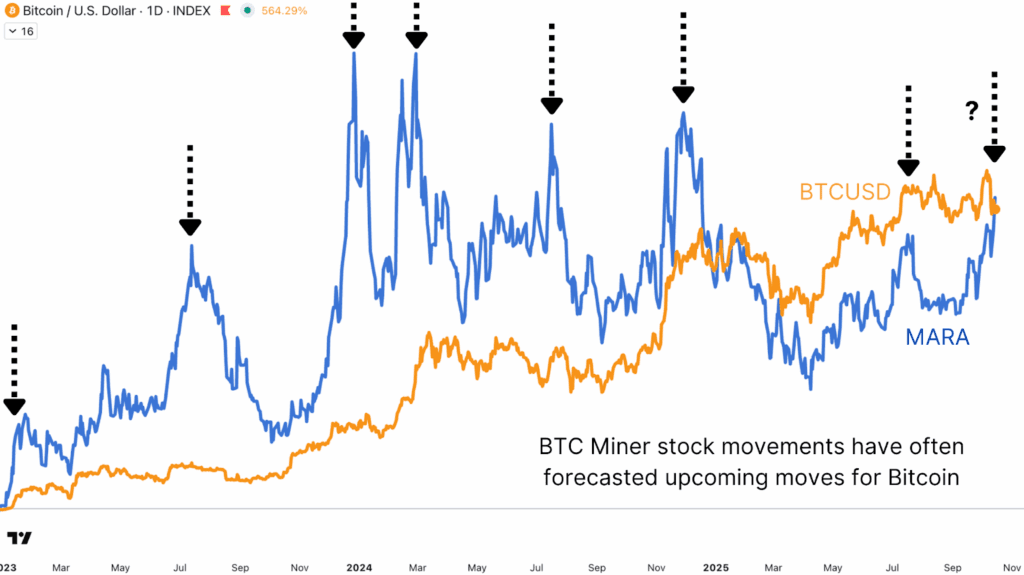

In distinction to the underperformance of treasury corporations, Bitcoin miners have been surging. Over the previous six months, Bitcoin itself has gained roughly 38%, whereas Listed Miner equities have exploded larger: Marathon Digital (MARA) is up 61%, Riot Platforms (RIOT) has surged 231%, and Hive Digital (HIVE) has soared a staggering 369%. The WGMI Bitcoin Mining ETF, a composite of main listed miners, has outperformed Bitcoin by roughly 75% since September, underscoring the sector’s newfound momentum.

Zooming in on Marathon Digital, the world’s largest publicly traded Bitcoin miner, offers extra perception. Traditionally, the MARA chart has been a dependable main indicator of market inflection. On the tail finish of the 2022 bear market, for instance, MARA surged over 50% simply earlier than Bitcoin entered a brand new multi-month rally. This sample has occurred a number of instances this cycle.

Bitcoin Mining Shares and Company Treasuries: Diverging Paths in Bitcoin Market Management

With over 1 million BTC now held on company stability sheets, the affect of those entities on Bitcoin’s supply-demand equilibrium stays profound. However the stability of management seems to be shifting. Treasuries like Technique and MetaPlanet, whereas structurally bullish over the long run, at the moment are sitting at main ratio inflection factors, struggling to outperform spot BTC. In the meantime, miners are experiencing one in all their strongest intervals of relative efficiency in years, typically a sign that broader market momentum could quickly comply with.

As at all times, our purpose at Bitcoin Journal Professional is to chop via market noise and current data-backed insights throughout each aspect of the Bitcoin ecosystem, from company holdings to miner conduct, on-chain provide, and macroeconomic liquidity. Thanks all very a lot for studying, and I’ll see you within the subsequent one!

For a extra in-depth look into this subject, watch our most up-to-date YouTube video right here: Now Or Never For These Bitcoin Stocks

For deeper information, charts, {and professional} insights into bitcoin value developments, go to BitcoinMagazinePro.com.

Subscribe to Bitcoin Magazine Pro on YouTube for extra skilled market insights and evaluation!

Disclaimer: This text is for informational functions solely and shouldn’t be thought of monetary recommendation. At all times do your individual analysis earlier than making any funding selections.