So, you simply received a elevate or a brand new job with an even bigger paycheck. Good for you! However what occurs to the additional money now coming your approach every month? Should you aren’t cautious, life-style creep can get you off observe from getting forward together with your cash. So, let’s discuss what it’s and how one can keep away from it.

What Is Life-style Creep?

Plain and easy, life-style creep is when your earnings goes up and your spending creeps proper as much as meet it. You don’t even discover the shift. It simply occurs. If you consider it, it’s the good identify, proper?

Life-style creep is usually referred to as life-style inflation … or liflation. (Really, liflation isn’t a phrase. I simply made that up.)

Now, on one hand, issues could possibly be worse. You would be overspending. However life-style creep continues to be unhealthy to your cash. All these financial goals you’ve received? A elevate may actually make it easier to get there approach sooner! However not for those who simply begin mindlessly spending it on impulse buys, consuming out, espresso runs or effectively . . . something!

Life-style creep can occur at any life stage. Raises, facet hustles, promotions: Any time you up your earnings, you’ve received to be intentional with that cash. In any other case, your life-style will creep in and take over.

Indicators of Life-style Creep

Okay, so how are you aware for those who’re experiencing life-style creep? Listed below are just a few indicators to tip you off:

Your cash objectives are at a standstill.

Most of us have cash objectives. What are yours? Constructing an enormous emergency fund? Paying off your debt? Saving up for that dream trip? Investing in retirement?

The excellent news is—you are able to do all of these issues. The unhealthy information is—you possibly can’t for those who’re spending every part you make. You’ve received to be intentional together with your cash. That’s the way you make it do what you need it to do.

In case your earnings goes up however you’re not seeing progress in your cash objectives, that’s one of many indicators of life-style creep.

Your spending has gone up, however your financial savings hasn’t.

Pay attention, I’m a natural-born spender. It’s not on the extent of a shopping addiction. I’m simply geared towards spending cash, and I really like spending it.

However I do know that about myself. So if my earnings goes up, I do know I’ve received to be diligent about the place that cash goes.

So, in case your spending is on the rise however your financial savings isn’t, that’s one other clue you could be experiencing life-style creep.

Little luxuries have develop into widespread habits.

Bear in mind when getting a flowery latte within the drive-thru on the way in which to work was treating your self? And now you get one practically each morning?

Okay, possibly it’s not coffees for you. Perhaps it’s shopping for lunch each workday or getting pedicures every week or getting a $13 cocktail each time you exit for dinner.

No matter it’s, hear this: There’s nothing unsuitable with spending cash on enjoyable issues, so long as it’s within the funds and never holding you again. But when all of the issues that have been as soon as treats now really feel fully regular—and even essential—it may be an indication of life-style creep.

Why Life-style Creep Is Dangerous

I hope you possibly can see that purchasing good issues isn’t the issue right here. The issue is senseless spending. The issue is letting your cash do no matter as a substitute of telling it to do what you need.

Life-style creep is dangerous to your financial health and your financial security. You’re buying and selling the long run for the current—however you aren’t even actually conscious you’re doing it!

Get Rachel Cruze’s new book to learn why you handle money the way you do!

Pay attention, for those who get a elevate or begin making more money another approach—take a minute to rejoice it with family and friends. However then, begin making a plan for what to do with that cash. Or the following 12 months will come and go with out you even realizing what you spent it on.

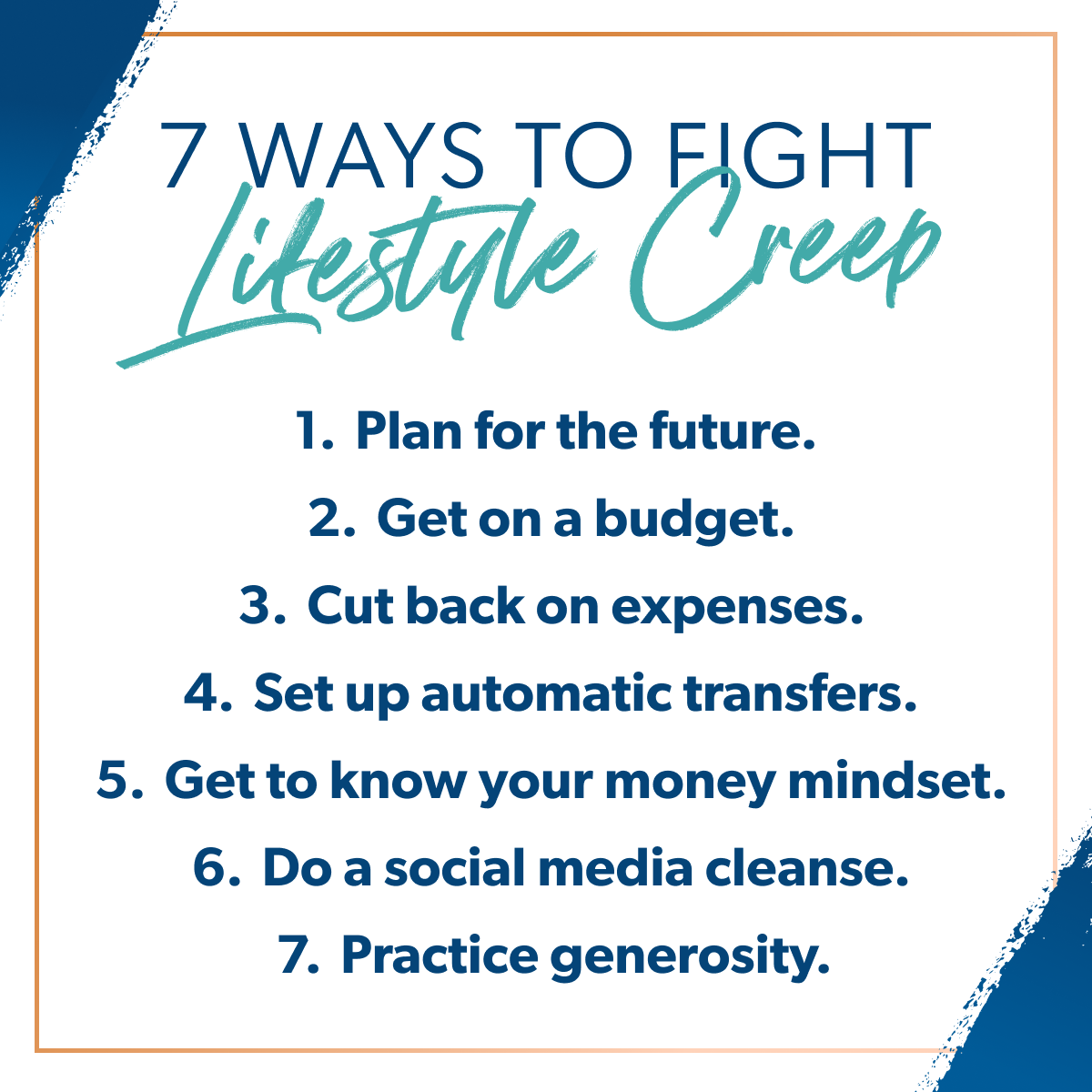

7 Methods to Combat Life-style Creep

Okay, guys. It’s time to do the precise factor I simply stated—begin making a plan. This subsequent half is all about being intentional together with your elevated earnings, as a result of that’s the way you’ll struggle life-style creep. And win.

1. Plan for the long run.

All your cash choices will circulation out of what’s vital to you. Your profession selections, purchases, investments, school choice for the children—every part! So, let’s begin there!

Take a while to consider your values. Then, write down your monetary objectives and put up photos of these objectives so that you might be reminded of why you’re taking over the struggle towards life-style creep. You must put within the work immediately to get the tomorrow you’re dreaming of. And belief me, it’s value it.

2. Get on a funds.

Budgeting is the key to getting forward together with your cash. A budget is only a plan to your cash. And that’s precisely what you want proper now.

Life-style creep occurs when you don’t have any plan to your additional earnings. You spend it—however not in a approach that displays your private values and will get you nearer to your desires for the long run.

Get on a funds and track every single transaction so you possibly can see the place your cash’s going—and begin telling it the place to go. That is how you are taking management. That is the way you get forward.

3. Reduce on bills.

On this sample of life-style creep, you’ve gotten used to some bills that you just don’t really want. Take a look at that funds you made. Bear in mind, you don’t must drop every part. However I’m certain you’ll discover some extras that sneaked into your spending habits.

What spending can you cut out or in the reduction of on? Do it, after which funds that cash towards what you really need it to do.

4. Arrange computerized transfers.

When you’ve made the funds and trimmed it, do your self a favor and arrange some computerized transfers that can assist you transfer ahead together with your objectives.

For instance, for those who’re making an attempt to construct up that financial savings account, have a few of your paycheck go straight into financial savings—or arrange an computerized switch that strikes cash out of your checking to financial savings a minimum of as soon as a month.

Or, for those who’re on Baby Step 4, arrange 15% of your earnings to go straight into your retirement accounts.

Hey, you didn’t discover that elevate whenever you have been spending it right here and there. This can be a approach to be in management—on the entrance finish—of the place your cash goes.

5. Get to know your cash mindset.

Your money mindset is your distinctive set of beliefs and your perspective about funds. It drives the selections you make about saving, spending and dealing with cash. Lots goes into what your cash mindset is—together with your previous and your character. If you will get a deal with in your cash mindset, you will get a deal with in your life.

By the way in which, I do a deep dive on this in my Know Yourself, Know Your Money course.

6. Do a social media cleanse.

One approach to struggle life-style creep (and to stop comparing yourself to others) is to do a social media cleanse. Take into consideration who you observe and delete accounts that make you are feeling discontent or that strain you to purchase issues. Take breaks from going surfing. Interval. That may be every week off, sure hours of the time without work, or no matter is finest for you.

All this may make it easier to make real connections with other people—and make it easier to keep true to these private values you wrote down earlier on this course of!

7. Follow generosity.

How can giving back assist? Effectively, life-style creep naturally encourages us to consider ourselves. Generosity strikes the main target off of us (our issues, our cash, our needs) and on to others. It’s an effective way to make a shift in your cash mindset and assist others on the similar time.

You Can Beat Life-style Creep

Pay attention. Should you’ve been caught within the life-style creep cycle, I do know you’ve gotten into some spending habits you’ll have to interrupt. However you are able to do this! And, within the course of, you possibly can stop being stressed over feeling such as you’ve received nothing to indicate for all the additional cash you’re making.

However you possibly can’t make any of those modifications for those who don’t have a plan—aka your funds. And guess what? I’ve received simply the budgeting software for you. It’s referred to as EveryDollar, and it’s what my husband, Winston, and I exploit each single month to make our funds and observe our transactions. Oh. And it’s free!

Yup. So get began immediately. Beat life-style creep! And line up your cash habits together with your cash objectives, one EveryDollar funds at a time!