- On-chain information reveals renewed shopping for curiosity and decrease provide on Binance, driving Bitcoin’s latest worth enhance.

- Open Curiosity and lively addresses additionally recommend stronger market participation and potential for additional positive factors.

Bitcoin [BTC] has been on a risky path because the begin of the 12 months. Following an early rally, the cryptocurrency confronted a pointy correction that left many buyers unsure in regards to the market’s direction.

Nonetheless, a latest surge on the twentieth of January pushed Bitcoin’s worth to a brand new all-time excessive, briefly breaking above $109,000.

Though the asset skilled a slight pullback, buying and selling at $107,945, it remained up by 3.5% within the final 24 hours, reflecting a double-digit achieve over the previous week.

Amid this worth exercise, analysts have been carefully monitoring key on-chain metrics.

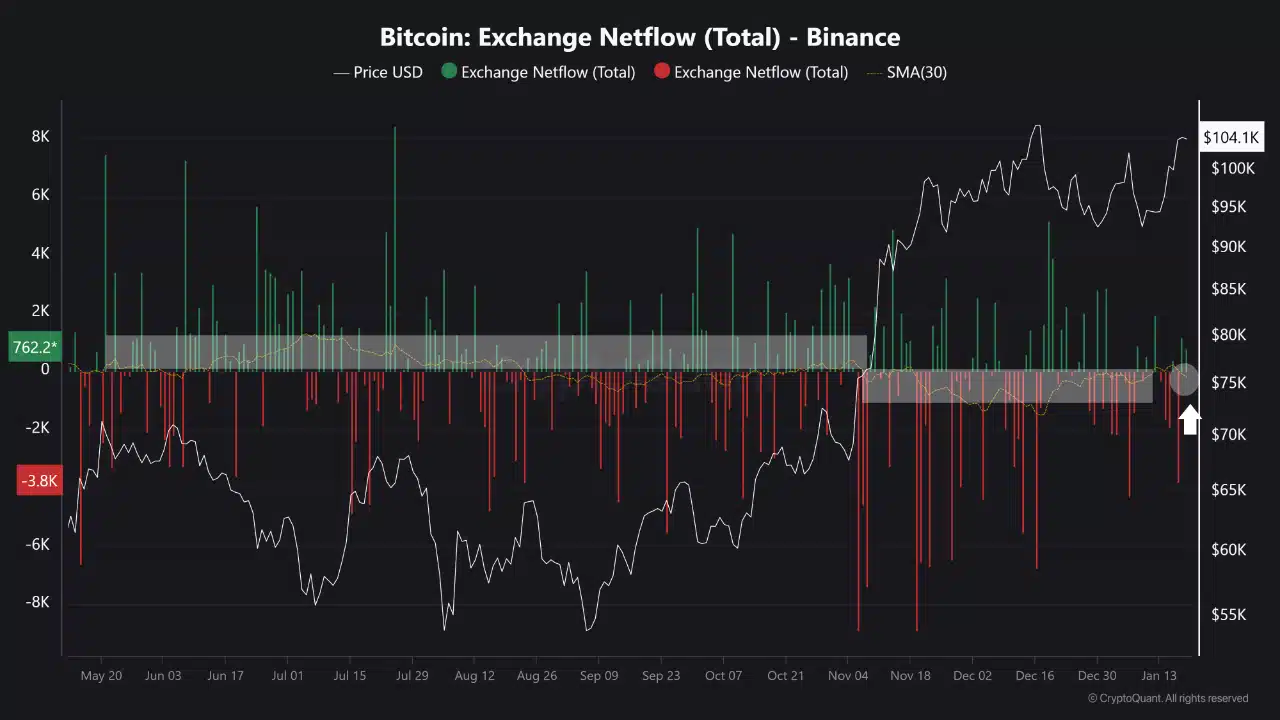

In line with one CryptoQuant analyst, the Binance Netflow SMA30—a 30-day shifting common of netflows on Binance—has supplied useful insights into market sentiment and worth traits.

The analyst factors out that shifts on this metric usually correlate with notable worth actions, indicating that the present rally might have extra room to run.

Bitcoin netflow traits and market dynamics

The Binance Netflow SMA30 metric has traditionally been a helpful indicator for anticipating Bitcoin’s short-term worth course.

When the metric enters optimistic territory, it usually indicators elevated promoting stress as extra Bitcoin flows into Binance.

For instance, in Might 2024, a optimistic Netflow SMA30 coincided with a drop in Bitcoin’s worth from $71,000 to $50,000, highlighting a interval of elevated provide and bearish sentiment.

Conversely, when the Netflow SMA30 turns detrimental, it sometimes signifies decreased spot provide and stronger upward momentum.

This sample was evident in November 2024, when the metric shifted detrimental, and Bitcoin climbed from $74,000 to $108,000.

As of the seventeenth of January, the SMA30 returned to detrimental territory, sitting at -207.85, suggesting renewed shopping for curiosity and elevating the potential of one other rally to a brand new all-time excessive.

Further insights

Past the Binance Netflow SMA30, different indicators supplied a broader perspective on Bitcoin’s near-term outlook.

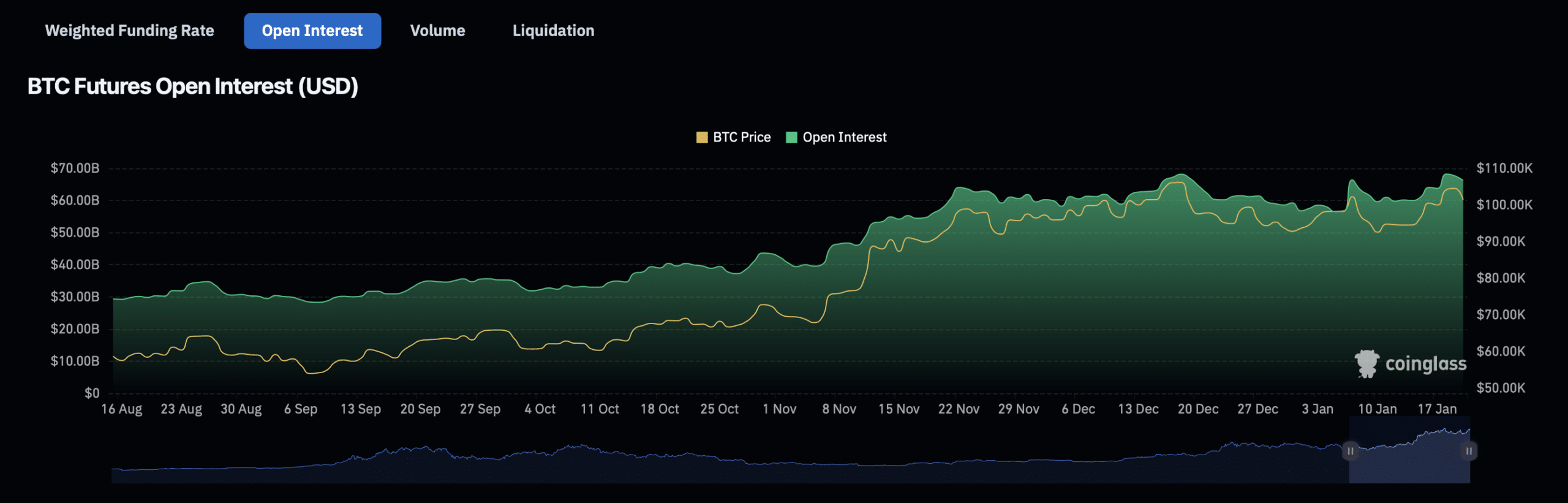

Open Curiosity information from Coinglass shows a 4.61% enhance within the final 24 hours, reaching a valuation of $71.21 billion.

Open Curiosity quantity has additionally risen by 156.60% over the identical interval, hitting $179.14 billion.

These will increase mirrored rising dealer engagement and potential momentum within the derivatives market, which may affect Bitcoin’s spot worth.

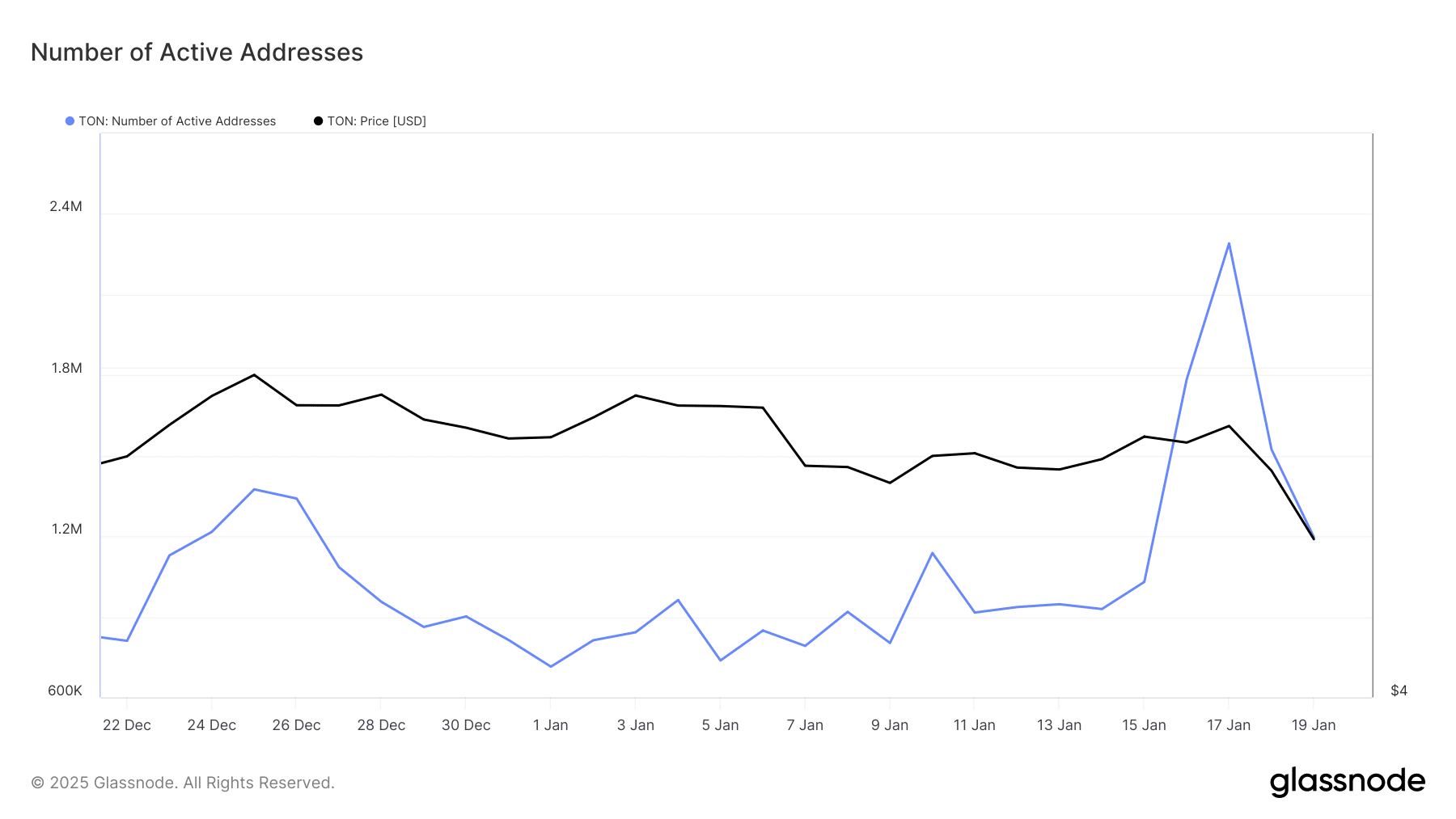

As well as, Glassnode data on lively addresses—a proxy for retail participation—revealed latest spikes in consumer exercise.

Learn Bitcoin’s [BTC] Price Prediction 2025–2026

The variety of lively addresses surged from beneath 1 million earlier this month to 2.2 million by the seventeenth of January, earlier than retreating to 1.1 million as of the nineteenth of January.

Whereas the fluctuation in lively addresses signifies variability in retail curiosity, the general enhance earlier within the month means that extra members are participating with the Bitcoin community.