Bitcoin’s muted volatility part continues, with structural help holding agency. The market’s subsequent decisive transfer will seemingly be formed by reactions on the $114,000 and $111,000 help zones.

BTC Value Evaluation: Technicals

By Shayan

The Every day Chart

Bitcoin continues to consolidate throughout the slender $116K–$120K vary, marked by low volatility and subdued value motion. This sideways motion suggests an ongoing equilibrium between shopping for and promoting strain, probably resulting from capital rotation into the altcoin markets.

A key concern is the emergence of a bearish divergence between the worth and the RSI indicator, indicating a fading of bullish momentum. This divergence will increase the chance of renewed promoting strain and suggests a doable continuation of the correction part. If that’s the case, a transfer towards the $111,000 help stage turns into possible.

Regardless of this, the broader market construction stays bullish so long as the $111,000 stage holds. If this value level acts as a dependable demand zone, an eventual breakout above $120K may resume the bigger uptrend.

The 4-Hour Chart

On the decrease timeframe, BTC is forming a bullish flag sample, a traditional consolidation formation inside an uptrend. The value has constantly printed increased highs and better lows, supported by an ascending trendline appearing as dynamic help, at the moment close to the $114K stage.

So long as this trendline stays intact, the market is more likely to proceed consolidating contained in the flag, which aligns with a wholesome correction.

Nonetheless, a breakdown under this ascending help would seemingly set off a sharper pullback towards $111K, forming a key liquidity zone.

On-chain Evaluation

By Shayan

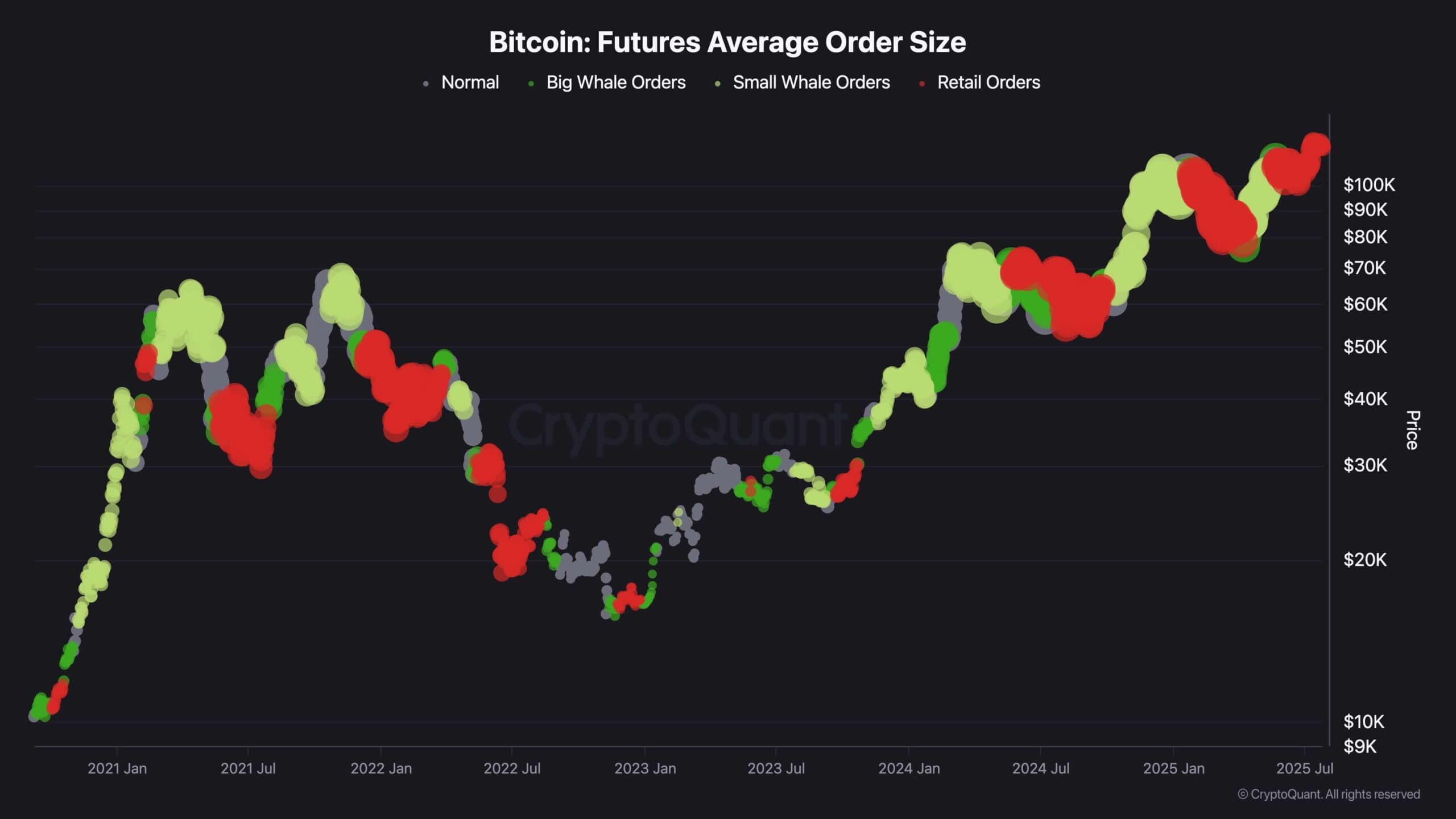

The most recent futures order movement reveals a noticeable surge in small-sized positions, a powerful indication that retail merchants are actively collaborating within the present value vary. This spike reveals a excessive stage of retail engagement, particularly throughout the $116K–$120K consolidation zone.

Apparently, large-scale sell-side exercise (represented by inexperienced circles), sometimes related to establishments or whales, will not be current. These main gamers usually are not offloading their positions, suggesting that they continue to be assured within the ongoing bullish pattern and don’t anticipate a significant reversal simply but.

This setup, with retail exercise excessive and good cash quiet, has traditionally preceded main bullish strikes. Whereas the market could seem stagnant, this part usually serves as a cooling-off interval earlier than one other leg of the upward pattern. The dearth of panic from whales provides weight to the idea that it is a wholesome consolidation, not a pattern reversal.

As soon as the present vary resolves, a recent wave of demand could enter the market, seemingly pushing Bitcoin towards new highs.

The publish Bitcoin Price Analysis: Is a Crash to $111K Imminent for BTC? appeared first on CryptoPotato.