BlackRock’s fund, which is concentrated on the highest cryptocurrency, has surpassed the holdings of Technique and is now second on this planet by way of reserves, a minimum of when it comes right down to identified entities.

Whereas this marks a pivotal step in mainstream adoption, warning ought to be exerted, as centralization was not the unique thought conceived within the whitepaper.

Historical past Being Made

The on-chain evaluation platform shared its newest report, highlighting a monumental feat achieved by BlackRock’s iShares Bitcoin Belief (IBIT) ETF. Launched in January of final 12 months, the exchange-traded fund has amassed over 781,000 bitcoins, a staggering quantity equal to greater than $88 billion, contemplating the asset’s present value of round $113,000.

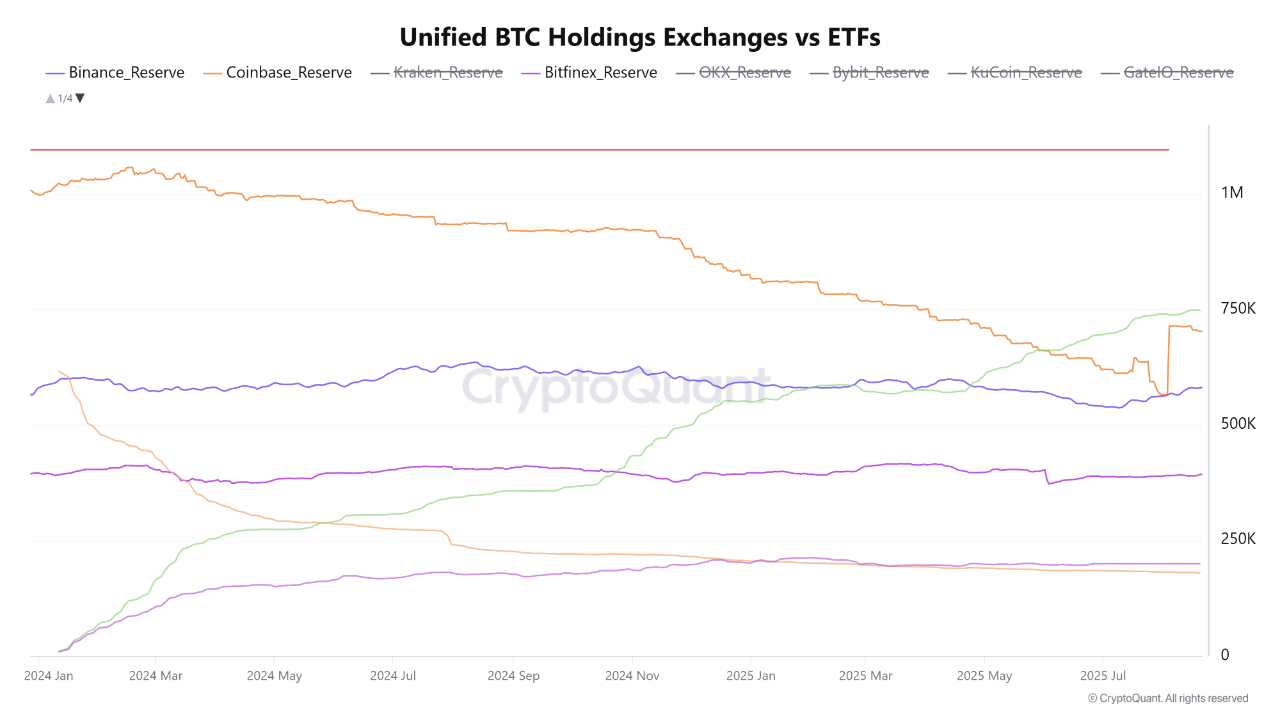

In accordance with CryptoQuant’s information, the ETF has been main the buildup cost since Could 2025, when it surpassed the stash held on Coinbase. As August got here round, the lead was solidified, making the fund the biggest holder of Bitcoin, with solely the pseudonymous Satoshi Nakamoto’s pockets holding extra.

The newest readings present a big lead over Coinbase, and even Binance stays behind, with the exchanges proudly owning over 703,000 and 558,000 items, respectively.

The funding firm’s fund has even surpassed the gargantuan Bitcoin treasury firm Technique, as in response to the newest information from BitcoinTreasuries, it at present has 629,376 bitcoins, valued at round $71 billion, contemplating the costs on the time of writing.

What makes BlackRock’s achievement much more spectacular is that the behemoth managed to overthrow the Saylor-led firm’s 5-year accumulation lead in only a 12 months and a half, showcasing the quickly accelerating institutional adoption of the main crypto asset.

What Does This All Imply?

The unrelenting inflows into the ETF point out a big shift out there. The principle driver of demand is now not restricted to retail exchanges and seasoned buyers, however is now shifting to regulated monetary merchandise tailor-made to organizations.

The fixed shopping for stress from the IBIT fund is creating an ever-increasing provide shock, because the capital from the ETF is, for probably the most half, faraway from circulation, in comparison with exchanges that use their reserves for buying and selling. This gives robust help for the value, because the out there provide drops.

This alerts a behavioral change for buyers as effectively, because the santiment in the direction of extra conventional and compliant funds will increase. As holdings in distinguished exchanges decline, their typical function as a storehouse of property makes room for institutional demand.

Whereas this marks a brand new chapter for the OG crypto, which has undergone a exceptional journey because it got here to gentle in 2009, this corporational centralization goes in opposition to its ethos. It’s unclear what impact this will likely have going ahead, so steady monitoring shall be essential in sustaining the steadiness.

Binance Free $600 (CryptoPotato Unique): Use this link to register a brand new account and obtain $600 unique welcome provide on Binance (full details).

LIMITED OFFER for CryptoPotato readers at Bybit: Use this link to register and open a $500 FREE place on any coin!