It’s simple to confuse them. They each begin with the letter “C” they usually’re each types of car insurance that cowl injury to your automotive solely, however that’s the place their similarities finish. So as to add to the confusion, automotive insurance coverage corporations often bundle complete and collision insurance coverage collectively.

So, what’s the distinction between collision vs. complete automotive insurance coverage? Prepare for a type of explanations that once you hear it, you understand, oh, that makes good sense!

Let’s go over the fundamentals and clear up the confusion.

What Is Complete Insurance coverage?

The only method to clarify comprehensive car insurance is to say that it covers injury—to your automotive solely—that’s attributable to one thing apart from a collision with one other automotive.

It could possibly be a pure catastrophe, theft, injury from hitting an animal, vandalism, act of terrorism or a falling object. So, in case your automotive will get broken in a twister, is stolen from the airport long-term parking zone, or your new paint job will get “keyed,” you’d be coated by complete insurance coverage. (Extraordinarily unfortunate however coated!)

Complete insurance coverage occasions are typically known as “acts of God” since you haven’t any management over them. Most certainly, you’re not even round once they occur.

The primary good thing about complete insurance coverage is to present you peace of thoughts and monetary safety if one thing actually unfortunate occurs to your automotive.

What Is Collision Insurance coverage?

Collision insurance covers restore or substitute prices—to your automotive solely—for those who trigger injury to your automotive by colliding with one other automobile or an object like a tree, fence or visitors barrier. A great way to recollect such a insurance coverage is that you’ve got management over the collision. (Aspect word: Hitting a deer or different animal is roofed by complete. It would look like it’d fall below collision however consider it like this: The deer is operating into you. You don’t have management over that.)

Let’s say you sideswipe a guardrail at excessive velocity. In case you have collision insurance coverage all you’re accountable for is paying your deductible, and your insurance coverage firm will cowl the associated fee to restore your automotive.

The primary advantages of carrying collision insurance coverage are peace of thoughts that you just received’t should pay excessive restore prices, and usually, that you just received’t should cope with one other driver’s insurance coverage firm.

What’s the Distinction Between Complete vs. Collision Insurance coverage?

The primary distinction between collision vs. complete insurance coverage is that collision insurance coverage covers injury triggered when the motive force is in command of the automotive, whereas complete protection typically covers occasions which are out of the motive force’s management.

Let’s use a twister for example the distinction between collision vs. complete insurance coverage. Think about the next two eventualities:

- A sofa from a house that was caught within the funnel of a twister falls in your automotive whereas it was parked in your driveway.

- You swerved to keep away from hitting a sofa that was caught within the funnel of a twister and drove right into a road pole.

In situation one, because you didn’t have management over the falling sofa, your insurance coverage firm would reimburse you for damages to your automotive below your complete automotive insurance coverage.

In situation two, you did have management over your automotive in that scenario, so your insurance coverage firm would reimburse you for injury to your automotive from the road pole below your collision protection.

What Do Complete and Collision Insurance coverage Cowl?

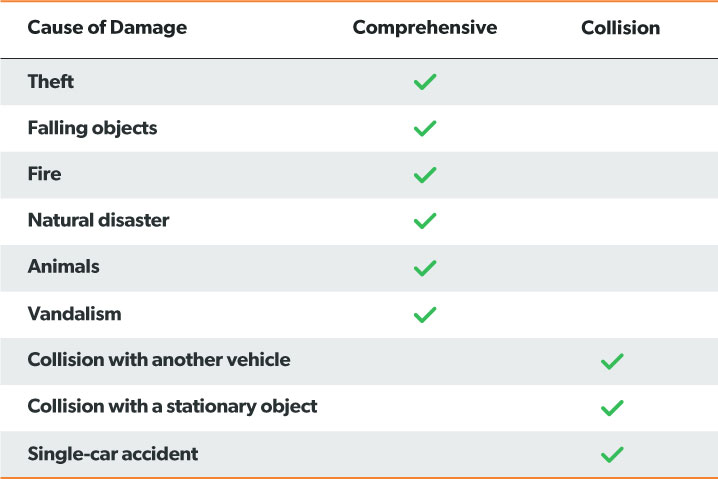

Collectively, complete and collision insurance coverage (mixed with the required legal responsibility insurance coverage) is named full protection. Right here’s a chart that exhibits what complete and collision insurance coverage cowl individually.

Do you have the right insurance coverage? You could be saving hundreds! Connect with an insurance pro today!

We advocate connecting with one of our Endorsed Local Providers (ELPs) to search out the most effective worth for complete and collision protection.

Do I Want Complete and Collision Insurance coverage?

For those who’re questioning whether or not each forms of protection are essential, the reply is nearly all the time sure. Each forms of injury are widespread, so we do recommend carrying comprehensive and collision insurance most often. Right here’s why.

Your Monetary State of affairs

In case your automotive is totaled, are you able to afford to exchange it with out going into debt? It’s an disagreeable thought, however automotive accidents occur on a regular basis. In case your reply isn’t any, then that’s a threat you don’t must take. Get complete and collision protection so the insurance coverage firm will help together with your automotive’s substitute value and you’ll preserve your emergency fund for one more time. The one exception to that is in case your automotive is paid for and never price very a lot, and you might simply afford to exchange it. In that case, you might skip complete and collision.”

Your Driving Habits

Do you’ve got a protracted commute to work or a relationship with somebody in a distinct metropolis? In that case, be mindful (as you’re caught in freeway visitors, but once more) that the extra you drive, the upper the chance of injury to your automotive, and the extra probably you must purchase complete and collision insurance coverage.

The place You Reside

Your location has quite a bit to do with shopping for automotive insurance coverage protection. Even for those who don’t drive that usually, for those who dwell in an space that has a excessive crime fee or is liable to pure disasters, you must at the least purchase complete insurance coverage.

How Your Automotive Is Financed

For those who lease or finance your car, the lender will most probably require that you just carry complete and collision insurance coverage. Lenders need to make sure that they’re not in danger in case your automotive is totaled or stolen, and also you stroll away out of your mortgage or lease.

For those who own your car (the higher monetary alternative!), you’re not required by legislation to hold complete or collision insurance coverage, however once more—for those who can’t afford to pay to restore or exchange your automotive by yourself, it’s too dangerous to go with out the fitting protection.

How A lot Does Complete and Collision Insurance coverage Price?

Normally, collision insurance coverage is dearer than complete insurance coverage as a result of collision claims are extra frequent than complete claims. Let’s have a look at the typical charges in every state.

|

State |

Common Annual Collision Premium |

Common Annual Complete Premium |

|

Alabama |

$380.51 |

$175.28 |

|

Alaska |

$387.12 |

$147.87 |

|

Arizona |

$326.28 |

$208.25 |

|

Arkansas |

$375.25 |

$235.36 |

|

California |

$483.60 |

$94.72 |

|

Colorado |

$330.50 |

$272.44 |

|

Connecticut |

$407.54 |

$133.86 |

|

Delaware |

$352.86 |

$140.52 |

|

District of Columbia |

$535.96 |

$228.71 |

|

Florida |

$361.79 |

$149.26 |

|

Georgia |

$408.41 |

$176.31 |

|

Hawaii |

$357.78 |

$107.66 |

|

Idaho |

$262.67 |

$139.75 |

|

Illinois |

$339.04 |

$140.57 |

|

Indiana |

$286.49 |

$135.63 |

|

Iowa |

$252.65 |

$214.65 |

|

Kansas |

$287.24 |

$276.33 |

|

Kentucky |

$312.51 |

$164.68 |

|

Louisiana |

$487.44 |

$248.57 |

|

Maine |

$294.80 |

$113.33 |

|

Maryland |

$422.06 |

$167.61 |

|

Massachusetts |

$440.55 |

$147.06 |

|

Michigan |

$479.11 |

$159.08 |

|

Minnesota |

$265.74 |

$206.45 |

|

Mississippi |

$372.17 |

$239.34 |

|

Missouri |

$315.49 |

$216.92 |

|

Montana |

$283.65 |

$306.00 |

|

Nebraska |

$272.48 |

$260.97 |

|

Nevada |

$366.54 |

$119.28 |

|

New Hampshire |

$327.30 |

$118.58 |

|

New Jersey |

$414.39 |

$130.26 |

|

New Mexico |

$311.24 |

$214.10 |

|

New York |

$457.77 |

$180.64 |

|

North Carolina |

$342.13 |

$137.45 |

|

North Dakota |

$279.45 |

$256.76 |

|

Ohio |

$302.57 |

$130.74 |

|

Oklahoma |

$346.73 |

$267.99 |

|

Oregon |

$280.61 |

$106.87 |

|

Pennsylvania |

$376.21 |

$169.21 |

|

Rhode Island |

$474.58 |

$140.40 |

|

South Carolina |

$318.08 |

$207.09 |

|

South Dakota |

$244.47 |

$327.11 |

|

Tennessee |

$355.01 |

$163.83 |

|

Texas |

$442.88 |

$269.90 |

|

Utah |

$309.20 |

$127.53 |

|

Vermont |

$329.47 |

$147.81 |

|

Virginia |

$316.05 |

$148.25 |

|

Washington |

$312.65 |

$118.19 |

|

West Virginia |

$350.20 |

$224.86 |

|

Wisconsin |

$247.95 |

$159.82 |

|

Wyoming |

$297.61 |

$317.22 |

* Statistics are from the National Association of Insurance Commissioners

Get the Greatest Protection for the Greatest Value

We advocate carrying each complete and collision insurance coverage. Sure, the 2 forms of protection are totally different, however they’ll each shield your emergency fund within the occasion of serious injury to your automotive.

Connect with one of our Endorsed Local Providers (ELPs) who can discover the most effective charges for complete and collision insurance coverage in your state. Our ELPs are impartial brokers, that means they’ll give you the results you want, not the insurance coverage firm.