Questioning should you want earthquake insurance coverage? You’re not alone.

On the one hand, not all earthquakes trigger catastrophic injury. (Earthquakes occur on a regular basis, however they’re so small we don’t even discover them.)

However however, it solely takes one quake, and never even an enormous one, to trigger in depth, everlasting injury to your own home.

So, does that imply everybody can buy earthquake insurance coverage?

Not essentially. Let’s stroll by way of all of the questions it’s worthwhile to reply earlier than you make a last resolution.

What Is Earthquake Insurance coverage?

Earthquake insurance coverage reimburses you for prices associated to earthquake injury, together with injury to your own home and private property, and for momentary dwelling bills.

If you wish to go deeper, we put collectively a complete guide to earthquake insurance to offer you an in-depth image of what earthquake insurance coverage is all about.

What Does Earthquake Insurance coverage Cowl?

Basically, earthquake insurance coverage covers injury from an earthquake. A normal earthquake coverage consists of the next:

- Dwelling protection: Covers the price of repairing or rebuilding your own home, together with hooked up buildings like a storage or patio.

- Private property protection: Covers prices of repairing or changing your private stuff, together with furnishings, clothes, home equipment and electronics.

- Further dwelling bills: If your own home is so broken by an earthquake that you would be able to not reside in it, earthquake insurance coverage will reimburse you for momentary dwelling bills (resort, meals) and/or misplaced rental revenue whereas your own home is repaired.

Most insurers additionally provide non-compulsory coverages that you would be able to add to your earthquake coverage for issues like constructing code upgrades and emergency repairs.

Do I Want Earthquake Insurance coverage?

We will’t make the choice for you. However we can steer you in the correct route so you can also make the only option to your state of affairs.

Earthquake insurance coverage is nice if your own home is significantly broken, and the injury exceeds your deductible. But it surely does include a value.

The premiums and deductible are often excessive, so the distinction between what you pay for earthquake insurance coverage and what you get is usually a arduous capsule to swallow.

We get that.

However the goal of any insurance coverage protection is to switch danger you may’t afford from you to the insurance coverage firm. So, should you reside in an space the place you’re at excessive danger of getting your own home broken or destroyed in an earthquake, and also you don’t have a whole lot of money readily available to cowl repairs, earthquake insurance coverage is your greatest guess.

Even should you don’t assume you fall into that class, hear us out. Take into account these three issues earlier than you make your resolution.

How seemingly is it that an earthquake will occur in your space?

The very first thing to consider once you’re contemplating earthquake insurance coverage is how seemingly it’s {that a} quake will occur in your space. Earthquakes can occur in all 50 states, however some states are extra liable to earthquakes than others.

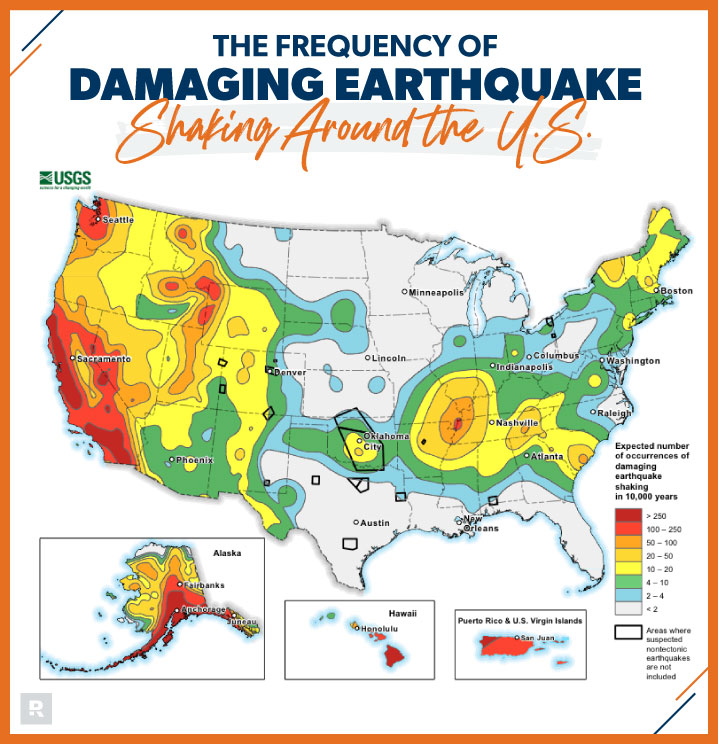

To see how your state compares to others, check out the map beneath that reveals how typically scientists anticipate damaging earthquake shaking across the U.S.1

As you may see from the map, residents of the western United States ought to be on excessive alert for the danger of an earthquake and the necessity for insurance coverage. On the flip aspect, should you reside in a low-risk state like Minnesota, it’s protected to say that you simply don’t have to spend your cash on earthquake insurance coverage.

How seemingly is it that your own home might be broken in an earthquake?

Even should you reside in a state the place frequent earthquakes don’t happen, the situation of your own home and surrounding environmental elements management how your own home will do throughout an earthquake.

Protect your home and your budget with the right coverage!

One of the best ways to weigh the chances of harm to your own home is to assume by way of the identical elements that insurance coverage corporations use to calculate your premium:

- The age of your own home. If your own home was constructed earlier than 1980, chances are high it wasn’t constructed utilizing supplies that stop earthquake injury.2 Issues like bolted foundations and strengthened shear partitions are used to construct newer properties, which do higher throughout earthquakes.There’s a straightforward repair right here although. If your own home was constructed earlier than 1980, you may and may have it retrofitted with stronger constructing supplies so that it’ll maintain up higher throughout an earthquake. (It is a nice option to save on premiums.)

- The variety of tales. Children love properties with a couple of degree—going up and down stairs appears to be endlessly entertaining. (Go determine!) However there’s a draw back too—taller properties don’t do effectively in earthquakes, so that they’re costlier to insure.

- Soil kind. Dig round in your backyard a lot? If that’s the case, you need to be capable of inform the kind of soil your own home sits on. If the soil feels compact (like clay) as an alternative of granular (like sand), odds are that your own home sits on arduous soil. That’s a very good factor! Houses constructed on arduous soil do higher throughout earthquakes.

- Raised basis. Understanding raised foundations can get difficult. Their potential to face up to earthquake exercise depends upon the constructing supplies used.3 One of the best ways to measure a raised basis’s energy is to seek the advice of an engineer.

- Constructing supplies. Wooden-framed properties often face up to earthquakes higher as a result of wooden is extra elastic than concrete. Unsure what your own home is framed with? The simplest option to inform is to take away an outlet cowl so you may see what’s behind {the electrical} field. When you see an open void, it’s most likely a wood-framed wall. If the world across the field is totally strong, it’s more than likely a concrete wall.

Would you be capable of afford to switch your own home after an earthquake with out the assistance of insurance coverage?

Right here’s a sensible option to reply this significant query.

Google the typical per-square-foot house rebuilding value to your space and multiply that quantity by your own home’s general sq. footage. The quantity you calculate is the amount of money you’d want to switch your own home.

Most individuals can’t provide you with that sort of cash out of pocket even when they emptied their savings account. That is the place earthquake insurance coverage is available in. Bear in mind—it solely takes one earthquake to completely injury your own home.

Take into account this too once you’re tallying your own home’s substitute value. The principle type of federal catastrophe reduction is a low-interest mortgage. And earlier than they even provide you with a mortgage, it’s worthwhile to show that you would be able to pay it again. (Fairly harsh, proper? Particularly should you’re already frazzled from an earthquake.)

So, is earthquake insurance coverage price it?

Once more, we are able to’t reply that query for you. The perfect we are able to do is boil it down to at least one query: Can I afford not to have earthquake insurance coverage?

Don’t Wait Till After an Earthquake

Ready till after an earthquake to purchase insurance coverage received’t enable you to pay for injury that’s already occurred.

Shield your own home and your loved ones now. Join with considered one of our Endorsed Native Suppliers (ELPs). Our ELPS are impartial brokers who can reply your questions on earthquake insurance coverage and store round for the very best earthquake protection at the very best worth for you.

All in favour of studying extra about householders insurance coverage?

Signal as much as obtain useful steering and instruments.