- Six accounts containing 499 BTC not too long ago grew to become energetic.

- The BTC at the moment are price over $47 million.

Between twenty eighth November and 1st December, six dormant Bitcoin wallets holding a whole lot of BTC sprang to life, ending an inactivity streak of almost 11 years.

Amongst these, the most important transaction got here from a pockets holding 429 BTC, now price over $41 million at Bitcoin’s present worth of roughly $95,900.

The sudden exercise of those wallets has sparked curiosity concerning the motivations behind the actions and their implications for the market.

Dormant Bitcoin wallets resurface after a decade

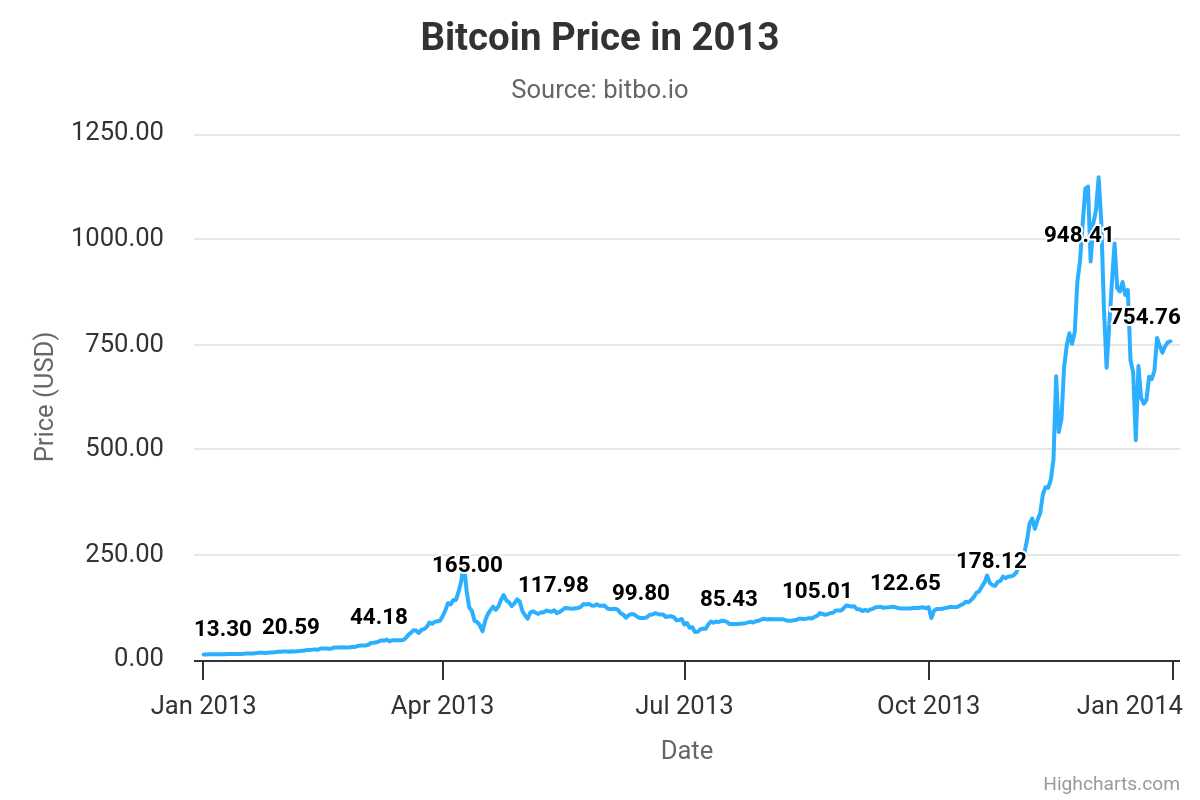

The reactivation of six dormant Bitcoin wallets, every inactive since late 2013, marks a major occasion. The most important account held 429 BTC, with a mixed inactivity interval of 10.9 years. When these wallets final moved funds, Bitcoin traded at roughly $700–$900.

At press time, their holdings have been price greater than $41 million, reflecting an eye-watering 4,500% enhance in worth.

In response to knowledge from Whale Alert, the most recent awakening on 1st December concerned an account holding 11 BTC that had been inactive for 11.6 years.

The awakening of such wallets typically alerts distinctive circumstances. These may embrace rediscovered keys, safety considerations, or profit-taking throughout a bull market.

On-chain insights and whale exercise

On-chain evaluation reveals that actions from long-dormant wallets are uncommon however impactful, typically triggering hypothesis throughout the crypto group.

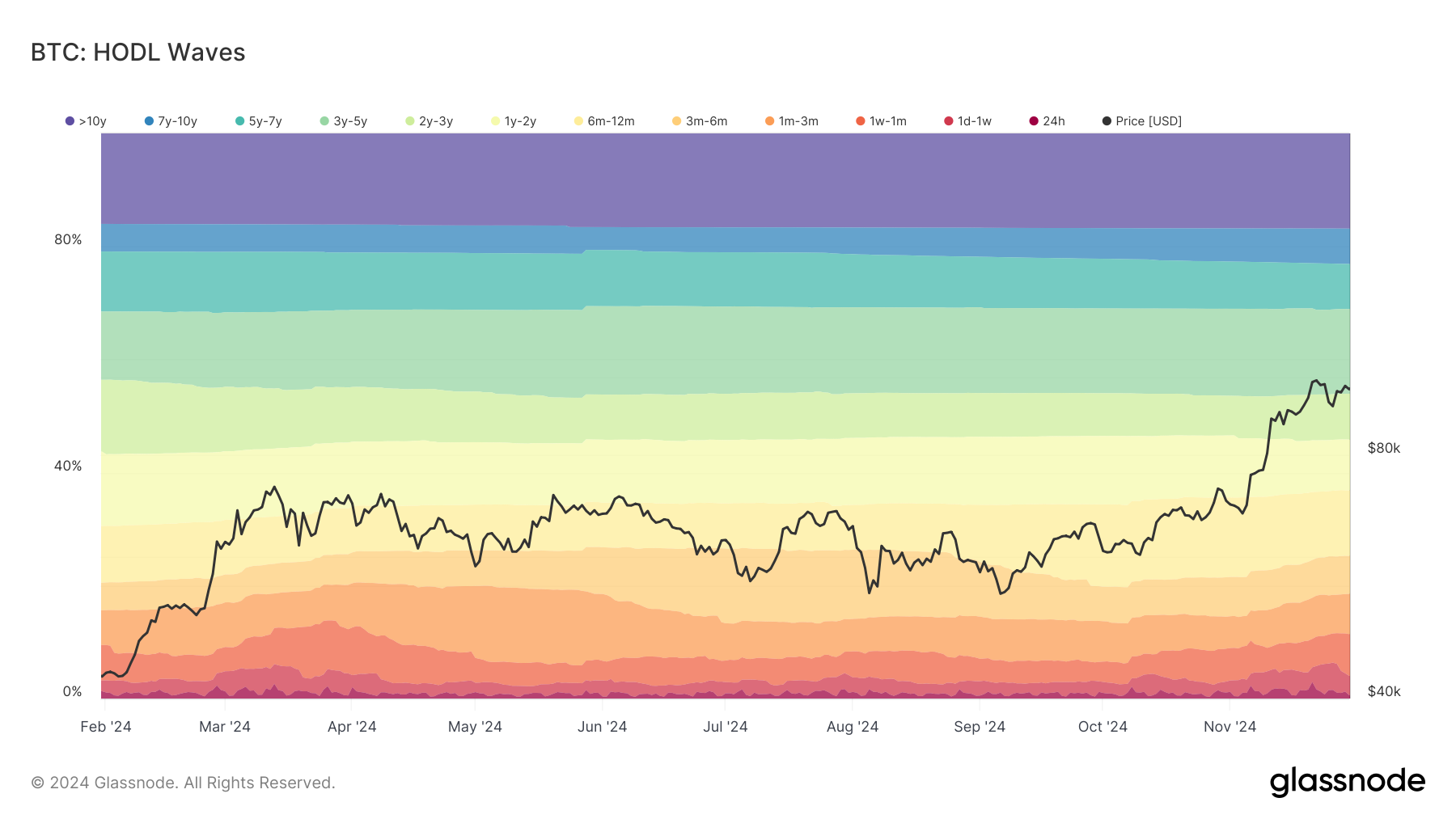

In response to Glassnode’s HODL Waves, the share of Bitcoin held in wallets inactive for greater than 10 years stays excessive, emphasizing the conviction of long-term holders.

Nonetheless, actions from these wallets can stir worry, uncertainty, and doubt (FUD) as market contributors wonder if such strikes precede a sell-off.

Including to the market intrigue, vital whale exercise was recorded, per Lookonchain. Previously 4 hours, a large whale deposited 1,000 BTC ($97.5 million) to Binance.

This similar whale had gathered 11,657 BTC ($780.5 million) from Binance between 14th March and thirty first October, at a median worth of $66,953 per BTC.

Regardless of these actions, Bitcoin’s worth stays close to $95,900, suggesting robust demand and market confidence.

Such giant inflows to exchanges sometimes increase considerations about elevated promoting stress, however the market has but to exhibit indicators of panic, highlighting its present energy.

Historic context: Bitcoin’s worth then and now

The reactivated wallets have been final energetic throughout Bitcoin’s first main rally in late 2013 when the cryptocurrency surged from underneath $100 to almost $1,200. This meteoric rise was adopted by a pointy correction pushed by the notorious Mt. Gox collapse.

Learn Bitcoin (BTC) Price Prediction 2024-25

For these long-term holders, the worth progress is monumental. The 429 BTC from the most important pockets, price lower than $400,000 in 2013, is now valued at over $41 million.

As Bitcoin continues its climb, surpassing $95,900, extra dormant wallets and strategic whale actions will seemingly floor. Whether or not these strikes will gas the subsequent rally or spark a correction stays to be seen.