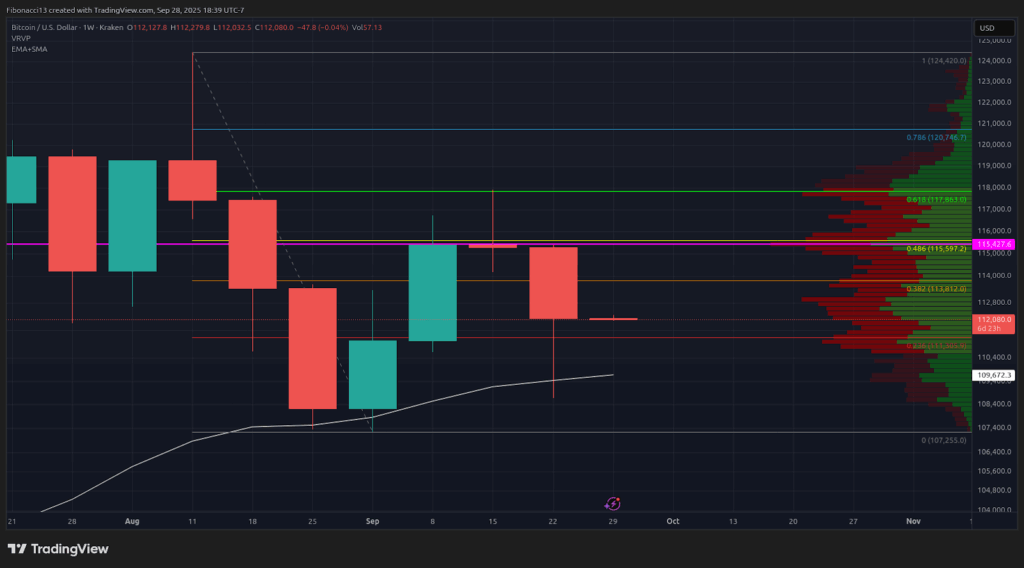

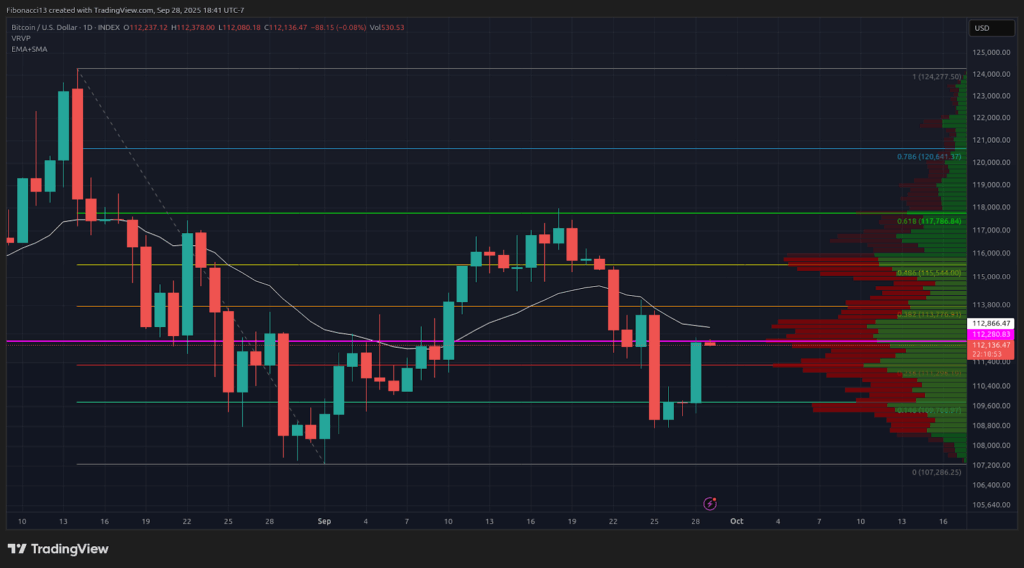

As highlighted in final week’s evaluation, bitcoin had an enormous drop final Sunday evening, right down to $111,800. The worth then bounced again to retest the $113,800 resistance stage and the 21-day EMA at $114,000, however was rejected there, falling again right down to the $111,300 assist stage. This stage produced one other bounce for the bulls again to the 21-day EMA, however was denied entry once more above the $113,800 resistance stage, dumping down slightly below the weekly assist at $109,500 on Thursday. Value rallied from that Thursday low to shut the week out at $112,225.

Key Help and Resistance Ranges Now

For the reason that value closed above the 21-week EMA at $109,500 to complete the week, the bulls will search for this assist to carry going ahead. $109,500 needs to be the ground heading into this week if the bulls are to provide a weekly increased low and switch issues round. $105,000 is the subsequent assist stage down, and there may be potential for a significant reversal from there right down to about $102,000. Shedding $102,000 opens the door right down to main long-term assist, at $96,000.

On the upside, bulls will search for the worth to shut above the $115,500 resistance stage to re-establish the uptrend. This would supply confidence for the bulls to deal with the $118,000 resistance as soon as once more and sure transfer above it. $121,000 sits above right here because the gateway to new highs, however possible received’t maintain for lengthy if we get a weekly shut above $118,000.

Outlook For This Week

Search for value to re-test the $109,500 low early within the week, with potential to safe this stage as assist for a bullish transfer again as much as $113,800. It might possible take very robust shopping for strain to push above the $115,500 resistance stage this week, so anticipate this stage to maintain a lid on issues if $113,800 could be conquered. Bulls will look to place in a inexperienced candle this week to verify final week as a better low.

Bias continues to be bearish on the weekly chart, nevertheless, so we should always anticipate the $113,800 resistance stage to carry over the brief time period. Shedding $109,500 on the day by day chart might result in one other massive value drop this week, right down to new lows, testing the $105,000 to $102,000 assist zone.

Market temper: Bearish — with an enormous purple candle to shut the week out, the bears are firmly in management. The bulls might want to come out robust this week to defend the 21-week EMA assist.

The subsequent few weeks

The weekly chart continues to be bearish till confirmed in any other case. Bulls should tilt the bias again of their favour to foster extra optimistic value motion going ahead; it’s potential for them to try this with a powerful shut to finish this week. With September’s rate of interest reduce now behind us, markets will likely be on the lookout for extra price cuts into the October and December FOMC conferences to maintain capital flowing. Buyers will likely be eyeing US monetary stories intently over the approaching weeks for knowledge supportive of additional cuts. Any impediments to additional cuts within the knowledge will possible lead to extra bearish value motion and additional promoting.

Terminology Information:

Bulls/Bullish: Consumers or buyers anticipating the worth to go increased.

Bears/Bearish: Sellers or buyers anticipating the worth to go decrease.

Help or assist stage: A stage at which the worth ought to maintain for the asset, at the least initially. The extra touches on assist, the weaker it will get and the extra possible it’s to fail to carry the worth.

Resistance or resistance stage: Reverse of assist. The extent that’s prone to reject the worth, at the least initially. The extra touches at resistance, the weaker it will get and the extra possible it’s to fail to carry again the worth.

EMA: Exponential Transferring Common. A shifting common that applies extra weight to current costs than earlier costs, lowering the lag of the shifting common.