Bitcoin has traditionally adopted a well-recognized four-year cycle. Now, two years into the present cycle, buyers are carefully watching patterns and market indicators for insights into what the subsequent two years might maintain. This text dives into the anatomy of Bitcoin’s four-year cycle, previous market conduct, and future potentialities.

The 4 12 months Cycle

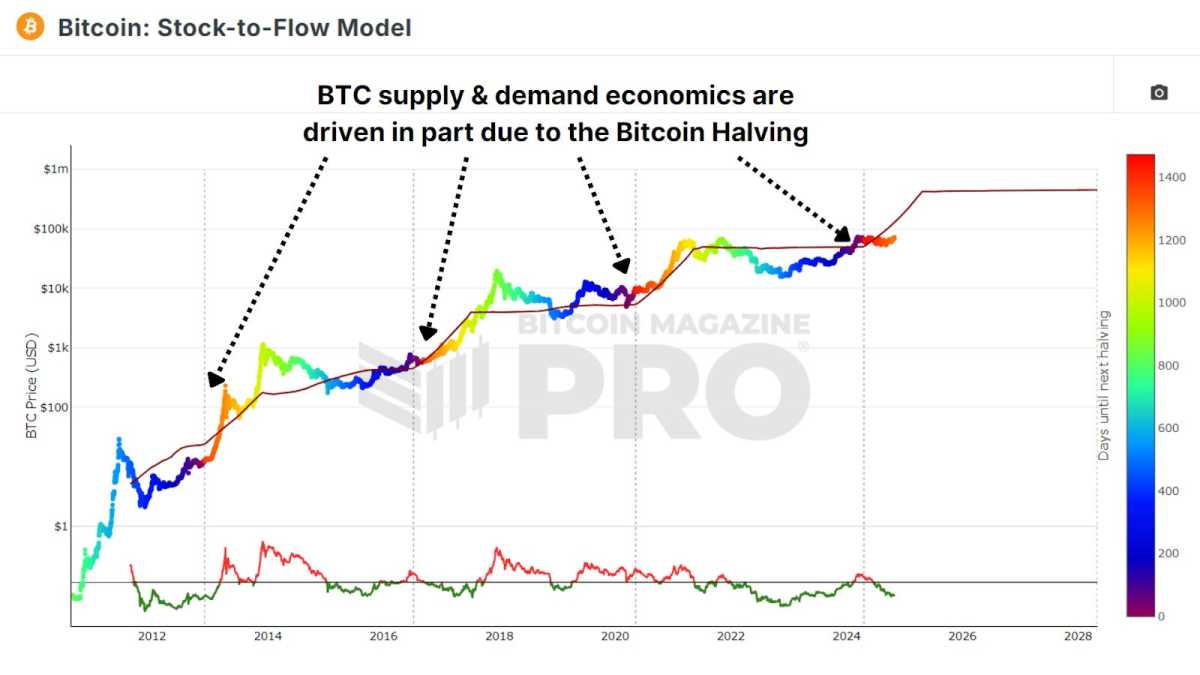

Bitcoin’s four-year cycle is partly influenced by the scheduled halving occasions, which scale back the block reward miners obtain by 50% each 4 years. This halving decreases the availability of latest Bitcoin getting into the market, usually creating supply-demand pressures that may push costs larger.

This may be clearly visualized by the Stock-to-Flow Model, which compares the present BTC in circulation to its inflationary price, and fashions a ‘fair-value’ primarily based on comparable exhausting belongings corresponding to Gold and Silver.

At the moment, we’re halfway by way of this cycle, that means we’re probably getting into a interval of exponential positive factors as the everyday one yr catch-up section following the halving progresses.

A Look Again at 2022

Two years in the past, Bitcoin confronted a extreme crash amid a collection of company implosions. November 2022 marked the downfall of FTX, as rumors of insolvency triggered large sell-offs. The domino impact was brutal, as different crypto establishments, corresponding to BlockFi, 3AC, Celsius, and Voyager Digital, additionally went underneath.

Bitcoin’s worth tumbled from round $20,000 to $15,000, mirroring the broader market panic and leaving buyers nervous about Bitcoin’s survival. Nonetheless, true to type, Bitcoin rallied once more, climbing again up fivefold from the 2022 lows. Buyers who weathered the storm have been rewarded, and this rebound helps the argument that Bitcoin’s cyclical nature stays intact.

Related Sentiment

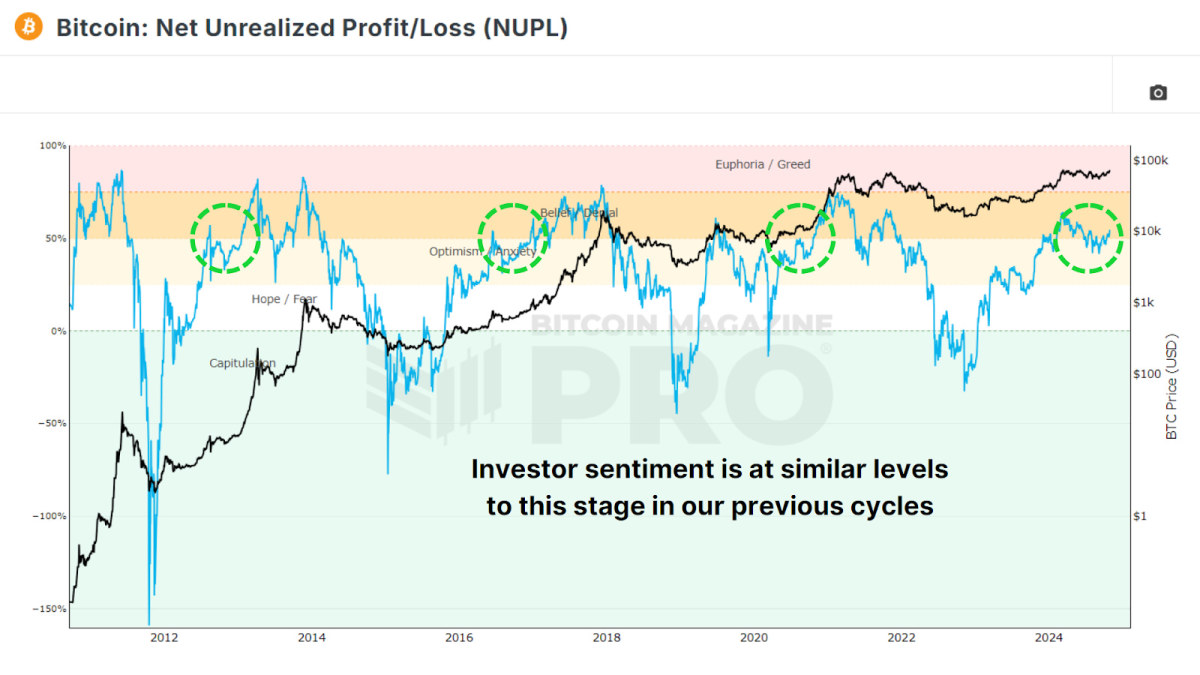

Along with worth patterns, investor sentiment additionally follows a predictable rhythm throughout every cycle. Analyzing the Net Unrealized Profit and Loss (NUPL), a metric exhibiting unrealized positive factors and losses available in the market, means that feelings like euphoria, worry, and capitulation repeat often. Bitcoin buyers sometimes face intense emotions of worry or pessimism throughout every bear market, solely to shift again towards optimism and euphoria as costs recuperate and rise. At the moment, we’re as soon as once more getting into the ‘Perception’ stage following our early cycle runup and subsequent consolidation.

The World Liquidity Cycle

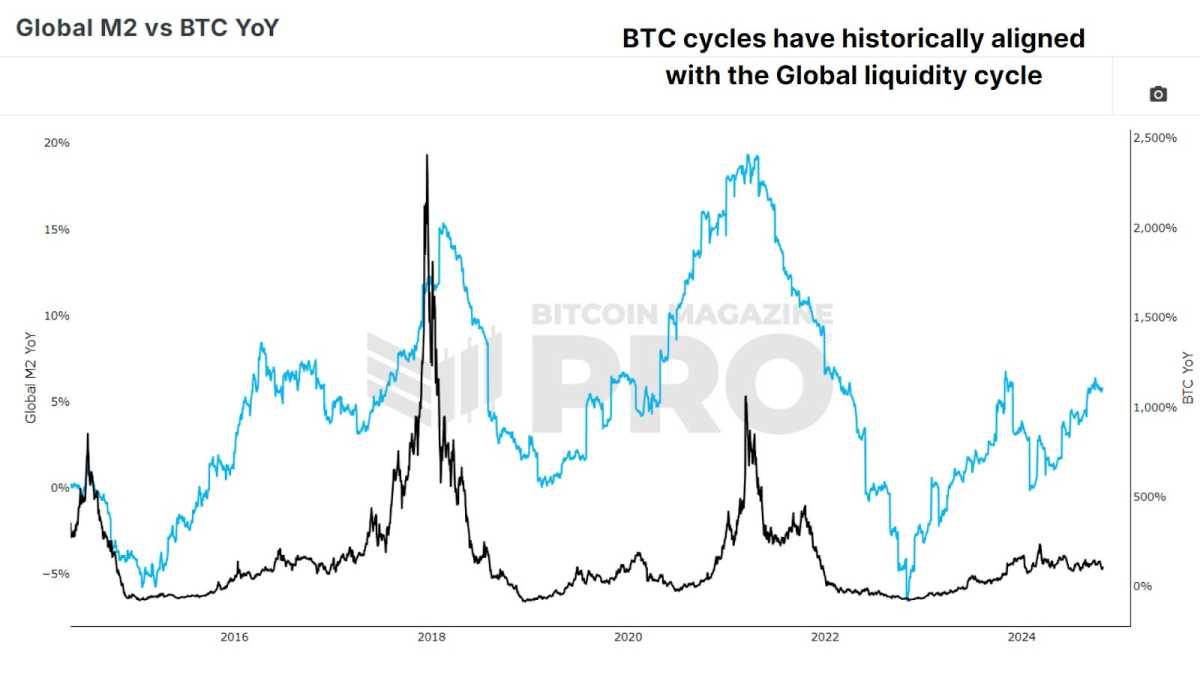

The worldwide cash provide and cyclical liquidity, as measured by Global M2 YoY vs BTC, has additionally adopted a four-year cycle. As an example, M2 liquidity bottomed out in 2015 and 2018, simply as Bitcoin hit lows. In 2022, M2 once more hit a low level, completely aligning with Bitcoin’s bear market backside. Following these intervals of financial contraction, we see fiscal growth throughout central banks and governments in every single place, which results in extra favorable circumstances for Bitcoin worth appreciation.

Acquainted Patterns

Historic worth evaluation means that Bitcoin’s present trajectory is strikingly much like earlier cycles. From its lows, Bitcoin often takes round 24-26 months to interrupt previous earlier highs. Within the final cycle, it took 26 months; on this cycle, Bitcoin’s worth is on the same upward trajectory after 24 months. Bitcoin has traditionally peaked about 35 months after its lows. If this sample holds, we might even see vital worth will increase by way of October 2025, after which one other bear market might set in.

Following the anticipated peak, historical past suggests Bitcoin would enter a bear section in 2026, lasting roughly one yr till the subsequent cycle begins anew. These patterns aren’t a assure however present a roadmap that Bitcoin has adhered to in earlier cycles. They provide a possible framework for buyers to anticipate and adapt to the market.

Conclusion

Regardless of challenges, Bitcoin’s four-year cycle has endured, largely as a result of its provide schedule, international liquidity, and investor psychology. As such, the four-year cycle stays a helpful instrument for buyers to interpret potential worth actions in Bitcoin and our base case for the remainder of this cycle. Nonetheless, relying solely on this cycle could possibly be shortsighted. By incorporating on-chain metrics, liquidity evaluation, and real-time investor sentiment, data-driven approaches will help buyers reply successfully to altering circumstances.

For a extra in-depth look into this subject, try a current YouTube video right here: The 4 Year Bitcoin Cycle – Half Way Done?