In case you’re overwhelmed by debt and don’t know the place to start out, start by gathering all of your monetary info, together with your earnings, bills, and money owed. Then create a easy month-to-month finances, prioritize your highest-interest money owed, and begin constructing a small emergency fund. Even a small emergency fund—simply $500 to $1,000—can forestall future setbacks when you start paying down debt. Talking with a licensed credit score counselor can even enable you create a customized finances and debt administration plan. And don’t fear, you’re not alone—46% of Individuals have unpaid bank card debt, in accordance with Bankrate’s 2025 Credit score Card Debt Report. The excellent news is that with the suitable help, you’ll be able to take management of your funds and work towards a debt-free future.

Key Takeaways

Begin by gathering all of your monetary info to realize a whole understanding of your monetary panorama. This foundational step is essential in crafting a tailor-made debt administration plan.

Making a finances is a crucial element of debt administration. It lets you observe spending, establish pointless bills, and set monetary targets that preserve you motivated.

If managing debt independently feels daunting, skilled assist can present vital help. Organizations like American Shopper Credit score Counseling provide providers similar to credit score counseling and debt consolidation, serving to you devise a plan that aligns along with your monetary targets.

Constructing an emergency fund acts as a monetary buffer, stopping future debt accumulation. Begin by saving sufficient to cowl at the least three months of bills, step by step constructing your fund via automated financial savings transfers.

Often monitoring your credit score report is significant for efficient debt administration. Entry free annual credit score reviews and test for inaccuracies which may have an effect on your monetary well being

Collect Your Monetary Data

Step one in managing your debt is to collect all of your monetary knowledge. You want a whole image of your monetary scenario earlier than you proceed.

This contains your earnings, bills, and excellent money owed. Having a transparent image of your monetary scenario is important. Use a spreadsheet or a budgeting app to maintain all the pieces organized.

- Listing all money owed: Embody bank cards, private loans, pupil loans, and another excellent obligations.

- Word rates of interest: Realizing the rates of interest will enable you prioritize which money owed to repay first.

- Doc minimal funds: Doc the minimal fee for every debt to make sure you keep present and keep away from late charges.

Does Making a Price range Assist With Debt Administration?

Sure, making a finances is a elementary step in debt administration. It helps you observe your spending and establish areas the place you’ll be able to reduce.

- Observe bills: Use free online budgeting tools or apps to categorize and monitor your spending.

- Determine pointless bills: Reduce on non-essential spending to unencumber extra money for debt compensation.

- Set monetary targets: Set up each short-term and long-term monetary targets to maintain you motivated.

How Can I Prioritize My Money owed?

Upon getting established a finances, it’s vital to prioritize which money owed to sort out first. Two widespread methods for debt compensation are the avalanche and snowball strategies. The avalanche method includes specializing in paying off money owed with the best rates of interest first, which helps lower your expenses on curiosity over time. Then again, the snowball technique encourages paying off the smallest money owed first. This method is designed to construct momentum and motivation as you clear smaller obligations, offering a way of feat and inspiring continued progress.

Are There Extra Debt Administration Choices Obtainable?

In fact, if managing your debt by yourself feels overwhelming, contemplate looking for assist from professionals.

- Credit score counseling: Converse to a licensed credit score counselor to develop a customized debt administration plan.

- Debt consolidation: Take into account consolidating a number of money owed right into a single mortgage with a decrease rate of interest.

- Debt settlement: In some instances, negotiating with collectors to accept a decrease quantity could possibly be an possibility.

American Shopper Credit score Counseling (ACCC)

If managing your debt by yourself feels overwhelming, contemplate looking for assist from professionals like American Shopper Credit score Counseling. ACCC provides a variety of providers to help people in regaining management of their monetary scenario.

As talked about above, one possibility is credit score counseling, the place you’ll be able to converse to a licensed credit score counselor to develop a customized debt administration plan tailor-made to your wants. Moreover, they’ll information you thru debt consolidation, which includes consolidating a number of money owed right into a single mortgage with a decrease rate of interest, making it simpler to handle. With their experience, you’ll find an answer that fits your monetary targets and brings peace of thoughts.

Ought to I Construct an Emergency Fund?

It is best to positively construct an emergency fund. It’s is a monetary security web put aside to cowl sudden bills or monetary emergencies, similar to medical payments, automobile repairs, or sudden job loss.

Having an emergency fund is essential to keep away from accumulating extra debt sooner or later as a result of it lets you deal with unexpected bills with out resorting to high-interest bank cards or loans. To start, intention to avoid wasting at the least 3 months of bills.2 You’ll be able to construct your fund over time by organising automated transfers to a financial savings account, making the method simpler and extra constant.

Will Monitoring My Credit score Report Assist Me?

Sure! Often monitoring your credit score report is important to managing your debt successfully. It’s essential to evaluation your credit score report for errors and dispute any inaccuracies you discover. Moreover, monitoring your credit score rating lets you gauge your monetary well being and make knowledgeable choices. Thankfully, there are free assets out there the place you’ll be able to get hold of a credit score report for gratis.

Free annual credit score report providers, similar to AnnualCreditReport.com, help you entry your credit score report from every of the three main credit score bureaus—Equifax, Experian, and TransUnion—annually. 3

Your Credit score Rating

Furthermore, understanding your credit score and the components that influence it may empower you to enhance your monetary standing over time. Paying payments on time, maintaining bank card balances low, and avoiding pointless credit score inquiries are just some methods to keep up a wholesome credit score rating. Often reviewing your credit score report and rating can even present insights into areas for enchancment, serving to you obtain your monetary targets with confidence.

Free Credit score Report Obtainable

For these managing debt however not sure the place to start out, monitoring your credit score report is an important step. It lets you observe your progress, establish any errors or fraudulent actions, and perceive how varied money owed influence your credit score rating. This information might help you prioritize debt compensation and develop a transparent technique to regain monetary stability.

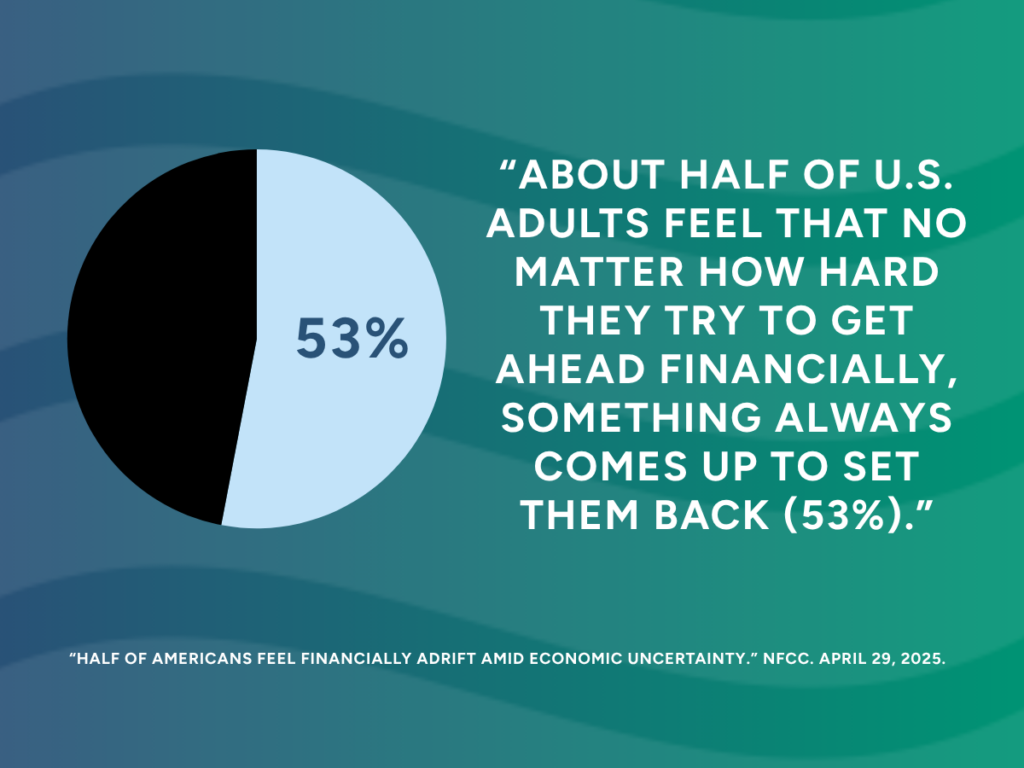

You’re Not Alone

Though being in debt could make you are feeling stressed and remoted, hundreds of thousands of Individuals are going via the identical troubles. Whether or not going via a nonprofit group like American Shopper Credit score Counseling or utilizing the avalanche/snowball debt technique, relaxation assured, there isn’t any disgrace in being in debt and getting the assistance and training you want. Life comes at you quick, and we do the very best we are able to with what we now have. Right here’s to a debt-free future!

FAQs

Why is gathering monetary info step one in managing debt? Gathering all of your monetary info gives a whole image of your monetary scenario, which is essential for creating an efficient debt administration plan. This contains noting your earnings, bills, money owed, rates of interest, and minimal funds.

How does making a finances assist with debt administration? A finances helps observe your spending, establish pointless bills, and set monetary targets. This lets you allocate extra assets towards debt compensation and make knowledgeable monetary choices.

What are some efficient methods for prioritizing debt compensation? Standard methods embody the avalanche technique, which targets money owed with the best rates of interest first, and the snowball technique, which focuses on paying off the smallest money owed first to construct momentum and motivation.

Are there skilled providers out there to assist with debt administration? Sure, organizations like American Shopper Credit score Counseling provide providers similar to credit score counseling and debt consolidation. These providers might help you develop a customized debt administration plan and discover choices like debt settlement.

Why is constructing an emergency fund vital? An emergency fund acts as a monetary security web, serving to you cowl sudden bills with out resorting to high-interest bank cards or loans. It’s advisable to avoid wasting sufficient to cowl at the least three months’ price of bills.

How can monitoring my credit score report assist in managing my debt? Often checking your credit score report helps establish errors, observe your credit score rating, and perceive how your money owed have an effect on your monetary well being. This information aids in making knowledgeable choices and prioritizing debt compensation.

Is it regular to really feel overwhelmed by debt, and what can I do about it? Sure, it’s regular to really feel overwhelmed. Keep in mind, you’re not alone—many individuals face related challenges. Searching for assist from professionals and utilizing structured methods like budgeting and prioritization can present aid and a path to a debt-free future.

In case you’re struggling to repay debt, ACCC might help. Schedule a free credit counseling session with us in the present day.

1. Bankrate-Bankrate’s 2025 Credit Card Debt Report