Feeling overwhelmed by cash issues? You’re not alone. With U.S. family debt reaching $ 18.20 trillion {dollars}1, monetary stress is affecting extra Individuals than ever earlier than. Practically 50% of adults report feeling pressured or anxious about their monetary state of affairs, based on a 2024 survey from Motley Idiot Cash.

Key Perception

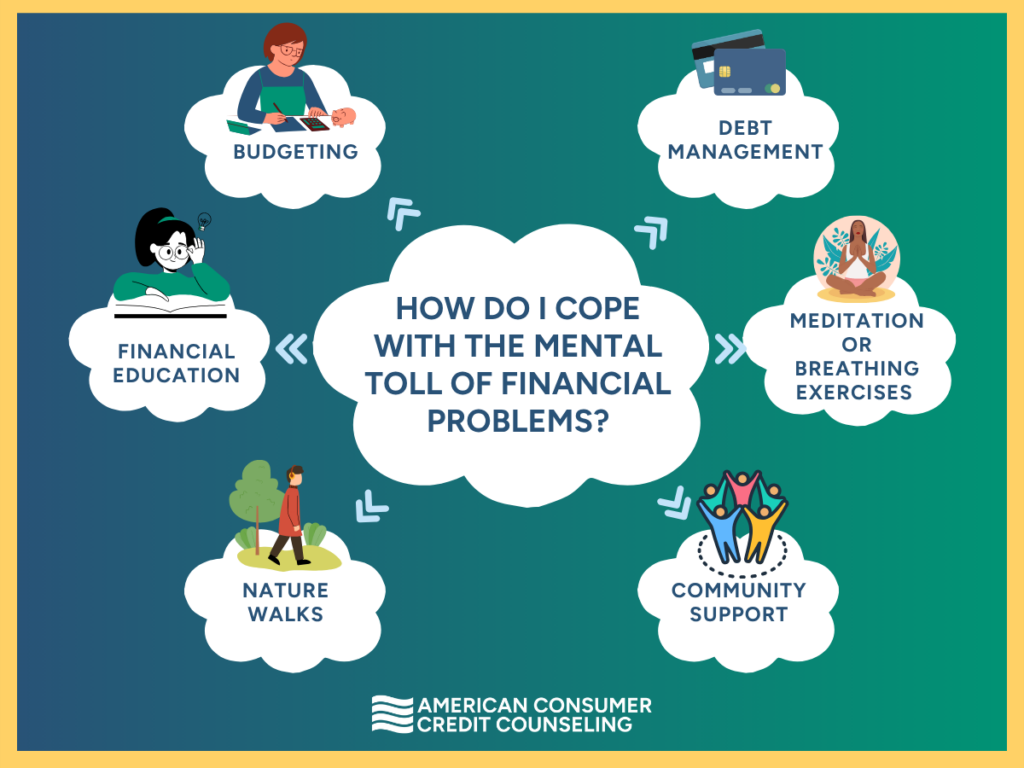

Dealing with the psychological toll of economic issues entails a mixture of monetary methods (like budgeting and debt administration) and emotional instruments (akin to meditation, group assist, and bodily exercise). Searching for skilled assist each monetary and psychological could make a big distinction.

For data on debt administration applications, contact ACCC.

Understanding the Psychological Impression of Monetary Stress

Monetary stress can manifest in numerous methods, affecting each mental and physical health. Widespread signs embrace fixed fear, sleep disturbances, irritability, and problem concentrating. Over time, these points can result in extra critical psychological well being issues akin to anxiousness issues or melancholy. Recognizing these indicators early and taking proactive steps to handle them is essential for sustaining general well-being.

Please do not forget that these responses are frequent and that there isn’t a disgrace in looking for assist to alleviate the burden.

Can Monetary Points Impression My Relationships?

Sure, the psychological burden of economic stress can considerably pressure your relationships, typically leading to arguments. It might additionally result in diminished communication, as people would possibly really feel embarrassed or overwhelmed by their monetary circumstances. Moreover, restricted funds for social occasions may cause folks to withdraw from their family members, isolating themselves as an alternative of reaching out. This lack of communication can additional exacerbate emotions of isolation and helplessness.

How Monetary Stress Impacts Bodily Well being

Unchecked monetary stress may also manifest in bodily well being. The BetterHelp Editorial Staff and Nikki Ciletti be aware that,

“Like many different varieties of stress, monetary stress can result in bodily well being points. Individuals experiencing stress may need complications and migraines or digestive issues like abdomen cramps, bloating, and irritable bowel syndrome (IBS). Power stress can contribute to persistent muscle pressure and ache, insomnia, poor-quality sleep, or hypertension.”3

It’s essential to acknowledge these indicators early and deal with them proactively. Taking small, manageable steps to enhance your monetary state of affairs can alleviate stress and promote general well-being.

Bear in mind, taking good care of your monetary well being is a vital part of sustaining a balanced and wholesome life.

What are A few of the Coping Methods For Monetary Stress

To successfully handle the psychological affect of economic stress, it’s important to mix sensible monetary methods with emotional coping methods. Listed here are some actionable steps you may take:

Get Lively, Downside Fixing:

- Monetary Training: Gaining a greater understanding of private finance can empower you to make knowledgeable selections and cut back anxiousness. Take into account taking free on-line programs, attending workshops, webinars, or studying books on budgeting, saving, and investing. Data is a robust software in regaining management over your monetary state of affairs. Don’t know the place to begin? Verify in together with your native library for books and upcoming group lessons.

- Budgeting: Creating an in depth price range may help you achieve readability over your funds. Checklist your revenue, bills, and money owed to establish areas the place you may in the reduction of and allocate funds extra successfully. A well-structured price range offers a roadmap for managing bills and decreasing debt, assuaging among the monetary stress. Make it a behavior to usually assessment and modify your price range; it needs to be versatile sufficient to accommodate the adjustments in your life.

- Debt Administration: For those who’re scuffling with credit card debt, take into account reaching out to a nonprofit credit score counseling company like American Consumer Credit Counseling (ACCC). They may help you create a customized debt administration plan that consolidates your money owed right into a single month-to-month cost, typically with diminished rates of interest. This strategy simplifies the reimbursement course of and may relieve monetary stress. Having a technique to remove your debt can alleviate stress and anxiousness, because it permits you to visualize the end line forward.

Emotional and Psychological Coping Strategies

- Mindfulness and Meditation: Incorporating mindfulness practices, akin to meditation or deep respiration workout routines, into your day by day routine may help cut back stress and enhance psychological readability. These methods encourage rest and supply a psychological break from monetary worries, permitting you to strategy challenges with a calmer mindset.

- Bodily Exercise: Participating in common bodily exercise, whether or not it’s yoga, a brisk stroll, jog, or a exercise session, can have a constructive affect in your psychological well being. Train releases endorphins, which act as pure temper lifters, serving to to cut back stress and anxiousness.

- Group Assist: Becoming a member of group teams or assist networks can provide a way of connection and understanding. Sharing experiences and options with others dealing with comparable challenges can present emotional reduction and sensible recommendation. Take into account collaborating in on-line boards or native meetups centered on monetary wellness and psychological well being.

- Nature Walks: Spending time in nature has been proven to cut back stress and promote rest. Taking common walks in a park or pure setting can present a peaceable respite from monetary issues, serving to you to reset and recharge.

What if I nonetheless really feel the psychological toll of economic issues? Search skilled assist.

If monetary stress turns into overwhelming, don’t hesitate to hunt skilled assist. Psychological well being professionals, akin to therapists or counselors, can present steerage and assist tailor-made to your state of affairs. They may help you develop coping methods and work by means of any emotional boundaries associated to monetary stress.

Key Takeaways

Dealing with the psychological toll of economic issues requires a balanced strategy that addresses each monetary and emotional points. By combining sensible monetary methods with psychological well being practices, you may cut back stress and anxiousness, enhancing your general well-being. Bear in mind, it’s vital to take one step at a time and search assist when wanted, figuring out that you simply’re not alone in your journey towards monetary stability and peace of thoughts. Managing monetary stress is a journey, not a vacation spot. Be affected person with your self and acknowledge that progress takes time. If you end up struggling, don’t hesitate to succeed in out for skilled assist—each monetary and emotional—to information you in your path to restoration.

Often Requested Questions

Can monetary stress trigger well being issues?

Sure. Power monetary stress can result in bodily situations like hypertension, insomnia, and digestive points.

Is monetary anxiousness frequent?

Very. Surveys present that about 1 in 2 Individuals really feel anxiousness associated to their monetary state of affairs.

What’s a debt administration plan?

It’s a structured reimbursement plan—provided by nonprofit companies like ACCC—that helps you pay down unsecured debt by means of one month-to-month cost, typically at a decrease rate of interest.

For those who’re struggling to repay debt, ACCC may help. Schedule a free credit counseling session with us as we speak.

Sources: