What prices about the identical as a weekly latte and protects your belongings from unhealthy issues that would occur?

No, it’s not a barbed-wire fence. It’s renters insurance coverage!

Renters insurance coverage is among the most reasonably priced kinds of insurance coverage on the market. In the event you’re questioning, How a lot is renters insurance coverage? you’re in the correct place. We’ll break down every little thing it is advisable to know.

What Is Renters Insurance coverage?

Renters insurance protects your private belongings in the event that they’re ever broken, vandalized or stolen. Residence renters insurance coverage is a type of property insurance that covers catastrophes like fires, electrical surges and explosions. Much like homeowners insurance, it’s a technique to switch danger from you to an insurance coverage firm.

Right here’s the way it works: You pay your monthly premiums, and the insurance coverage firm pays to switch your issues if one thing goes mistaken—after you’ve paid your deductible. This manner you’re not draining your checking account when Murphy strikes.

Since your landlord’s insurance coverage solely covers their constructing, not your issues, you need renters insurance. Interval.

How A lot Is Renters Insurance coverage?

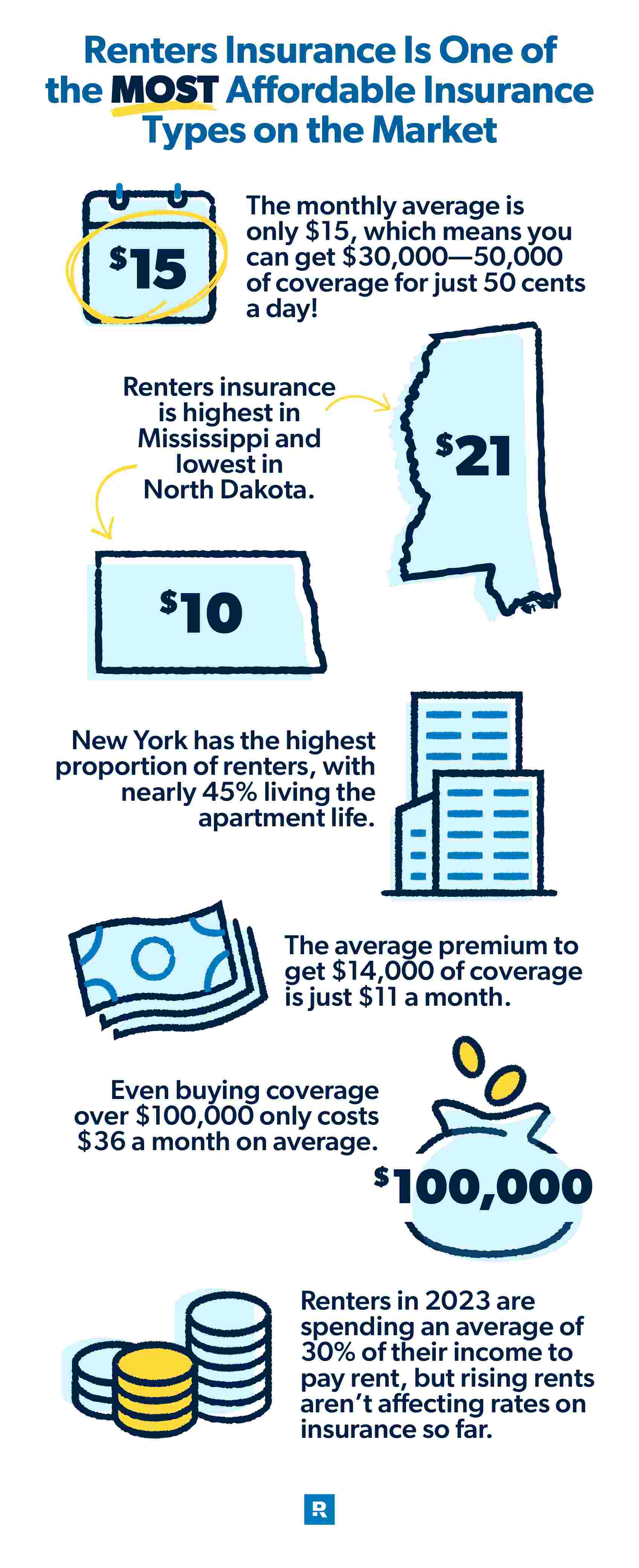

We’ll say it once more. Residence renters insurance coverage is among the most reasonably priced insurance coverage you may get. Whereas householders insurance coverage and auto insurance can simply value over $100 monthly, renters insurance coverage prices round $15 monthly on common, or $173 per yr.1

Even when you’re on an extremely tight budget, working the Baby Steps, you may put away 50 cents a day to insure $30,000 to $50,000 price of stuff.

Let’s take a more in-depth have a look at the typical value of renters insurance coverage by state.

How A lot Is Renters Insurance coverage in Your State?

|

State |

Price of Common Yearly Premium |

State |

Price of Common Yearly Premium |

|

Alabama |

$225 |

Montana | $153 |

|

Alaska |

$186 |

Nebraska | $143 |

|

Arizona |

$164 |

Nevada | $179 |

|

Arkansas |

$210 |

New Hampshire | $147 |

|

California |

$171 |

New Jersey | $154 |

|

Colorado |

$161 |

New Mexico | $180 |

|

Connecticut |

$180 |

New York | $173 |

|

Delaware |

$151 |

North Carolina | $160 |

|

Florida |

$182 |

North Dakota | $116 |

|

Georgia |

$212 |

Ohio | $162 |

|

Hawaii |

$176 |

Oklahoma | $226 |

|

Idaho |

$148 |

Oregon | $154 |

|

Illinois |

$157 |

Pennsylvania | $152 |

|

Indiana |

$164 |

Rhode Island | $183 |

|

Iowa |

$136 |

South Carolina | $186 |

|

Kansas |

$162 |

South Dakota | $118 |

|

Kentucky |

$157 |

Tennessee | $187 |

|

Louisiana |

$247 |

Texas | $216 |

|

Maine |

$148 |

Utah | $147 |

|

Maryland |

$160 |

Vermont | $151 |

|

Massachusetts |

$172 |

Virgina | $152 |

|

Michigan |

$181 |

Washington | $158 |

|

Minnesota |

$134 |

West Virginia | $179 |

|

Mississippi |

$256 |

Wisconsin | $128 |

|

Missouri |

$172 |

Wyoming | $1462 |

Most Costly States for Renters Insurance coverage

Location issues so much in relation to renters insurance coverage value. In the event you reside in these 5 states, you may anticipate to open up your pockets somewhat wider. 4 of those locations are coastal, and all of them usually see extra excessive climate.

|

State |

Price of Common Yearly Premium |

|

Mississippi |

$256 |

|

Louisiana |

$247 |

|

Oklahoma |

$226 |

|

Alabama |

$225 |

|

Texas |

$216 |

Least Costly States for Renters Insurance coverage

Enjoyable truth: In the event you reside in South Dakota, you would transfer throughout the border to North Dakota and save $2 on renters insurance coverage. Okay, possibly it’s not price transferring throughout state traces simply to save lots of on insurance coverage, however it does look like there’s some tight competitors between the Dakotas!

A part of the rationale these states see decrease charges is that they have fewer giant cities. Property insurance coverage charges are sometimes tied to property values, that are clearly larger in additional densely populated cities.

|

State |

Price of Common Yearly Premium |

|

North Dakota |

$116 |

|

South Dakota |

$118 |

|

Wisconsin |

$128 |

|

Minnesota |

$134 |

|

Iowa |

$136 |

States With the Most Renters

As you may guess, states with excessive property values are inclined to have a excessive variety of renters. Lots of these are saving up for a down payment on a house. However within the meantime, they positively want renters insurance coverage. Listed below are the states with the very best proportion of renters.

|

State |

Proportion of Housing Occupied by Renters |

|

New York |

44.6 |

|

California |

44.1 |

|

Nevada |

40.9 |

|

Hawaii |

37.4 |

|

Texas |

37.43 |

How A lot Is Renters Insurance coverage in Your Metropolis?

Reminder: Location is a big consider your value of residing—and that features the price of renters insurance coverage for metropolis dwellers. Let’s have a fast have a look at how renters insurance coverage costs look in a variety of cities throughout the U.S.*

|

Metropolis |

Common Annual Price for $15,000 of Protection |

Common Annual Price for $30,000 of Protection |

Common Annual Price for $50,000 of Protection |

|

Madison |

$223 |

$266 |

$340 |

|

Durham |

$272 |

$335 |

$495 |

|

Milwaukee |

$257 |

$309 |

$393 |

|

Raleigh |

$267 |

$329 |

$495 |

|

Detroit |

$289 |

$360 |

$488 |

|

Boston |

$282 |

$351 |

$490 |

*Based mostly on Ramsey Options inner analysis.

Protect your home and your budget by working with a RamseyTrusted pro to get the right coverage!

Renters Insurance coverage Price by Protection Quantity

In addition to location, your insurance coverage premium additionally relies on how much coverage you need. The upper the protection quantity, the extra you’ll pay.

Right here’s an inventory of the typical premiums within the U.S. based mostly on protection quantities.

|

Protection Restrict |

Annual Premium |

Month-to-month Premium |

|

$13,999 and beneath |

$132 |

$11 |

|

$14,000 to $19,999 |

$143 |

$12 |

|

$20,000 to $25,999 |

$162 |

$14 |

|

$26,000 to $31,999 |

$179 |

$15 |

|

$32,000 to $37,999 |

$171 |

$14 |

|

$38,000 to $43,999 |

$203 |

$17 |

|

$44,000 to $49,999 |

$192 |

$16 |

|

$50,000 to $74,999 |

$229 |

$19 |

|

$75,000 to $99,999 |

$288 |

$24 |

|

$100,000 and up |

$428 |

$36 |

|

Nationwide Common |

$173 |

$144 |

How Rental Costs Are Altering

Information flash: The price of housing nationwide has been on the rise since 2020, together with your hire. The typical U.S. renter in 2023 spends 30% of their revenue to pay the hire, a brand new all-time excessive.5 Yikes! And rising rents may even have performed a task in barely elevating the general value of renters insurance coverage. On the whole although, renters insurance coverage in 2023 continues to be very reasonably priced—to not point out one of many smartest methods to guard your stuff from on a regular basis disasters.

How Is the Price of Renters Insurance coverage Decided?

Now that we’ve seemed on the common prices of renters insurance coverage, let’s see how these prices are decided.

Listed below are among the elements that may trigger your renters insurance coverage price to rise or fall:

- Your credit score historical past: Insurance coverage firms typically use a credit-based insurance score to calculate your price. So whereas they’re not pulling your FICO score, they are utilizing credit score historical past to partially decide your danger.

- Historical past of claims: When you’ve got an extended historical past of filing insurance claims, your insurer will almost definitely see you as a higher danger. And claims can keep in your document for as much as seven years. So it is perhaps higher in the long term to pay for small issues out of pocket and never file a declare.

- Your deductible: The upper your deductible, the much less you’ll pay monthly, and vice versa.

- Protection quantities: In the event you’re insuring $50,000 price of stuff, your premiums will value extra. Then again, in case your issues are solely price $10,000, your renters insurance coverage will likely be on the decrease finish.

- Your location and neighborhood: We already noticed how a lot location issues. In the event you reside in part of the nation that sees extra excessive climate (like hurricanes or flooding), you’ll in all probability want an additional layer of protection and also you’ll pay extra. Neighborhood issues too. In the event you reside in an space with larger crime, you may find yourself paying extra for insurance coverage.

What’s Included in Renters Insurance coverage Charges?

Now, what sort of safety does renters insurance coverage provide you with? A typical rental insurance coverage coverage covers the next issues.

Private Property

Issues like your sofa, your laptop and people scorching pink neon Crocs (dear however price it). No matter you personal, renters insurance coverage has you coated, as much as a sure restrict. So when you’ve got $15,000 in property protection, your insurance coverage firm would reimburse you as much as that quantity. Nevertheless, when you personal bougier loot (costly jewellery, artwork, and many others.), you’ll want an endorsement. (An endorsement is an add-on to your coverage that gives additional protection.)

Additionally, it’s necessary to know the distinction between actual cash value and replacement cost coverage. Precise money worth means the insurance coverage firm will write you a test for what the gadgets have been price after they have been misplaced or broken, factoring in depreciation. Alternative value protection means your insurance coverage firm pays the complete quantity to switch the merchandise you misplaced.

Legal responsibility Protection

Renters insurance coverage additionally covers accidents that occur in your residence or house, once more, as much as sure limits. So in case your canine bites your neighbor, or somebody slips in your flooring, breaks an ankle, and sues you, you’re coated. Legal responsibility would assist pay for authorized and medical bills.

Further Dwelling Bills

Renters insurance coverage additionally covers you when you needed to briefly reside some place else whereas your residence was being repaired. Further residing bills (ALE) covers issues like lodge prices, clothes and meals.

Private property, legal responsibility and extra residing bills are simply three of the principle issues renters insurance coverage covers. It additionally covers issues like:

- Theft (even when it occurs when you’re on trip)

- Objects in storage items

- Meals that goes unhealthy from an influence outage

- Some kinds of water harm are coated, like from flooded bogs or leaky pipes. Nevertheless, renters insurance coverage doesn’t cowl sure pure disasters.

Get the correct safety on your belongings.

Having a RamseyTrusted professional by your aspect means you’ll get high quality renters insurance coverage with out breaking the financial institution.

How A lot Renters Insurance coverage Do I Want?

You’ll clearly want protection for every of the three foremost areas of renters insurance coverage outlined above. By way of private property, you’ll need to make your self a house stock listing of your belongings. These are the sorts of issues to incorporate once you’re placing it collectively:

- Movies or photographs of your stuff

- Descriptions of your possessions, particularly those which are most precious

- Particulars, together with the serial quantity, for digital tools

- An estimated worth for every merchandise

- Dates of purchases

- Receipts

From there, you can also make an general estimate for the greenback worth of your possessions. That ought to provide you with a superb sense of how a lot private property protection to purchase.

For legal responsibility, many renters insurance coverage insurance policies have a default quantity of protection, with $100,000 being a typical determine. However be at liberty to lift that when you simply love having additional protection, particularly if it suits in your funds. Lawsuits can get ugly—and costly—and that’s when legal responsibility insurance coverage counts!

For added residing bills, you’ll typically see it supplied in considered one of two methods:

- As a flat quantity per incident, or

- As a proportion of your private property restrict.

Which means that as soon as you determine how a lot private property protection you want, you may in all probability know what your ALE protection will likely be as properly. However this type of protection will also be raised, relying by yourself wants and funds.

The way to Save on Renters Insurance coverage

Now that we’ve answered, How a lot is renters insurance coverage? let’s have a look at some ideas to save cash.

Making fewer claims is one technique to maintain your premiums low. So if somebody steals your purse, and it was solely price $50, it may not be price submitting a declare.

One other nice technique to save is to extend your deductible. Sometimes, the upper the deductible, the decrease your premium. However solely do that when you’ve got sufficient in your financial savings to pay the upper deductible when a thief (or explosion or leaky rest room) strikes.

Organising autopay together with your insurer or putting in security measures like deadbolts will also be a simple technique to shave some prices off your month-to-month invoice.

How Can I Bundle Renters and Automobile Insurance coverage?

You can even lower your expenses by doing issues like bundling your renters insurance coverage coverage and an auto insurance coverage coverage with the identical firm. Let’s say you’ve obtained renters insurance coverage and auto insurance coverage by way of two totally different insurance coverage suppliers. Effectively, when you have been to bundle them collectively by eliminating one (or each) of them and shopping for your insurance coverage by way of one supplier, you’d be capable to conveniently handle your insurance policies and lower your expenses on premiums.

Some firms say they’ll prevent as much as 25% once you bundle your insurance coverage, and it may not be a foul concept to research whether or not that’s a promise they’ll maintain.

Can I Save Cash by Sharing Renters Insurance coverage With Roommates?

Lastly, you may assume sharing renters insurance with your roommates is an efficient approach to avoid wasting money. Sorry, however no. There are a number of causes it’s not price it, together with:

- You’ll pay larger premiums.

- Your roommate’s claims historical past may increase your price too.

- Something your roommate does to convey on a legal responsibility declare may make you partially liable too.

- You’ll have to determine how you can break up the protection limits pretty between you and your roommate.

- In case your roommate strikes out, you’ll have the headache of eradicating them out of your coverage.

It’s often higher to only get your own separate policy and keep away from the effort and added danger that comes with sharing a coverage.

Get the Proper Protection

In the event you’re prepared to start out your very personal rock-solid renters insurance coverage coverage, we suggest working with considered one of our impartial insurance coverage brokers. These guys are at all times RamseyTrusted, which implies they can provide you free quotes and assist you discover the correct amount of protection to suit your wants.

Connect with one of our RamseyTrusted agents today!

Often Requested Questions

-

Why does renters insurance coverage value lower than house insurance coverage?

-

The principle motive renters insurance coverage is a lot cheaper than householders is straightforward: as a result of as a renter, your landlord is the one who pays to insure the constructing you’re residing in. In different phrases, your coverage is just designed to cowl harm to your private property, which is so much much less worthwhile than the fee to switch the home or residence—the dwelling—you reside in. However with householders insurance coverage, you’re masking not solely all your possessions, but additionally the big value to switch the home if it’s misplaced.

-

Does the price of renters insurance coverage enhance with high-value gadgets?

-

Positively. The less your possessions (or the decrease their complete estimate worth), the much less private property protection you’ll want to purchase. Nevertheless a lot protection you select, your premium goes to trace with that.