Your debt-to-income ratio compares what you owe in opposition to what you earn. In its easiest type, it’s the share of your month-to-month earnings that goes towards debt funds.

Your debt-to-income ratio is without doubt one of the most vital components the lender considers whenever you apply for a mortgage or line of credit score, proper up there together with your credit score. In case your debt-to-income ratio is simply too excessive, which means you may have an excessive amount of debt in comparison with your earnings, you’ll wrestle to qualify for every type of credit score, together with mortgages and bank cards, or discover your selections restricted to these with excessive rates of interest and charges.

Earlier than you apply for a mortgage, it’s best to perceive what qualifies as debt-to-income ratio and the way to calculate yours. There’s some math concerned, however don’t fear; it’s fairly easy.

Find out how to Calculate Debt-to-Revenue Ratio

To calculate debt-to-income ratio, add all of your month-to-month debt funds, divide the entire by your complete month-to-month earnings earlier than taxes, and multiply the consequence by 100 to show the outcomes right into a proportion.

The system is:

Debt-to-Revenue Ratio = (Debt ÷ Revenue) x 100

or

R = (D ÷ I) x 100

Nonetheless confused? That’s OK. Simply take it step-by-step.

1. Add Your Month-to-month Debt Funds

The commonest debt funds lenders use to calculate debt-to-income embody:

Each lender is totally different, however debt-to-income calculations often exclude some recurring funds you would possibly consider as “debt.” Widespread examples embody utility payments, most sorts of insurance coverage premiums, cellphone payments, and most sorts of taxes apart from escrowed property taxes.

Debt-to-income calculations additionally omit variable however important bills like groceries and transportation.

For those who’re not sure about which money owed your lender contains and excludes within the calculation, ask your mortgage officer. It’s their job to arrange you for the mortgage utility course of.

2. Divide by Your Gross Month-to-month Revenue

Subsequent, calculate your month-to-month earnings earlier than taxes.

Assuming your earnings hasn’t modified considerably and also you maintain a conventional job, the simplest manner to take action is to seek out your gross earnings in your most up-to-date paycheck stub (search for gross earnings, not internet).

For those who don’t have one useful otherwise you’re a freelancer or small-business particular person, you may also discover your newest tax return and divide the quantity you discover by 12. You may also take a look at your most up-to-date W-2 (conventional job) or 1099s (for freelancers) and divide your gross earnings by 12.

In case your earnings has modified considerably, you might have to do the mathematics. Simply keep in mind that it’s the quantity earlier than taxes. That ought to make it simpler to calculate.

Now that you’ve your complete month-to-month earnings, plug it into the system.

3. Multiply by 100

The ultimate step can also be the quickest and best. To specific your debt-to-income ratio as a proportion, multiply the quantity you bought within the earlier step by 100.

Instance Debt-to-Revenue Calculation

For those who’re nonetheless misplaced, maybe an instance will probably be useful.

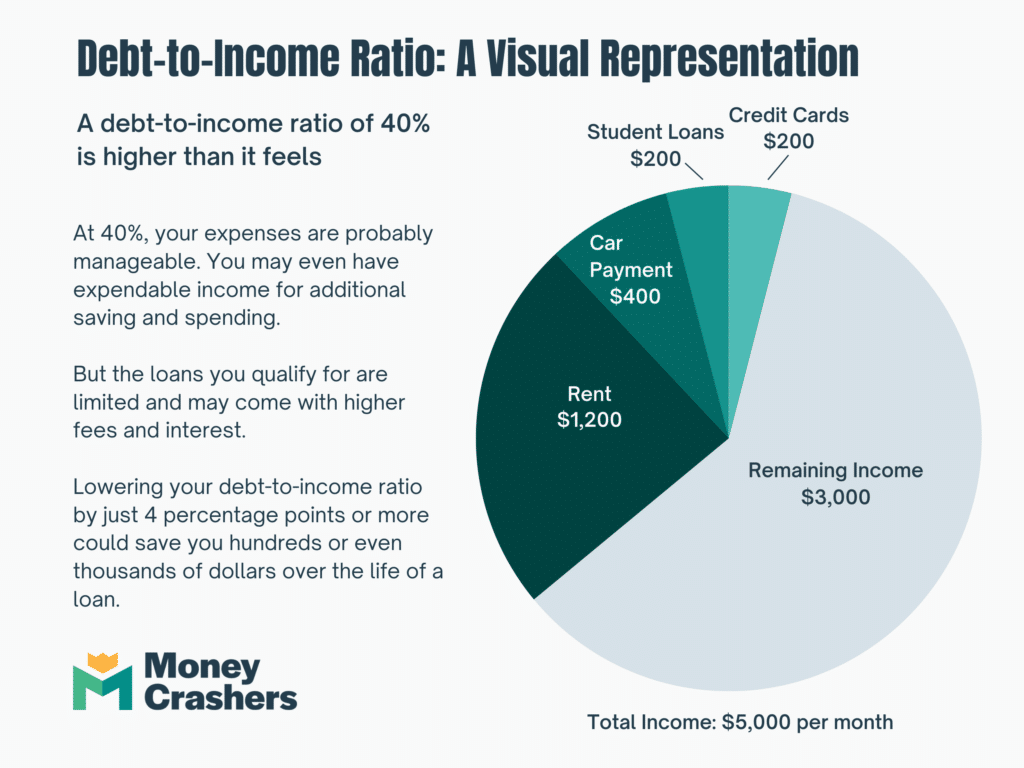

You’ve got $2,000 in complete month-to-month debt funds, damaged down as follows:

- $1,200 for lease

- $400 on your automotive fee

- $200 in scholar mortgage funds

- $200 in bank card minimal funds unfold throughout a number of playing cards

The earnings facet is easier. You’re a full-time salaried worker who earns precisely $60,000 per 12 months, or $5,000 per thirty days.

After plugging the numbers into the system, you get:

R = (D ÷ I) x 100

R = (2,000 ÷ $5,000) x 100

R = 0.40 x 100

R = 40

With $2,000 in complete month-to-month debt funds and $5,000 in complete month-to-month earnings, your debt-to-income ratio is 40%. Lower than half your earnings goes towards your money owed, which could not sound so unhealthy, however that’s truly greater than lenders wish to see. To get the bottom charges and charges on a mortgage, and particularly a mortgage mortgage, your debt-to-income ratio ought to be below 36%.

Forms of Debt-to-Revenue Ratio

There are two sorts of debt-to-income ratio: front-end and back-end. With few exceptions, the front-end ratio solely comes into play whenever you’re making use of for a mortgage mortgage. The back-end ratio is extra complete and used extra usually in lending selections.

- Entrance-end. Your front-end debt-to-income ratio contains solely your complete month-to-month housing prices, not another money owed. For those who lease, it’s your complete lease fee divided by your earnings. For those who’re a home-owner, it’s your complete mortgage fee (together with taxes and insurance coverage if relevant) divided by your earnings.

- Again-end. This can be a extra thorough measure that features your housing prices and all different relevant money owed, similar to bank card minimal funds, automotive mortgage funds, and scholar mortgage funds.

When Debt-to-Revenue Ratio Is Necessary

Excessive debt-to-income ratios make lenders nervous. The upper it’s, the much less wiggle room you need to make good in your promise to repay debt.

You is likely to be making ends meet on paper, however you’re not safe. Even a modest decline or interruption in your earnings or an surprising improve in your bills may pressure a alternative between placing meals on the desk and persevering with to make your mortgage funds.

The danger of default will increase together with debt-to-income. So most lenders decline mortgage functions from individuals whose debt-to-income ratios they contemplate unacceptably excessive. They might approve functions from individuals with decrease however still-high debt-to-income ratios, however they usually cost increased rates of interest and charges to offset the elevated danger.

What’s a Good Debt-to-Revenue Ratio?

A great debt-to-income ratio is beneath 36%. A minimum of that’s the straightforward, one-sentence reply to this query.

Actual life is a little more sophisticated. What counts as debt-to-income ratio is determined by the kind of debt-to-income ratio you’re speaking about, the kind of mortgage in query, and the lender concerned within the transaction.

Mortgages

Mortgage lenders strategy debt-to-income otherwise than others. They’re the one sort of lender that cares in regards to the front-end debt-to-income ratio, they usually’re additionally ruled by totally different federal lending laws that have an effect on debt-to-income requirements.

Mortgage lenders usually need to see a front-end debt-to-income ratio beneath 28%. The truth is, few mortgage lenders approve conventional mortgage loans with front-end ratios above 28%. For FHA loans, that are backed by the U.S. Federal Housing Administration and designed for first-time homebuyers with decrease credit score scores, the utmost front-end ratio is 31%.

In terms of back-end ratios, two numbers actually matter for mortgage lenders: 36% and 43%.

Something below 36% is a capital-G Good debt-to-income ratio. Debtors with sub-36% back-end ratios have one of the best shot at qualifying for the bottom accessible rates of interest and mortgage charges, assuming additionally they have wonderful credit score and secure employment and meet different standards lenders wish to see.

A debt-to-income ratio between 36% and 45% isn’t Good, nevertheless it’s usually ok for a lender’s approval if the applicant has secure earnings and good credit score.

Above 45%, issues get trickier. With some exceptions, Fannie Mae and Freddie Mac — the large government-backed firms that purchase and promote mortgage loans — gained’t contact typical loans with back-end ratios above that threshold. As a result of their choices for promoting these loans are restricted, most lenders gained’t approve them within the first place.

That mentioned, Fannie and Freddie purchase sure loans with back-end ratios between 45% and 50%. These loans require stricter lender scrutiny, which most really feel isn’t price it. And 50% is absolutely the most Fannie and Freddie settle for.

Different Forms of Loans

Non-mortgage lenders don’t have to fret about Fannie’s and Freddie’s debt-to-income requirements, however they nonetheless need to receives a commission.

Whereas there’s some variation between lenders and mortgage sorts, 36% stays the important thing threshold for auto lenders and private mortgage suppliers. Most non-predatory lenders decline loans with back-end ratios above 49% or 50% — or at the least scrutinize these functions extra carefully.

For those who’re shopping for a brand new automotive or attempting to qualify for a personal loan, get your debt-to-income ratio properly below 50% and ideally as near 36% as potential.

How Your Debt-to-Revenue Ratio Impacts Your Monetary Well being

Your debt-to-income ratio impacts loads moreover your skill to qualify for credit score (at the least non-predatory credit score). You are feeling it in your credit score rating, your longer-term monetary plans, and possibly even your psychological well being.

- Problem acquiring credit score. The upper your debt-to-income ratio, the much less doubtless you’re to be authorized for brand spanking new credit score. That impacts your life in comparatively small methods (say, being declined for a retail bank card out of your favourite division retailer) and greater ones too (like not with the ability to purchase a home).

- Restricted borrowing capability. Even if you happen to qualify for brand spanking new credit score, a better debt-to-income ratio reduces the entire quantity you may borrow. You would possibly must accept a decrease credit score restrict in your bank card or a smaller mortgage mortgage that places your splendid house out of attain.

- Monetary stress. A excessive debt-to-income ratio doesn’t essentially imply you’re dwelling past your means, nevertheless it definitely will increase your danger of economic — and psychological and bodily — stress.

- Threat of default. Even when issues don’t really feel uncontrolled proper now, a excessive debt-to-income ratio places you at increased danger of default. You’ve got much less capability to soak up monetary shocks, like a interval of unemployment or an enormous surprising expense.

- Credit score rating affect. When you have a excessive debt-to-income ratio, you most likely have a excessive credit score utilization ratio as properly. Debt-to-income doesn’t have an effect on your credit score rating straight, however credit score utilization does. It’s one of the crucial vital credit-scoring factors.

- Restricted monetary flexibility. With extra of your earnings earmarked to repay your money owed, you may have much less flexibility to purchase the belongings you need or want, to not point out spend money on your future.

- Delayed monetary targets. Comparatively few homebuyers — and even fewer first-timers — purchase homes in money. Many automotive patrons finance their rides too, particularly new ones. A excessive debt-to-income ratio may imply renting whenever you’d relatively purchase or sinking increasingly money into an outdated, failing automotive.

Managing Your Debt-to-Revenue Ratio

Your debt-to-income ratio isn’t set in stone. It varies over time as you tackle new money owed and repay outdated ones. And you may take any variety of incremental steps — and extra drastic ones too — to trim your debt-to-income ratio over time.

DIY: Methods for Enchancment

Decreasing your debt-to-income ratio means altering one or each of the variables concerned: your debt or your earnings. Ideally, it additionally means making and sticking to a monetary plan that helps you reside inside your means.

- Repay your bank cards in full every month. Except you’re making the most of a limited-time 0% APR promotion to finance a big buy or pay down a transferred balance, don’t carry month-to-month bank card balances. That raises your minimal month-to-month fee — and with it your debt-to-income ratio.

- Pay greater than required on loans. Put aside an inexpensive quantity every month to make further funds on loans like your mortgage and automotive mortgage. Even $100 per thirty days could make a distinction over time. Pull from nonessential purchases like takeout.

- Postpone massive purchases. Postpone any massive buy you have to finance — house enhancements, a brand new automotive, even a brand new TV if you happen to can’t pay for it out of pocket — till your present money owed are below management.

- Keep away from making use of for brand spanking new credit score. “Preapproved” bank card and private mortgage presents are tempting, however they’re unhealthy on your debt-to-income ratio. Don’t act on them or another presents of recent credit score till your debt-to-income ratio is decrease.

- Take steps to extend your earnings. That’s simpler mentioned than accomplished if you happen to already work full time and have nonwork obligations in your spare time. However a part-time job or occasional consulting work can considerably enhance your debt-to-income ratio. And it may have a much bigger affect than paying off present debt in your present earnings.

- Make a month-to-month funds. For those who don’t have already got a family funds, make one which prioritizes paying down your money owed. That may contain some sacrifice, nevertheless it’s price it in the long term. If you have already got a funds, revisit it and tighten up wherever you may.

Monetary Planners: Looking for Skilled Recommendation

For those who really feel overwhelmed or such as you’re not making progress rapidly sufficient, you may also search skilled assist from legit credit counselors or financial advisors.

The very best place to seek out assist to handle and cut back your debt is a nonprofit credit score counseling service. The U.S. Division of Justice retains an inventory of federally approved credit counseling agencies, as do most state attorneys basic and shopper safety companies. You may also search for certified financial planners.

Credit score counseling companies differ by group and shoppers’ monetary conditions. They’ll vary from free or very low-cost counseling and schooling periods to formal debt administration plans, which bundle some or your whole money owed in a manner that makes them simpler to handle and repay.

Debt administration plans carry some charges, however they’re not as costly or as unhealthy on your credit score as for-profit debt settlement services.

For those who already work with a monetary planner or advisor, ask them for steerage. Even if you happen to don’t, many monetary planners supply flat-fee monetary plans that don’t require an ongoing relationship. Count on to pay anyplace from a number of hundred to a couple thousand {dollars} on your customized plan, however that’s cash properly spent if in case you have comparatively excessive earnings (and a debt load to match).

Debt-to-Revenue Ratio FAQs

Calculating your debt-to-income is a straightforward math downside, and the idea itself is fairly simple to know. However given how vital your debt-to-income ratio is to your monetary life, it’s a good suggestion to grasp what it means for you — and what it doesn’t.

How Does Your Debt-to-Revenue Ratio Have an effect on Your Credit score Rating?

Your debt-to-income ratio doesn’t straight have an effect on your credit score rating. FICO and VantageScore, the 2 commonest shopper credit-scoring fashions, ignore debt-to-income as a credit-scoring issue.

Nevertheless, your debt-to-income ratio can not directly have an effect on your credit score rating. For starters, if in case you have a excessive debt-to-income ratio, you most likely have numerous debt in your identify, comparatively low earnings, or each. Your danger of lacking mortgage funds or defaulting in your loans — a very powerful credit score scoring issue — is increased.

Additionally, in case your debt-to-income ratio is excessive, there’s likelihood your credit score utilization ratio is excessive as properly. Credit score utilization is the second-most vital credit-scoring issue after fee historical past, so a excessive credit score utilization ratio is usually unhealthy information on your credit score rating.

How Does Debt-to-Revenue Ratio Have an effect on Mortgages?

Your debt-to-income ratio straight impacts your probabilities of qualifying for a mortgage. If it’s actually excessive, you’ll have a tough time qualifying for a mortgage mortgage. If it’s a bit of decrease however nonetheless excessive, count on to pay a better rate of interest and better charges than your less-indebted fellow debtors.

Which Bills Don’t Rely Towards Your Debt-to-Revenue Ratio?

Lenders’ debt-to-income calculations omit some bills you would possibly consider as money owed. The largest ones are:

- Revenue tax funds

- Most different tax funds, besides property taxes bundled right into a mortgage fee

- Most insurance coverage premiums, besides owners insurance coverage bundled right into a mortgage fee

- Utility invoice funds

- Funds on casual loans (like loans between relations) that aren’t reported to credit score bureaus

- Groceries and different family necessities

- Transportation bills, besides automotive mortgage funds

Last Phrase

Like your credit score rating, your debt-to-income ratio is a super-important quantity on your monetary life. It has an enormous say in whether or not you qualify for brand spanking new credit score and the way a lot mentioned credit score prices you. It may assist usher you into the house of your desires or maintain you tied to a rental property you hate for longer than you’d like.

However your debt-to-income ratio doesn’t cease there. On prime of its direct affect in your skill to qualify for brand spanking new credit score, a excessive debt-to-income ratio reduces your monetary flexibility, forces you to make robust selections about what to purchase and when, and raises your monetary stress baseline. Decreasing it might require robust selections that transcend skipping takeout one evening every week or canceling a streaming subscription or two.

It takes time too. But it surely’s a worthwhile funding in your monetary future — and in your private well-being.