Making a household price range is step one to managing your family funds. However budgeting can appear to be rather a lot—particularly whenever you’ve bought children. You’re busy, your cash’s tight, and cash talks are generally tremendous awkward.

Hear this: You can create a profitable household price range irrespective of your time, earnings or previous. We’ve been instructing folks how do to it for over 30 years and have seen it work repeatedly and once more. Right here’s a few of our greatest steering and tips about how one can make a household price range give you the results you want.

What Is a Household Funds?

A household price range is a plan on your family’s cash—every thing that is available in (earnings) and goes out (bills). Meaning you’re planning forward for all of the giving, saving and spending every month—from groceries and hire to emergency financial savings and retirement.

Create a Household Funds in 5 Steps

Funds Step 1: Checklist your earnings.

First, listing your earnings—that’s any cash you intend to get throughout that month.

Write down every regular paycheck for you and your partner—and don’t neglect any extra cash coming your approach via a side hustle, storage sale or something like that.

When you’ve bought an irregular income, put the lowest estimate of what you usually make on this spot. (You may alter the quantity later within the month should you make extra.)

Funds Step 2: Checklist your bills.

Now that you just’ve deliberate for the cash coming in, you’ll be able to plan for the cash going out. It’s time to listing your expenses. Examine your on-line checking account or have a look at your financial institution assertion that can assist you estimate your bills.

We imagine in beginning your price range with a spirit of generosity and giving. Additionally, should you don’t have an emergency fund but, it’s essential make saving certainly one of your priorities.

Then you definitely’ll listing what you spend cash on. Begin by overlaying your Four Walls—aka meals, utilities, shelter and transportation.

A few of these are referred to as fixed expenses, which means they keep the identical each month (like your mortgage or hire). Others change from month to month and are referred to as variable bills (like groceries).

Fastened bills are approach simpler to nail down the primary month. For variable bills, have a look at your previous spending and make your finest estimate. It normally takes about three months to get the dangle of this budgeting factor, so don’t fear if it’s exhausting to determine your spending at first. You’ll get higher at planning the extra you price range.

Subsequent, listing all of your different month-to-month bills. We’re speaking about insurance coverage, debt, childcare, leisure, eating places, pet prices, and any private spending. And bear in mind, wants come earlier than needs. All the time. So get these necessities in earlier than the extras.

Funds Step 3: Subtract your bills out of your earnings.

Once you subtract your bills out of your earnings, it ought to equal zero. We name this a zero-based budget. That doesn’t imply your checking account is at zero (hold a bit buffer of $100–300 in there). Nevertheless it does imply each little bit of your earnings has a job.

If you find yourself with cash left over after you’ve subtracted all of your bills, give these {dollars} a job too. In any other case, you’ll find yourself mindlessly spending them on coffees and people one-click offers of the day. Put something “further” towards your present cash purpose—one thing we’ll speak about extra in a bit.

What if you find yourself with a unfavorable quantity? It occurs. You simply want to chop your deliberate spending till your earnings minus your bills equals zero. Trace: Begin with extras like eating places and leisure. You may’t spend greater than you make. That math doesn’t add up. Actually.

Keep in mind, you’re employed exhausting on your cash. It ought to work exhausting for you. Each single greenback. So make a zero-based price range. Each single month.

Funds Step 4: Observe your bills all through the month.

Each time you spend or earn cash, it’s essential observe it within the price range. That’s the way you control your spending—so that you don’t threat overspending.

Start budgeting with EveryDollar today!

Additionally, tracking your spending creates accountability together with your partner. And your self.

Yup. Generally you’re the precise one that wants to take a look at that restaurant price range line and see it’s simply too low to hit up the Fry Guys meals truck for lunch together with your coworkers. (Did somebody say “brown-bag your lunch” simply then? We did. It was us.)

The primary three steps are all about making your loved ones price range. This step is the key to maintaining with it. Don’t skip it. Observe these bills!

Funds Step 5: Make a brand new price range (earlier than the month begins).

Your loved ones price range gained’t change a ton from month to month, however it’s going to a bit. You’ll have holidays, birthdays, annual subscriptions. You’ll additionally must cowl marching band uniforms one month and purchase new soccer cleats the following.

Don’t let any of it shock you! Copy over final month’s price range, after which make the tweaks it’s essential get prepped for all of the seasonal and month-specific spending coming your approach. And do that earlier than the month begins as a result of planning forward is the way you’ll get forward together with your cash.

(P.S. This calculator is just the start. What you actually need is a month-to-month price range. Check out EveryDollar. Without spending a dime. Right this moment.)

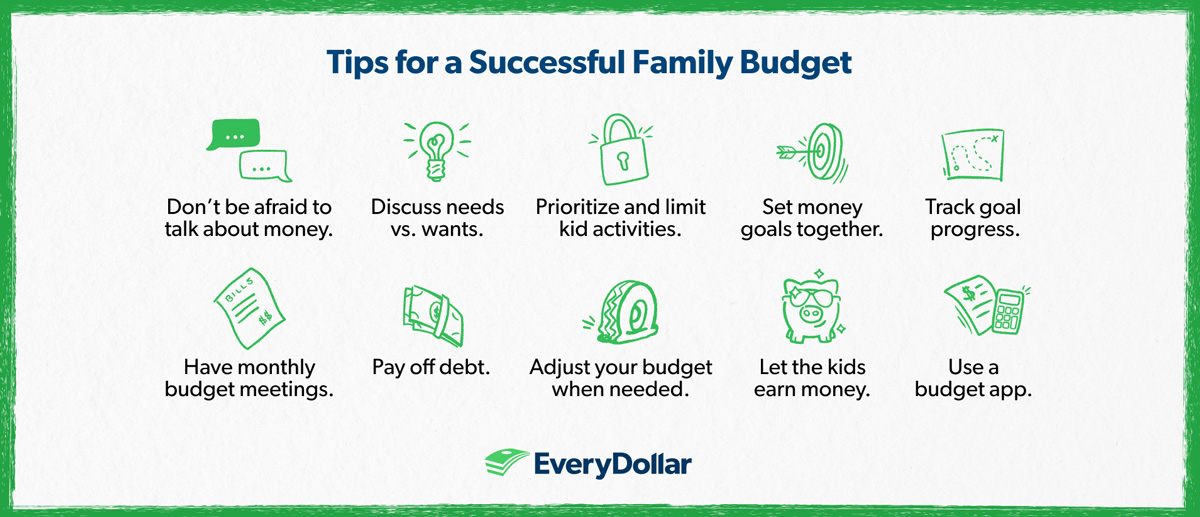

Suggestions for a Profitable Household Funds

Now that you know the way to create a family price range, let’s speak about how to ensure it really works for you.

1. Don’t be afraid to speak about cash.

Our research reveals over half of People (53%) say they had been by no means taught how one can deal with cash rising up. So it’s tremendous possible you gained’t be used to having these conversations, and that may make issues awkward at first.

However push previous these emotions and speak about cash collectively as a household. This builds a stable monetary basis on your children now—and much into the longer term.

2. Talk about needs vs. wants.

One of many first cash matters to cowl? The difference between wants and needs. And let’s be sincere, even the adults within the room can use a refresher on this one.

Be certain everybody is aware of: Wants come first. This implies you’re budgeting for necessities just like the 4 Partitions earlier than household memberships to the native wax museum.

3. Prioritize and restrict your children’ actions.

You in all probability don’t manage to pay for within the price range on your children to be concerned in every thing they’re curious about. And that’s okay.

With regards to extracurriculars, golf equipment, sports activities, classes and the like, one factor per child per season is a lot for their time and your price range. Work collectively to determine what that one factor ought to be.

4. Set cash targets collectively.

Begin making money goals collectively. That may be paying off debt or saving cash for emergencies, an enormous buy or a enjoyable household expertise. (When you don’t know the place to begin with setting cash targets, take a look at the 7 Baby Steps.)

Speak via how everybody could be concerned in making these targets occur. Talking of which . . .

5. Observe purpose progress.

Aim monitoring is very easy in EveryDollar (our free price range app). You may arrange a sinking fund on your purpose and determine how a lot to save lots of each month.

Then speak about methods to hit the purpose sooner like:

Once you embrace the youngsters, they find out about cash and the ability of exhausting work—life classes throughout.

6. Have month-to-month price range conferences.

Monthly budget meetings allow you to all keep on the identical web page. Right here’s what you must take into consideration earlier than and through these conferences.

Need assistance? Obtain the EveryDollar Couples Budget Meeting Guide to make these month-to-month conferences targeted—and enjoyable.

7. Mix funds.

When you haven’t but, you and your partner ought to mix funds. Meaning combining bank accounts. For some folks, that appears loopy. However if you wish to get on the identical web page about cash and actually work collectively as a workforce, you’ll be able to’t skip this step. You’ve develop into one. Your funds ought to too.

8. Repay debt.

$17.5 trillion. That’s the overall family debt in America as of the top of 2023.1 No. Joke.

Debt is consistently knocking on our entrance doorways like a sneaky salesman with tempting “rewards” and the promise of on the spot gratification. However actually, all debt does is maintain this month’s earnings hostage to pay on your previous.

Nicely, it’s time to slam the door in debt’s mendacity face. No extra being part of that $17.5 trillion statistic. Get everybody in your loved ones on board to repay your debt and take again your earnings. All of it!

9. Modify your price range when wanted.

Braces, bow ties and budgets. What do these three B-words have in frequent? All of them want adjusting.

Sure, you’re supposed to regulate your price range through the month. For instance, if the electrical energy invoice was greater than you deliberate, take the additional cash you want from a nonessential price range line.

A price range isn’t a sluggish cooker. You may’t set it and neglect it. You’ve bought to get in there and make changes so your price range works for you and your loved ones.

10. Let the youngsters earn cash (aka work on fee).

A lot of us bought an allowance rising up. However having your children work on fee as an alternative of handing them cash for nothing teaches them how the world of labor runs. They do chores—they receives a commission. They save their cash—they pay for issues.

Begin children out on commission-based incomes in order that they be taught the worth of cash, exhausting work, and the way these two issues are straight linked.

11. Use a price range app.

Right here’s an excellent sensible tip on how one can make a family price range that works. Use a price range app. It creates easy accessibility to the price range always. And if it’s easy to make and sustain with a price range, that’s half the battle!

And don’t neglect: We’ve bought a free price range app referred to as EveryDollar. You and your partner share one login. You may observe spending from wherever and all over the place. You may even pull up the price range in your desktop at your month-to-month price range conferences.

EveryDollar helps you convey every thing (and everybody) collectively and work as a workforce to handle your cash and hit your targets.

You’ve bought this! Get began with EveryDollar at the moment, as a household. And produce snacks.