Perceive your Debt: Debt from bank cards, loans, or medical payments can really feel overwhelming. Recognizing its commonality is step one in tackling it.

Assess Your Funds: Checklist all money owed, together with quantities and rates of interest. Determine price range areas for cuts, like subscriptions and eating out.

Create a Reimbursement Plan: Use methods just like the snowball (smallest money owed first) or avalanche (highest curiosity first) strategies. Set achievable objectives.

Improve Earnings: Take into account freelancing, part-time work, or monetizing hobbies to hurry up debt compensation.

Debt Administration Plan (DMP): Consolidates money owed right into a single reduced-interest fee.

Use Assets and Assist: Leverage on-line instruments and help networks for steering and accountability.

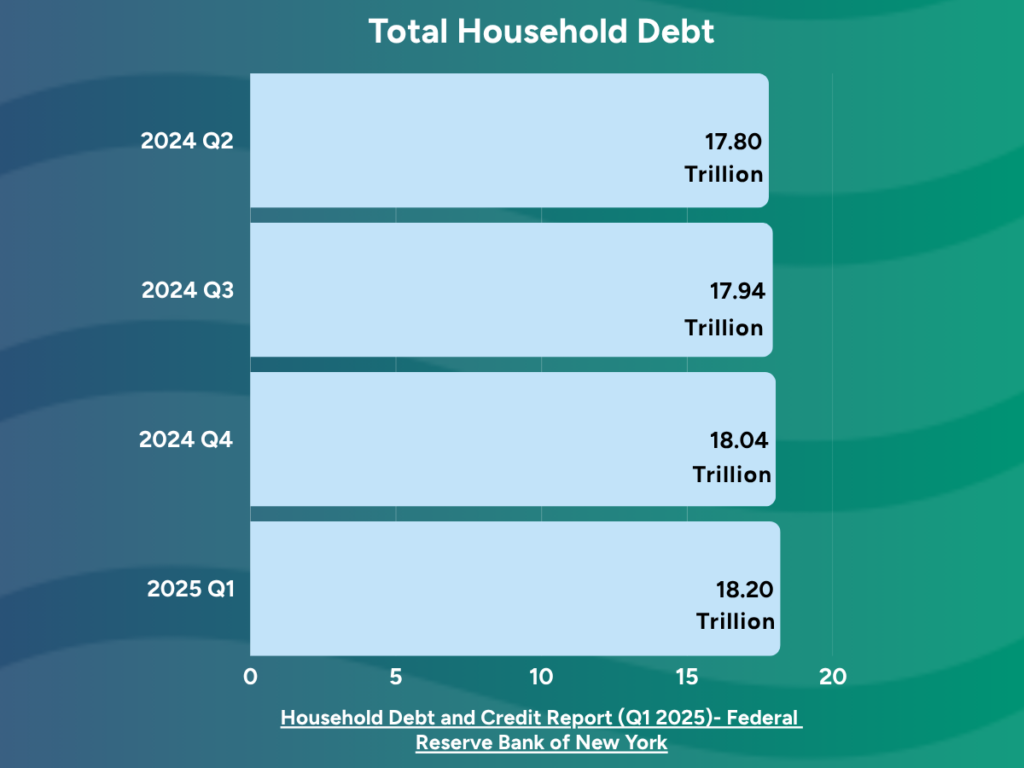

Understanding Debt Problem. Debt can accumulate from varied sources reminiscent of bank cards, pupil loans, or surprising medical payments. Based on a report by the Federal Reserve, American family debt reached $18.20 trillion this 12 months1, highlighting the widespread nature of this situation. With such vital figures, it’s no marvel many people really feel overwhelmed

Coping with debt can usually really feel like an unattainable process, leaving many overwhelmed and not sure of the place to begin. So that you’re now asking your self, I’m attempting to cope with debt, but it surely feels unattainable, what ought to I do? Nicely, breaking it down into manageable steps and in search of help from monetary professionals could make the method a lot much less daunting. On this information, we’ll discover sensible methods to sort out debt successfully and break down the method under:

Assess Your Monetary State of affairs

Create a Complete Checklist: Start by itemizing all money owed, together with the quantity owed, rates of interest, and minimal fee quantities. This supplies a transparent image of what you’re coping with and helps prioritize which money owed to sort out first.

Analyze Your Finances: Evaluation your revenue and bills. Determine areas the place you may reduce to unencumber funds for debt compensation. What are examples of issues I might reduce? Subscriptions like TV streaming providers. Reap the benefits of free ones. Some libraries even offer you entry to a streaming service with a library card known as Kanopy. Moreover, think about reducing again on eating out by planning meals and cooking at dwelling, which not solely saves cash however may also be a more healthy choice. Consider your transportation prices—carpooling, utilizing public transportation, and even biking can considerably cut back bills.

Develop a Debt Reimbursement Plan

Give attention to One Debt at a Time: Choose a debt repayment strategy just like the snowball methodology (paying off the smallest money owed first) or the avalanche methodology (tackling the very best rate of interest money owed first). Each strategies have their deserves and will be efficient based mostly in your private preferences.

Set Achievable Objectives: Set reasonable and particular objectives for paying off every debt. As an example, goal to pay an additional $50 on the bank card with the very best curiosity every month.

Can Extra Earnings Assist Me?

Sure, exploring extra revenue alternatives can speed up the method of repaying debt. Take into account freelancing or part-time work to complement your revenue. Platforms like Upwork or Fiverr provide varied freelance alternatives that may be pursued in your spare time. Moreover, take into consideration monetizing your hobbies or expertise by turning them right into a facet hustle. Whether or not it’s crafting, images, or tutoring, these actions will be each personally and financially rewarding.

Advantages of Skilled Assist

Participating with monetary professionals supplies customized methods and insights that may considerably improve your debt compensation journey. They provide experience in negotiating with collectors and might usually safe decrease rates of interest or waived charges. In search of skilled steering, reminiscent of via nonprofit credit score counseling providers, could be a worthwhile step. Organizations like American Shopper Credit score Counseling (ACCC) provide credit counseling that can assist you perceive your monetary state of affairs and develop a customized plan. ACCC additionally supplies debt administration plans (DMP), which can be tailor-made to your wants.

With their intensive expertise, ACCC can assist you discover varied debt aid choices, guaranteeing that you just select the one which greatest aligns together with your monetary objectives and circumstances. Participating with knowledgeable not solely alleviates the stress of managing debt by yourself but additionally empowers you with the information and instruments wanted to make knowledgeable selections. This help creates a structured path to monetary freedom, providing you with the peace of thoughts to deal with different life priorities.

Why Ought to I Take into account Skilled Assist?

- Knowledgeable Negotiation: Professionals can negotiate in your behalf to doubtlessly decrease rates of interest and get rid of charges, decreasing the general price of debt compensation.

- Tailor-made Options: Counseling providers present custom-made plans that think about your distinctive monetary state of affairs, guaranteeing a simpler strategy to debt administration.

- Stress Discount: By entrusting professionals with the complexities of debt negotiation and administration, you may deal with reaching your monetary objectives with out feeling overwhelmed.

- Instructional Assets: Entry to workshops and seminars can improve your monetary literacy, equipping you with expertise to handle funds extra successfully sooner or later.

- Lengthy-term Advantages: Skilled steering can result in improved credit scores and monetary habits, setting a stable basis for future monetary safety.

Participating with monetary professionals can remodel the daunting process of debt compensation right into a manageable and hopeful journey. With their help, you may pave the way in which towards a debt-free future, safe within the information that professional recommendation and help are only a click away.

Can a DMP Assist Me?

Sure! Enrolling in a debt management program can consolidate your money owed right into a single month-to-month fee, usually at a decreased rate of interest. This strategy simplifies your monetary obligations and will result in extra manageable compensation phrases. By working with professionals and using out there sources, you may take proactive steps in the direction of reaching monetary stability and decreasing debt successfully.

Leveraging Assets and Assist

Using on-line instruments and sources, reminiscent of on-line calculators and budgeting apps, can simplify managing your funds and monitoring your debt compensation progress. Connecting with a help community by sharing your objectives with mates or household can present encouragement and accountability.

Conclusion

Though coping with debt might really feel like an unattainable process, it doesn’t should be. By assessing your monetary state of affairs, prioritizing your money owed, and exploring extra revenue alternatives, you may create a transparent and efficient compensation roadmap. Don’t overlook the ability {of professional} help; partaking with monetary consultants can present tailor-made methods, cut back stress, and provide academic sources to empower your monetary selections. Moreover, debt administration packages and leveraging on-line instruments can streamline your efforts, making the trail to monetary freedom extra accessible. Bear in mind, with dedication, knowledgeable methods, and the suitable help, overcoming debt isn’t solely doable however can result in a safer and financially sound future.

FAQs

1. Why does coping with debt really feel overwhelming?

Debt feels overwhelming as a result of its complexity and emotional burden. A number of sources, like bank cards and loans, contribute to the problem, particularly with U.S. family debt at $18.20 trillion.

2. How do I begin tackling my debt?

Begin by itemizing all money owed, quantities, rates of interest, and minimal funds. Analyze your price range to chop bills, liberating up funds for compensation.

3. What are efficient methods for debt compensation?

Use the snowball methodology to repay small money owed first or the avalanche methodology for high-interest money owed. Select what matches your objectives and goal to pay further every month.

4. Can extra revenue assist with debt compensation?

Sure, further revenue can velocity up compensation. Take into account freelancing or part-time work, or monetize hobbies for further funds.

5. Why ought to I think about skilled monetary help?

Professionals can negotiate higher phrases, create tailor-made plans, and provide sources, decreasing stress and enhancing monetary literacy.

6. What’s a Debt Administration Program (DMP), and the way can it assist?

A DMP consolidates money owed into one fee, usually with decrease rates of interest, simplifying obligations and aiding monetary stability.

7. What sources can assist me handle my debt?

Use budgeting apps and debt calculators, and construct a help community for encouragement and accountability.

8. Is overcoming debt actually doable?