- BTC dipped by 2.55% over the previous day.

- Bitcoin noticed a surge in establishment demand because the Coinbase Premium Index flips to constructive.

Over the previous week, Bitcoin [BTC] has continued to commerce Between $95k and $98k. Actually, as of this writing, Bitcoin was buying and selling at $95936. This marked a 2.55% decline on day by day charts with an extension to this bearish outlook on weekly charts by 1.56%.

With Bitcoin struggling to take care of an uptrend and reclaim increased resistance, traders particularly establishments have taken this chance to purchase BTC.

Inasmuch, standard crypto analyst Ali Martinez has steered a rising institutional demand, citing the Coinbase Premium Index.

Bitcoin institutional demand surges

With Bitcoin’s continued consolidation, institutional demand has surged. Over the previous week, the Coinbase Premium Index has remained constructive.

When constructive, it suggests stronger shopping for stress on Coinbase than on Binance, implying that U.S. traders are dominating the market.

As such, establishments have taken benefit of the present worth stagnation to build up Bitcoin at decrease charges.

This rising shopping for stress from establishments displays bullish sentiments as they anticipate costs to rebound within the close to time period.

What BTC charts counsel

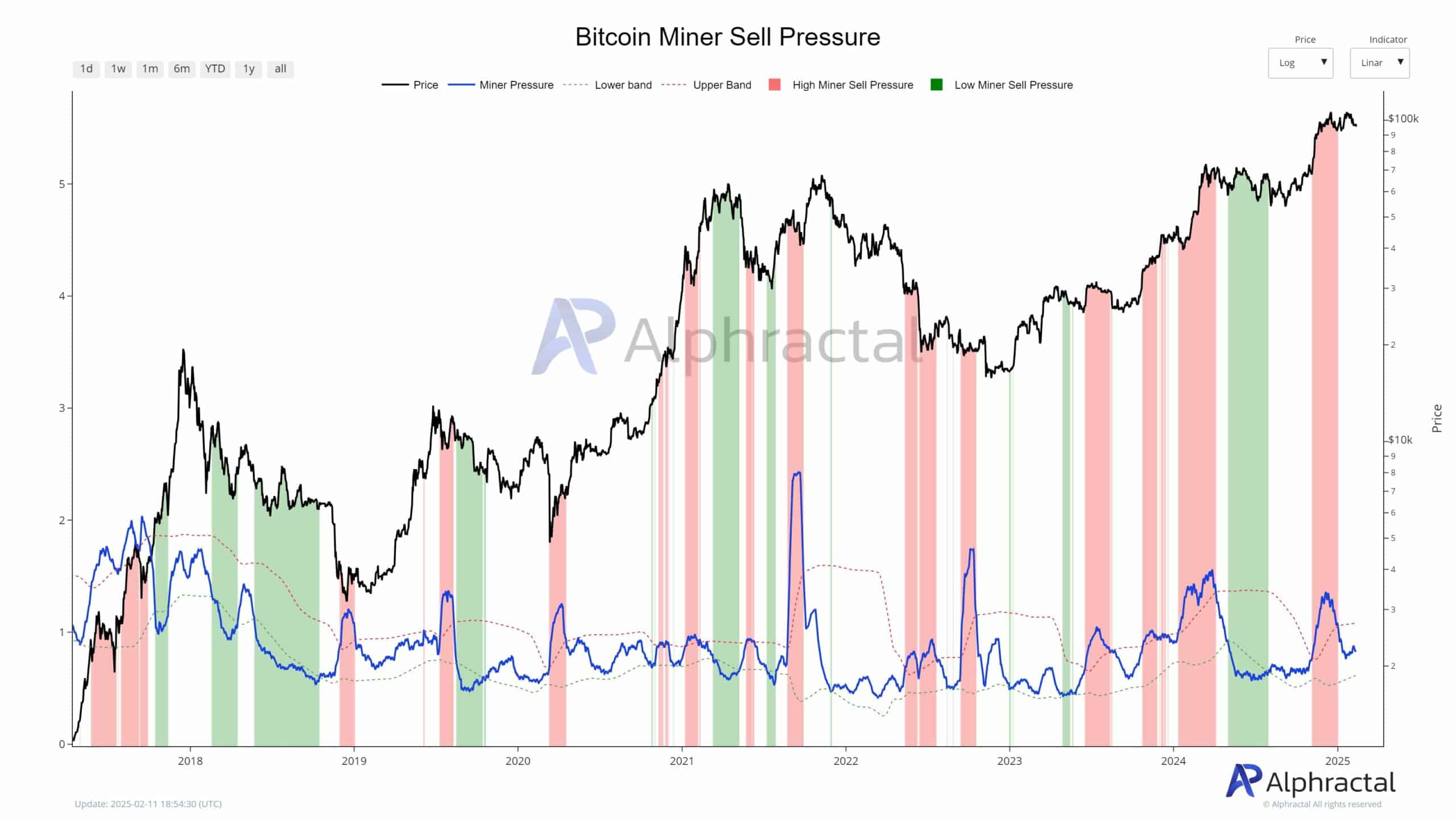

With institutional demand rising for BTC, it displays bullish sentiments from this group. For starters, we see this bullishness amongst establishments as promoting stress from miners is decreasing. In keeping with Alphractal, miners’ promoting stress has dropped, decreasing the BTC provide from miners.

Subsequently, after a interval of excessive promoting from miners, values are actually beneath common, suggesting a pause in miner liquidations.

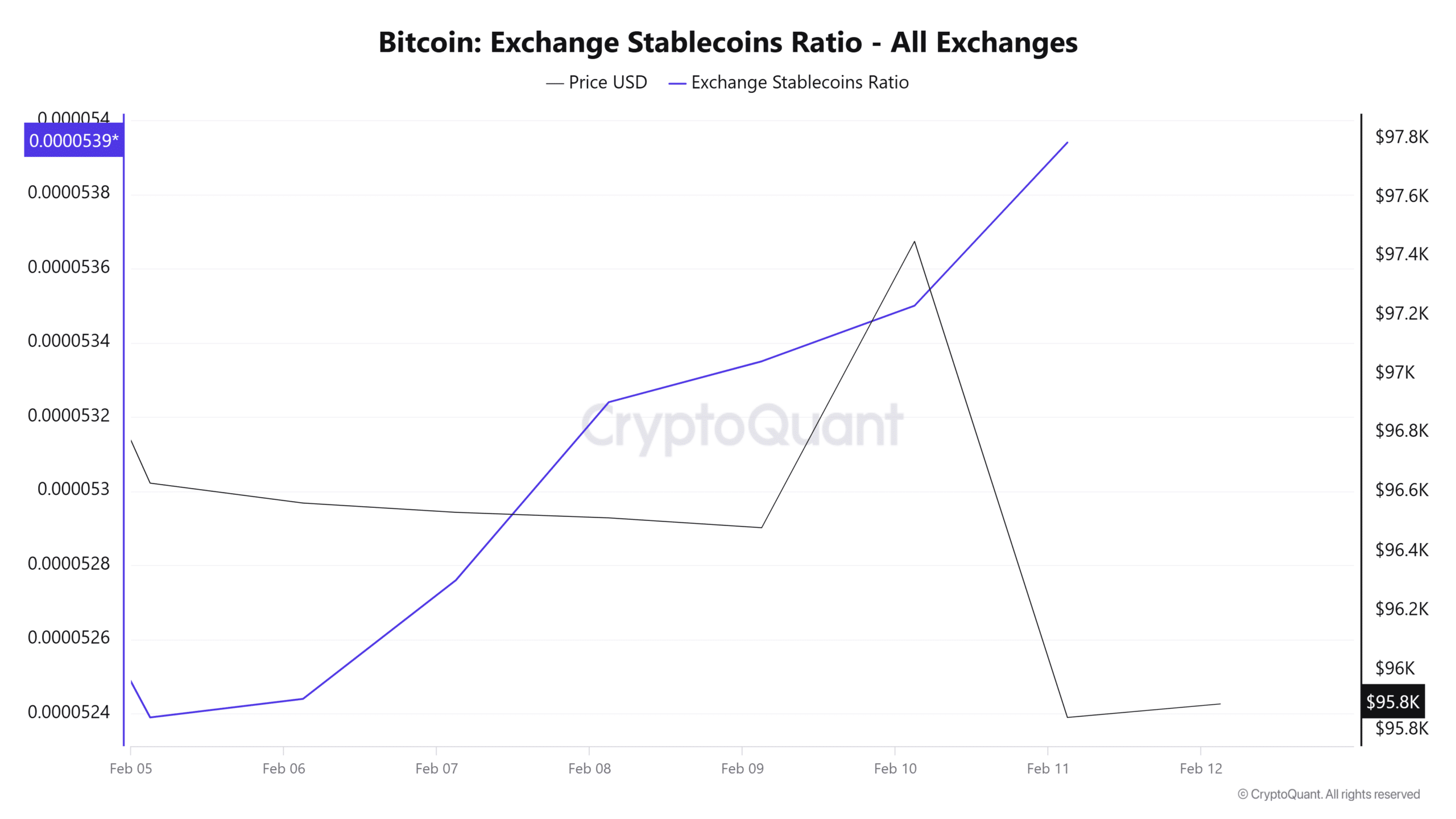

Moreover, Bitcoin’s trade stablecoins ratio has surged over the previous week. Usually, establishments use stablecoins similar to USDT or USDC to purchase BTC thus a rising stablecoin provide indicators potential shopping for energy available in the market.

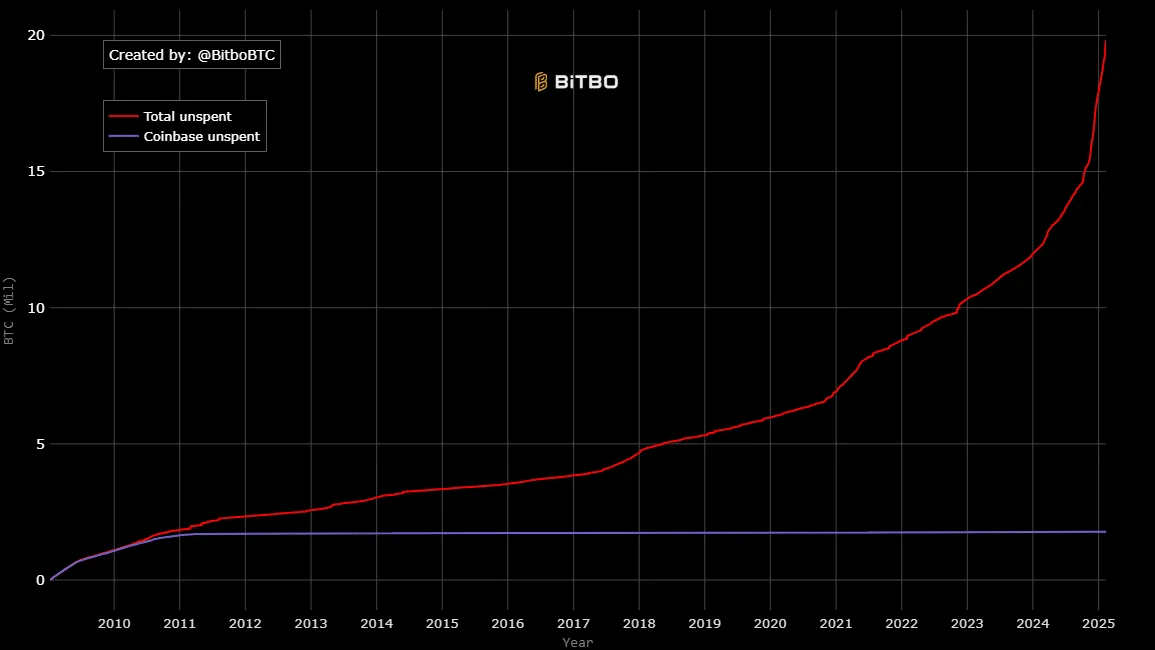

Equally, dormant cash, particularly complete unspent have skilled a gradual rise whereas Coinbase’s unspent cash have remained the identical.

This means that enormous and long-term holders usually are not promoting BTC, both by way of Coinbase or different exchanges.

In conclusion, Bitcoin was experiencing excessive demand from establishments, evidenced by lowered promoting stress and better shopping for exercise.

With establishments shopping for with out promoting, it displays robust bullish sentiments as they flip to build up.

Subsequently, the present market circumstances place BTC for extra positive factors on its worth charts. If this pattern holds, BTC might escape of $98,405 and try $100K.

Nevertheless, with STH sellers nonetheless available in the market, a pullback might see the crypto retrace to $95,031.