Cavemen, geckos, mayhem, Flo, Jake—are we at a theme park right here or shopping for insurance coverage?

The insurance coverage trade typically looks like it has a nasty case of mascot overload. However you simply need to know you’ve bought the best protection and that you simply’re not overpaying.

So, how do you get there? Properly, a lizard might not be your greatest wager. Higher to work with an actual skilled like an insurance coverage dealer.

You wouldn’t be alone in case you’ve ever puzzled, What’s an insurance coverage dealer? We’ll break down what they’re and the way they will help you get coated.

What Is an Insurance coverage Dealer?

An insurance coverage dealer is somebody who represents you to insurance coverage firms. A dealer can work in your behalf to search out you all the pieces from health insurance and auto policies to life insurance, homeowners insurance—and extra.

Whenever you work with a dealer for insurance coverage, their loyalty is to you, not the insurance coverage firms. They’re form of like private consumers. They will’t sell insurance however as a substitute go into {the marketplace} and search for the perfect protection for you. They’ll current you with totally different choices, and as soon as you discover what works greatest, they’ll work with a licensed skilled who can promote the coverage—often an insurance coverage agent.

When Ought to You Use an Insurance coverage Dealer?

Are you out there for car insurance? Discovering an insurance coverage dealer could be a wise transfer. Procuring your owners coverage? That’s a superb cause to work with a dealer. Then there’s bundling—yet one more means a dealer can conveniently prevent money. Or perhaps you’re simply feeling a schedule squeeze and need somebody to do the shopping for you. In your case, letting a dealer prevent money and time makes tons of sense.

Insurance coverage brokers are a good way to entry a variety of insurance policies throughout a number of kinds of insurance coverage. They prevent the work of looking down every type of coverage you need and as a substitute current you with the perfect of the perfect. What’s to not like about that?

And since you’re the client, they’re motivated to work laborious for you, discover you the perfect insurance policies, and earn your long-term enterprise. They’ll additionally have the option that will help you in a while throughout large life modifications when you must replace your coverage.

How Insurance coverage Brokers Get Paid

Bear in mind, insurance coverage brokers work for you. Regardless that brokers can’t promote you the coverage (they’ll hand it over to an agent to finish the sale), they do have entry to a broader vary of choices than brokers tied to just one or a number of insurance coverage firms.

So how do insurance coverage brokers make cash? By means of commissions and brokers’ charges. For each coverage they will go alongside to an agent, they obtain a fee from the insurance coverage firm.

Insurance coverage Dealer Commissions

Brokers get a fee from an insurer after they join you to the corporate promoting you the coverage. It’s often figured as a share of the premium you join. Appears easy, proper?

Take into account that some brokers would possibly attempt to upsell you on protection you don’t want. That’s only a phrase of warning, since there are dangerous apples in any trade, proper?

Alternatively, commissions undoubtedly don’t imply that brokers are simply after your cash. Actually, commissions make quite a lot of sense as a approach to pay each brokers and brokers (extra on them under) for his or her time and trade experience. Brokers can prevent quite a lot of time and legwork, and that’s price a fee—particularly while you’re working with one who’s looking for you.

The underside line right here is to confirm how your dealer’s commissions work earlier than you pay up.

Commissions additionally come into play in a giant means for one of many largest scams on the market, whole life insurance. (We hate it. Huge time!) It’s best to by no means purchase complete life anyway (time period life all day, child), however the truth that brokers are inclined to get a far bigger fee on them—typically 100% the primary yr of the coverage—ought to undoubtedly elevate flags about whether or not you’re shopping for one thing you want.

Right here’s a tip: Brokers will in all probability be capable to share a wider vary of insurance coverage choices with you than impartial brokers. However impartial brokers are inclined to have extra data in regards to the firms they work for than brokers do.

For different kinds of insurance policies like auto or owners, the commissions are smaller than with complete life scams. Nonetheless, it’s sensible to search out out out of your dealer how all their commissions work earlier than shopping for.

Right here’s some excellent news. Insurers do a few issues to assist shield you from pushy brokers seeking to promote pointless insurance policies.

- Insurers typically require brokers to repay their commissions if prospects cancel their insurance policies or cease making funds inside a sure time from buy. That rule helps forestall a commission-hungry dealer from speaking you right into a coverage you don’t want, since they know there’s a superb probability you’ll simply find yourself canceling.

- Corporations additionally determine commissions into their coverage costs, so that you’ll pay the identical value whether or not you purchase a coverage instantly from an insurer or via a dealer. If you happen to purchase it instantly, the corporate simply will get to maintain the fee.

Insurance coverage Dealer Charges

Brokers typically cost charges for connecting you with an insurer. They’re fairly low-cost although—often below $100. If that’s the case, it’s a share fee for the coverage you’re shopping for. However not all brokers cost charges. Most states require brokers to reveal their charges to the customer, and lots of additionally place a cap on how excessive the charges might be. Remember that dealer charges are most frequently nonrefundable, even in case you cancel your coverage.

What’s the Distinction? Insurance coverage Dealer vs. Insurance coverage Agent

An insurance coverage agent helps prospects discover and purchase insurance coverage insurance policies too. Bear in mind after we advised you brokers can’t really promote you an insurance coverage coverage? That’s the principle distinction between brokers and brokers: Brokers are licensed to promote insurance policies from a number of insurers.

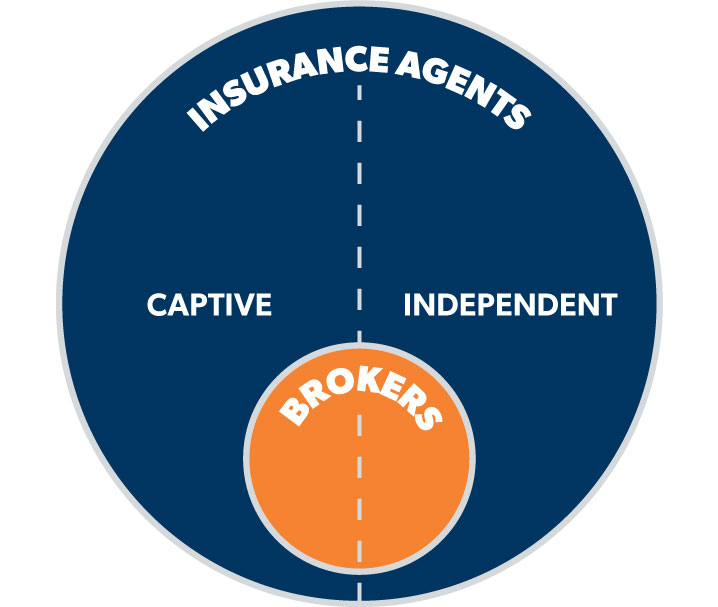

There are two sorts: captive insurance agents and independent insurance agents. Let’s see what makes them totally different from one another.

Captive Insurance coverage Agent

It’s form of a bizarre title, however a captive insurance coverage agent is an insurance coverage agent who solely sells insurance policies from one insurer. They’re locked in—captive—to working with one firm. They often work on wage plus fee, so the extra insurance policies they promote, the extra money they make. One draw back to working with a captive agent is you may not get the perfect coverage for you if the corporate they work with doesn’t provide it.

Impartial Insurance coverage Agent

Impartial insurance coverage brokers have entry to a number of insurance coverage firms. This implies a greater variety of choices for you. They work on fee solely and aren’t an worker of any of the businesses they work with.

Listed here are only a few advantages of utilizing impartial insurance coverage brokers:

- They provide a wider collection of insurance policies from a number of insurers (however remember that among the greater firms don’t work with impartial brokers).

- They’ve an in-depth data about these plans and insurance policies and will help you avoid some of the insurance gimmicks which can be on the market.

- They received’t steer you towards only one insurance coverage firm.

- They’re licensed professionals.

Most of our RamseyTrusted insurance coverage execs are brokers and impartial brokers. However all of our RamseyTrusted execs are certified to search out the perfect protection at the perfect value for you and your loved ones.

“We labored with a RamseyTrusted professional and are very completely happy,” Patricia M. stated within the Ramsey Child Steps Fb Group. “When it got here time to resume our owners and auto insurance coverage, he saved us a whole lot of {dollars}.”

What Ought to You Search for in an Insurance coverage Dealer?

If you happen to love the concept of letting a private shopper prevent money and time on insurance coverage, a dealer could possibly be an superior choice. Listed here are the qualities we advocate you search for in a thoroughbred dealer for insurance coverage:

- They assist individuals win with their cash and life objectives.

- They push themselves to continue to learn the trade and bettering their customer support.

- They’re dependable and have their shoppers’ greatest pursuits in thoughts.

- They’ve bought a number of years of trade expertise as brokers.

How Do I Get an Insurance coverage Dealer?

Now you realize what an insurance coverage dealer does, and even how they evaluate with an insurance coverage agent. However how will you put that data to work for your self? Properly that relies upon by yourself present wants and protection ranges. We put collectively a listing of simple and sensible steps you possibly can take immediately to maintain your self transferring towards the perfect protection.