We’ll stroll you thru the present panorama of pet insurance coverage and talk about present premium prices that can assist you determine if buying a coverage is smart on your pet and your pockets.

Watch: Is pet insurance coverage value it?

What pet insurance coverage covers (and what it doesn’t)

Pet insurance is much like medical insurance, nevertheless it’s on your pet. Similar to with a medical insurance coverage, you’ll pay a month-to-month payment, referred to as a premium, to maintain the coverage energetic so your furry buddy is roofed.

- An accident-only coverage covers accident-related accidents, comparable to these from a motorized vehicle accident, a torn ligament, meals poisoning, and ingested international objects.

- An accident and sickness coverage covers the accidents listed above, plus different varieties of emergencies, comparable to damaged bones, surgical procedure, hospitalization, prescription medicines, digestive points, infections, and diseases.

In case your pet wants medical care, you’ll take them to the vet as common. So long as the explanation for the go to is roofed by your insurance coverage coverage, you’ll pay solely your deductible and any co-pay, and the insurance coverage supplier will cowl the remaining (or pay as much as the protection restrict).

Some circumstances could also be excluded—pet insurance coverage doesn’t normally cowl pre-existing circumstances, older pets, particular breeds, or different strategies of remedy. It additionally doesn’t sometimes cowl preventative care and dental work except you buy a wellness add-on.

Professionals and cons of pet insurance coverage

Earlier than making any resolution that may influence your funds, it’s clever to contemplate the advantages and disadvantages.

How a lot does pet insurance coverage value?

A number of components decide how a lot you possibly can pay every month for pet insurance coverage, together with your pet’s breed, location, age, and medical historical past. Plus, there are components you possibly can management, such because the deductible, annual restrict on protection, and what number of prices your insurer reimburses.

Needless to say as your pet ages, the price of caring for and insuring it will increase. Some insurance coverage corporations even set a most age restrict on protection, so enrolling your pet whereas it’s younger and wholesome may unlock extra reasonably priced charges.

In accordance with knowledge from the North American Pet Health Insurance Association (NAPHIA), in 2024, the typical month-to-month premiums in Canada have been:

- $22.46 for canine and $18.47 for cats for an accident-only coverage

- $89.18 for canine and $45.86 for cats for an accident and sickness coverage

The extra protection and advantages you get, the upper the value tag. For that reason, it’s essential to contemplate the professionals and cons to determine whether or not buying insurance coverage is worth it for you.

Get free MoneySense monetary ideas, information & recommendation in your inbox.

Why is pet insurance coverage getting dearer?

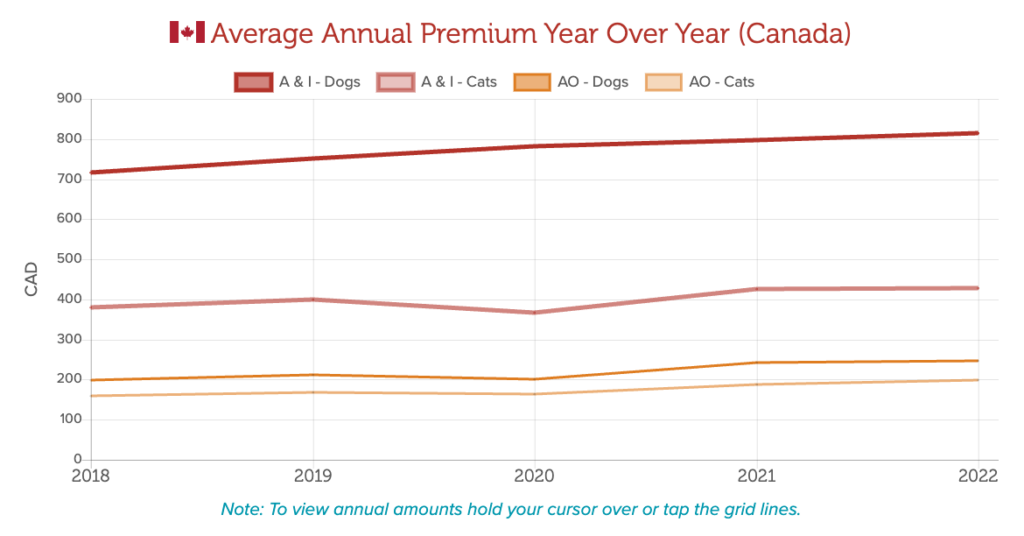

The price of pet insurance coverage has risen steadily over the previous decade or so. The typical annual improve for accident and sickness insurance coverage was 6.5% for canine house owners and 15.24% for cat house owners.

Inflation, elevated wages of veterinary employees, and better medical prices have all contributed to the rise in pet insurance coverage premiums because the pandemic; nevertheless, larger prices are additionally tied to developments within the medical care that pets obtain. Vet clinics are more and more in a position to deal with life-threatening circumstances like most cancers and different illnesses, however it may be costly.

Earlier than deciding whether or not or to not get insurance coverage, pet house owners should weigh the potential of paying 1000’s of {dollars} out-of-pocket for medical procedures vs. paying ongoing month-to-month premiums.

How one can preserve pet insurance coverage prices down

There are a number of methods you need to use to maintain pet insurance coverage prices low:

Store round and evaluate insurance policies. Insurers every have distinctive choices and calculate premiums otherwise. Get a number of quotes to search out probably the most reasonably priced charge, however be certain you’re evaluating related coverages.

Select the next deductible. The upper your deductible, the decrease your premium shall be. That stated, be certain you select a deductible quantity that you may afford to pay at a second’s discover in case your pet requires pressing care.

Select a decrease annual restrict. That is the utmost sum of money your pet insurance coverage firm can pay out to you yearly. When you’ve reached that threshold, you’ll be on the hook for any extra veterinary prices.

Ask about reductions. When you have a number of pets, it’s value asking if you may get a reduction out of your supplier for insuring them each (or all). Sometimes, it’s important to enroll every pet and pay separate premiums.