Let’s be actual: Most “house insurance coverage value calculators” provide you with obscure estimates primarily based on generic data. And that’s the very last thing you need in the case of defending your largest funding.

As a substitute of plugging numbers right into a random type, we’ll present you how you can estimate your individual owners insurance coverage prices the fitting method—primarily based in your precise house, belongings and monetary scenario.

Having the correct quantity of householders insurance coverage is essential to defending your property and your cash. In any case, your property is your largest funding, and lots can go mistaken that might doubtlessly devastate your monetary objectives.

We’ll begin by explaining how insurance coverage firms calculate owners premiums after which present you how you can give you your individual estimate for a way a lot protection you want. (And in case you’re simply beginning to analysis house insurance coverage, try our helpful Homeowners Insurance Guide.) Even when you flunked math in class (or simply didn’t achieve this nicely), don’t fear—you’ll be able to nonetheless determine what you want.

How Is Householders Insurance coverage Value Calculated?

The homeowners insurance secret sauce is complicated. However it’s not unattainable to know.

First, remember that insurance coverage firms are in the end within the enterprise of making a living (duh). Regardless of how noble their different intentions is likely to be, no firm can lose cash for lengthy and keep in enterprise. This implies the value they cost is a balancing act.

Charging too little might put them out of enterprise. Charging an excessive amount of will doubtlessly push prospects away.

So, what do they do? Nicely, within the period of Large Information, they flip to the numbers. When analyzing threat, insurers concentrate on two principal components: 1) the place you reside and a couple of) how dangerous you might be. They have a look at how doubtless you might be to file claims and the way a lot these claims will value them.

Right here’s how insurers usually determine what to cost for owners

insurance coverage premiums. (Have your calculator app helpful—we’re about to do some insurance coverage math.)

1. Pure Premium

Do you have the right insurance coverage? You could be saving hundreds! Connect with an insurance pro today!

The pure premium is without doubt one of the first numbers insurance coverage firms calculate for teams of comparable owners (as an example, owners in Los Angeles). One of many components that goes into the pure premium math is dividing the group’s whole property losses by their whole property worth. To get a practical concept of threat, firms usually contemplate information from at the very least the previous 5 years for the group.1 So if the properties have been valued at $200 million and the losses totaled $10 million, their losses can be 5%, or 5 cents for each greenback of property worth.

2. Expense Ratio

As soon as they’ve the pure premium, insurers discover the expense ratio (mainly the insurance coverage firm’s working bills plus desired revenue). That is often a share and contains issues like taxes, underwriting, administrative prices, advertising and marketing and commissions.

3. Premium Worth

Insurers then take the pure premium and the expense ratio, plug them into their fancy insurance coverage calculators—and out pops what’s referred to as the gross premium. (We’ve got to agree with the title.) That is what you find yourself paying.

However wait, there’s extra . . .

Elements That Have an effect on Householders Insurance coverage Premiums

There are just a few different issues house insurance coverage firms consider when calculating premiums.

Alternative Value

Your replacement cost—how a lot it will value to rebuild your own home—is an enormous a part of your premium. (We’ll present you how you can calculate it in a second.)

Location and Age of Your Dwelling

One other big issue is the place your property is positioned. For those who’re in a flood zone, reside in a high-crime space, or your property is older (so there’s a larger probability it should want repairs)—you’ll be able to count on greater premiums. Principally, greater threat means greater value. Kinda is sensible . . .

Stage of Protection and Deductible

Your premium can also be primarily based on how a lot protection you select and the scale of your deductible. The next deductible will imply a decrease month-to-month fee since you’ll pay extra out of pocket earlier than the insurance coverage firm has to cowl a declare. However earlier than you elevate your deductible, ensure you’ve got a full emergency fund to cowl the brand new quantity.

Building Sort

We’re speaking about what your own home is product of—brick, wooden, and many others. A house constructed with extra sturdy supplies are much less more likely to be broken—so insurers usually provide decrease premiums to replicate that lowered threat..

Private Claims Historical past

You probably have a protracted historical past of submitting claims for each little factor, an insurer goes to take that into consideration. Submitting claims on small repairs will solely value you extra in the long term. In reality, it might enhance your premium even when your neighbors file plenty of claims. (That may not appear honest, nevertheless it’s an element.)

Your Dwelling’s Sq. Footage

The bigger the house, the costlier it’s to insure. Preserve that in thoughts earlier than you add that epic kitchen bump-out or develop the laundry room!

How Many Stay There

For those who, your partner, your youngsters and your complete prolonged household are all residing beneath the identical roof . . . we hope you’ve obtained an enormous fridge! However critically, with that many individuals sharing house, you’ll pay extra for legal responsibility protection as a result of there’s a better probability of incidents.

Insurance coverage firms will even have a look at issues like the kind of roof you’ve got, how shut you might be to sources like hearth and police stations, whether or not you’ve got canines (together with the breed), your credit score rating and the type of safety and hearth alarm methods you’ve got.

Householders Insurance coverage Value Calculator: Tips on how to Estimate Your Wants

Now that we’ve coated how insurance coverage firms do their calculations, we’re able to sort out your protection estimates. Whereas we are able to’t show you how to calculate your actual premium (since insurance coverage math is a intently guarded secret), we can nonetheless show you how to estimate how a lot protection you want. When calculating your homeowners insurance needs, begin with these three questions:

- How a lot wouldn’t it value to completely rebuild my house at present building prices?

- How a lot wouldn’t it value to exchange my private belongings?

- If somebody sued me for legal responsibility and received, what private property can be in danger?

You also needs to contemplate whether or not you reside in an space that’s at greater threat for excessive climate. Take into consideration pure disasters like floods, earthquakes and hurricanes. Whereas a regular owners coverage covers a lot of different events, flooding and hurricanes are two issues it won’t cover.

The solutions to those questions will inform you how a lot owners insurance coverage to get in these three principal areas:

- Dwelling protection, which protects your own home

- Private property insurance coverage, which covers your private belongings

- Legal responsibility protection, which handles authorized payments when you’re sued over an accident in your property

Calculating Your Dwelling’s Alternative Value

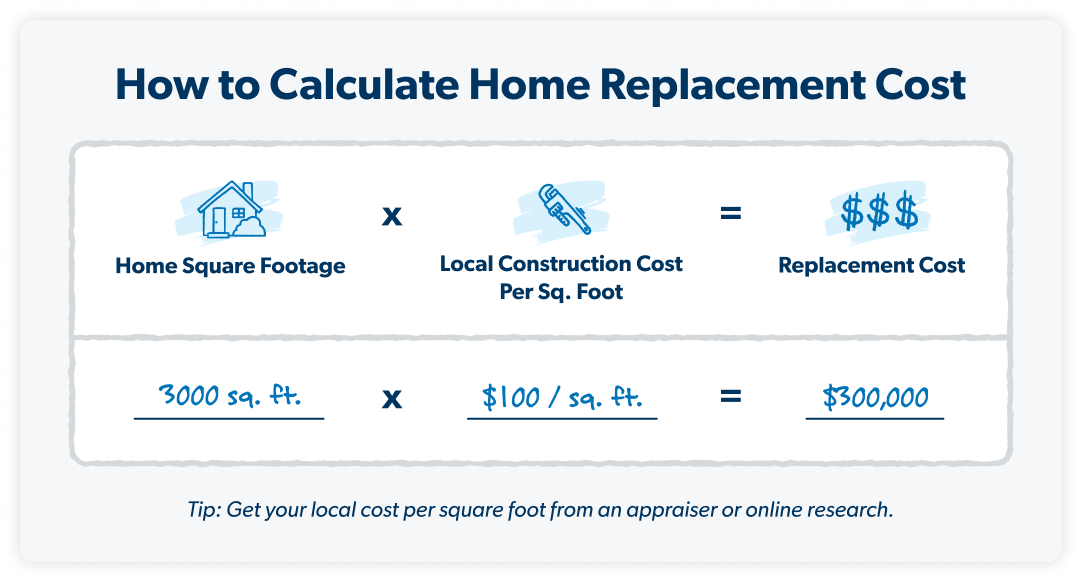

Fortunately, there’s a easy method to calculate your property’s alternative value. And this quantity will inform you precisely how a lot dwelling protection to get.

Multiply your house’s sq. footage by your native space’s common value to rebuild per sq. foot. Let’s say your own home is 3,000 sq. ft, and the common building value in your space is $100 per sq. foot. So, you multiply 3,000 by $100 and get $300,000. That’s the quantity of dwelling protection you need to get.

You’ll find the common building value in your space by doing a little analysis on-line or hiring an appraiser. You may also work with an insurance coverage agent to get this quantity. And keep in mind that your alternative value is totally different from your property’s market worth or how a lot you paid for it. You’re searching for how a lot it will be to rebuild.

4 Forms of Alternative Value Protection

Now that you’ve got your alternative value pinned down, you’ve got 4 protection choices to select from.

Precise Money Worth

An precise money worth (ACV) coverage will cowl your own home and belongings minus depreciation. So when you expertise a home hearth, your insurer will solely pay for what the buildings in your property have been price after they burned down—not if you first purchased them.

Alternative Value

Alternative value protection is an additional layer of safety because it doesn’t consider depreciation. It pays to restore or exchange your own home as much as its present worth (with some limits). As an illustration, if in case you have a $300,000 dwelling protection restrict and the rebuild prices $350,000, you’ll should pay $50,000 plus your deductible. But when the rebuild solely prices $290,000, your insurance coverage will cowl it—minus your deductible.

Prolonged Alternative Value

An alternative choice is prolonged alternative value protection. This may pay for the alternative worth of your property (as much as the protection restrict) however with an additional share of the protection restrict thrown in. It’s costlier than primary alternative value protection however can turn out to be useful when you reside in an space the place building prices are rising shortly (which appears to be nationwide in 2025).

Assured Alternative Value

Assured alternative value provides you much more protection, however you’ll pay extra for it. It pays for the full alternative value of your property and doesn’t consider depreciation or dwelling protection limits. So, if it prices $350,000, $400,000 or $500,000 to rebuild your property, that’s what the insurer can pay. No ifs, ands or buts about it.

Calculating the Alternative Value of Private Property

Subsequent, you’ll want to determine how a lot it will value to exchange your stuff. The easiest way to do that is by creating a listing of all the pieces you personal. This would possibly sound arduous, however we’ll provide you with just a few recommendations on how you can shortly verify this off your listing.

- Write all of it down. Decide a weekend if you’ll have some bigger blocks of time (in different phrases, Thanksgiving will not be a great time to chew this off). Then undergo your own home and storage and write down all the pieces you personal and the way a lot it’s price. Create a spreadsheet the place you’ll be able to whole all the pieces up. Additionally, since depreciation is an element, estimate how a lot your stuff is price now—not what you paid for it 20 years in the past.

- Make a digital file. Take images and movies so you’ve got an much more thorough file. And be aware costlier gadgets like jewellery or artwork, since there’s a restrict to what the insurance coverage firm can pay. You would possibly want further protection for pricier gadgets.

- Preserve it secure. Lastly, preserve the spreadsheet and paperwork in a spot the place they received’t be misplaced if there’s a home hearth.

Most individuals undervalue their belongings, so creating this stock is essential. Once you really add all the pieces up, you is likely to be stunned how a lot it’s all price (and the way a lot you continue to want to arrange or do away with!).

It’s additionally a good suggestion to ship your stock to your insurance coverage firm in order that they have the proof on file. This may assist lots when it comes time to file a claim. And don’t neglect to set a reminder to replace your stock yearly to ensure it’s present.

Now that you understand how a lot your belongings are price, you’ll be able to determine how a lot protection to get. Normally, your coverage restrict for private property alternative is round 50% to 75% of your dwelling protection. However you’ll be able to enhance this restrict if it’s essential.

Calculating Your At-Threat Belongings

The third and closing calculation you need to make is the whole worth of your property that will be in danger when you misplaced a lawsuit. This quantity will decide how a lot personal liability insurance you need to have. For those who don’t have private legal responsibility insurance coverage, a lot of your property can be in danger in a authorized battle. These property embrace:

- Your automobiles (in the event that they’re titled in your title)

- Future wages

- Financial savings

- Some investments, together with actual property

- Private belongings

- Boats

- Enterprise property

Relying on the place you reside, some property could also be protected and received’t be topic to seizure in a lawsuit. These embrace issues like:

- IRA accounts

- Annuities

- Social Safety advantages

- Fairness in your house

- Employer-sponsored 401(okay)s

Create a separate stock of property that will be in danger in a lawsuit. Upon getting this quantity, you’ll have a greater concept of how a lot legal responsibility protection you want. You should purchase legal responsibility ranging from $100,000 all the best way as much as $1 million. For those who want extra, you could wish to look into getting umbrella insurance for an excellent stronger protection.

Why Is My Householders Insurance coverage So Costly?

The typical value of householders insurance coverage is $1,411 for an annual premium (however that may differ lots primarily based on your property’s location, worth and protection quantity).2 That works out to round $117 a month. For those who’re paying extra, you might be wondering why. Whereas your insurance coverage firm received’t inform you (the software program and information that every firm makes use of is definitely a closely guarded secret), there are just a few causes you can be paying greater premiums. It may very well be primarily based on:

- The place you reside

- Your property’s worth

- Your deductible

(It’s at all times good to verify the main points of your present owners insurance coverage by taking a look at your insurance declaration page. That’s only a fancy time period for a abstract of your insurance coverage coverage. It outlines the who, what, and the way a lot of your insurance coverage coverage.)

Whereas these are components you’ll be able to (type of) management, there are different industry-related the reason why you’ve observed your insurance coverage charges getting greater. Charges nationwide have been rising steadily because the Nice Recession of 2007–2008, and premiums rose much more sharply—20%—from 2020 to 2023.3 A number of principal components are driving the premium surge: rising property values, elevated pure disasters and international provide chain shortages.

On the finish of the day, insurance coverage is a difficult enterprise, and also you’re not at all times going to know why your fee is greater. That’s why it’s necessary to know how you can calculate the correct quantity of insurance coverage you want—so that you’re not overpaying. You may also work with an skilled, unbiased insurance coverage agent to buy round and evaluate charges for the protection that matches your scenario.

Getting the Proper Protection

There’s lots that goes into how owners insurance coverage is calculated. It’s sophisticated!

For those who’re uninterested in questioning the way it all works or how you can get the fitting protection, we advocate working with a Ramsey-vetted unbiased insurance coverage agent.

They’re RamseyTrusted® and may have a look at your scenario that will help you discover the very best protection at the very best value.

In the case of insuring your largest funding, the very last thing you need is to play guessing video games along with your protection. By working with a RamseyTrusted professional, you’ll have peace of thoughts realizing that your property and belongings are literally coated if one thing ever occurs.