Everybody wants an skilled of their nook. The extra difficult life will get, the extra we want somebody to assist us navigate each day duties. A professional. A specialist. An authority. No matter you need to name it, all of us want one.

Discovering the perfect insurance coverage is not any totally different. The fitting skilled can simply sift by way of all of the insurance coverage protection choices on the market and discover the one with the perfect worth that’s an ideal match for you.

These professionals are referred to as unbiased insurance coverage brokers. Let’s stroll by way of some great benefits of working with an unbiased agent.

What Is an Impartial Insurance coverage Agent?

An unbiased insurance coverage agent is somebody who sells insurance insurance policies from a number of totally different insurance coverage corporations quite than only a single firm. They act as a intermediary between insurance coverage patrons and insurance coverage sellers.

Impartial insurance coverage brokers are often certified to promote a wide range of several types of insurance coverage coverages (auto, home, health, and many others.). They usually work for themselves, obtain commissions for the insurance policies they promote, and will not be thought of workers of any particular insurance coverage firm.

What Does an Impartial Insurance coverage Agent Do?

Now let’s discuss how unbiased insurance coverage brokers work.

As a result of unbiased brokers work with a bunch of insurance coverage carriers, they’re in a position to present a bunch of protection choices and costs to their purchasers. Crucial a part of their job is to match purchasers with the suitable insurance coverage protection and worth.

First, they contemplate particular person buyer wants. Then they discover coverage choices that meet these wants. A great unbiased insurance coverage agent will present a side-by-side comparability of the pricing and protection choices they discover. Lastly, the agent walks by way of all of the choices with you so you’ll be able to select the perfect coverage.

Successful independent agents—those who super-serve their purchasers—make it their job to remain present on all of the totally different protection choices and the costs accessible from the insurance coverage carriers they signify. Primarily, this implies they do the legwork for you, so that you don’t need to fill out a bunch of various on-line purposes to get your individual quote comparisons.

Even higher? Your inbox isn’t flooded with dozens of tacky gross sales pitches from totally different insurance coverage corporations.

As soon as you purchase your coverage, the insurance coverage firm pays a fee to the unbiased agent. Fee charges are often comparable throughout a number of insurance coverage corporations, so unbiased brokers can deal with discovering the coverage that’s actually best for you—not the one that can make them probably the most cash.

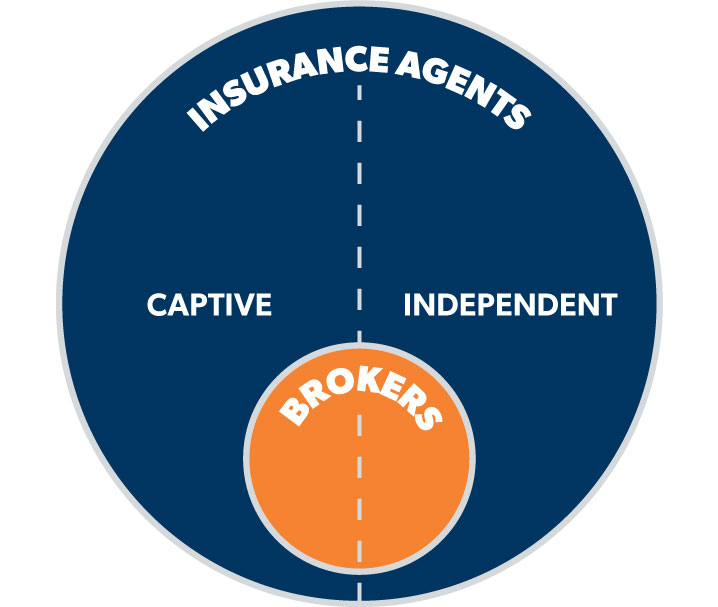

Impartial Brokers vs. Insurance coverage Brokers vs. Captive Brokers

This one is difficult to clarify, nevertheless it’s actually essential to know the excellence.

First, let’s go over the distinction between unbiased brokers and insurance brokers. One of the simplest ways to clarify the distinction is to start out with the truth that insurance coverage brokers can’t really promote you insurance coverage—they’re the go-between between you and insurance coverage brokers. Their goal is to seek out the perfect coverage and charges on your scenario.

At Ramsey, nearly all of our Endorsed Local Providers (ELPs) are each brokers and unbiased brokers. So, out of your perspective as a buyer, the excellence is mainly irrelevant as a result of all of our ELPs are certified to seek out the perfect protection at the perfect worth for you and your loved ones.

So, what’s the distinction between captive vs unbiased insurance coverage brokers?

The primary distinction is that captive agents can solely promote the merchandise of the insurance coverage firm they work for—they’ll’t discuss or promote choices outdoors of their firm’s lineup.

Do you have the right insurance coverage? You could be saving hundreds! Connect with an insurance pro today!

However, unbiased brokers aren’t certain to 1 provider, to allow them to store round for the perfect protection and worth.

Right here’s a picture that exhibits unbiased brokers vs. captive brokers and the way they relate to brokers.

The Advantages of Working With Impartial Brokers

The flexibleness unbiased brokers need to work with a number of corporations is the number-one motive we’re large followers of working with unbiased brokers on your insurance coverage wants. It’s only a truth of life that the extra choices you’ve gotten, the extra doubtless you’ll be capable to save money whereas getting the perfect protection.

Maintain on although. There are extra advantages you must find out about.

Licensed Specialists

Insurance coverage can get difficult, however unbiased brokers know their stuff. They’ve handed their state exams and have the license to show it.

They will take time to translate business phrases that will help you make sensible selections. They’ve constructed their profession on studying learn how to assess your wants and match them with the insurance coverage provider that’s greatest outfitted to satisfy these wants.

Private Advisers

Keep in mind after we talked about the significance of getting somebody in your nook? That is what unbiased insurance coverage brokers do greatest. They eat, sleep and breathe insurance coverage as a result of they love serving to folks. They work with you one-on-one, taking time to hear and perceive your particular person wants. They realize it’s not all about getting the perfect worth—it’s additionally about ensuring your insurance coverage protection will come by way of should you ever have to make use of it.

Native Authorities

Impartial brokers are your neighbors. We constructed our ELP program particularly so you’ll be able to work with an agent who lives in your neighborhood. Native unbiased brokers perceive the challenges and advantages of dwelling in your space and are proper across the nook, prepared to assist.

Consultants for a Lifetime

Good unbiased brokers periodically overview your insurance policies to ensure you’re nonetheless getting the suitable protection on the proper worth. Life comes with a number of modifications, some good and a few dangerous, (marriage, childbirth, beginning a enterprise, divorce, shopping for a house, insuring a teenage driver, and many others.) and unbiased brokers are there that will help you regulate to each change.

Often Requested Questions

Nonetheless have questions? We’ve bought solutions.

1. How can I inform if an agent is unbiased?

There are a number of straightforward methods to seek out out.

- Ask the insurance coverage agent straight: “Do you’re employed with a number of insurance coverage corporations? What number of carriers do you signify?”

- Search for web site or promoting wording that describes them as an unbiased agent.

- Overview their report along with your state licensing company and see what number of insurance coverage corporations they signify.

2. How do I grow to be an unbiased agent?

Turning into an unbiased insurance coverage agent requires a number of steps, together with taking programs (set by your state) and passing license exams (will depend on the kind of insurance coverage you need to promote). Turning into an unbiased insurance coverage agent is changing into an more and more well-liked profession alternative as a consequence of its flexibility.

Most newly licensed brokers work for a longtime company to realize expertise earlier than changing into an unbiased agent. Further training and licensing are required so that you can transfer ahead in your profession.

3. How does an unbiased agent receives a commission?

Impartial brokers are paid on fee and earn the next fee than captive brokers. On the whole, unbiased insurance coverage brokers earn between 10% and 25% fee on an insurance coverage coverage.

4. How a lot do unbiased brokers make?

The annual wage vary for insurance coverage brokers is $29,000 to $127,840.1 Like all commission-based job, your location, advertising and marketing expertise and the quantity of effort you set into the job have a direct impact in your take-home pay.

Everybody Wants an Impartial Insurance coverage Agent in Their Nook

Our Endorsed Native Suppliers (ELPs) are all unbiased brokers. They work for you, not the insurance coverage firm. Plus, they’re your neighbors and can take the time to get to know you—so that you by no means really feel such as you’re simply one other quantity in a sea of faceless prospects. Their number-one purpose is that will help you discover a coverage that’s tailored for you and your loved ones.