Image a man who desires to be smarter together with his cash. Naturally he appears to be like for tactics to take a position. Then sooner or later in line for espresso, he sees a fantastic girl dressed like a winner and she or he tells him if he places cash in fair-trade bespoke picket ingesting straws, he’ll get wealthy. “It’s what all the rich individuals do,” she says.

You already know the place that is going. After falling for her pitch, he makes no cash or (worse but) it disappears. We often name this type of factor a rip-off . . . however within the insurance coverage world, it’s referred to as money worth life insurance coverage.

Suppose we’re going too far? Stick round, pals. We’re going to dive deep into money worth life insurance coverage, and it doesn’t look something like Scrooge McDuck diving into his vault of gold.

- Money worth life insurance coverage is any sort of life insurance coverage that takes a part of your premiums and places them in a financial savings or funding account.

- Frequent varieties of money worth life insurance coverage embrace entire life, common life, variable common life, and listed common life insurance coverage.

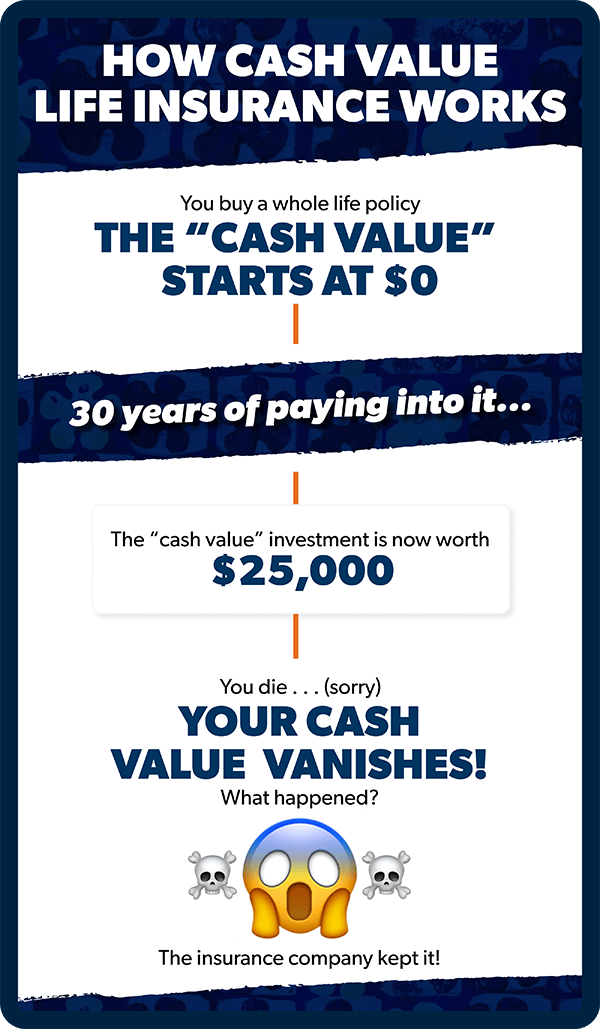

- Insurance coverage corporations wish to promote these sorts of insurance policies as a result of they take advantage of cash off them. One purpose is for those who die, your money worth goes to the insurance coverage firm, not your beneficiary.

- Because the insurance coverage firm is investing it for you (they usually’re not good at investing) and they cost a ton of charges, returns on money worth life insurance coverage are low.

What Is Money Worth Life Insurance coverage?

Money worth life insurance coverage is a type of life insurance policy that’s in place in your entire life and comes with a kind of financial savings account constructed into it.

So, you’re paying for 2 issues right here—the life insurance coverage half (the bit that covers your loved ones for those who die) and the money worth half (the financial savings account that supposedly grows your cash over time). How a lot it grows actually is dependent upon the kind of money worth coverage you purchase, and what its returns are.

Varieties of Money Worth Life Insurance coverage

Every of those insurance policies works somewhat otherwise—and there’s numerous superb print to wade by. Right here’s a breakdown of every sort of money worth life insurance coverage.

Complete Life Insurance coverage

Whole life insurance is the least versatile of the three selections we’re going to cowl. As soon as the insurer decides on your premium, that quantity will get completely laid out in your coverage. You’re caught paying that premium quantity yearly (or month) for, properly, your entire life. A slice of that premium will go into the money worth a part of your coverage, and that may’t change both. You’ll be able to anticipate your charge of return to hover round 2%—so it’ll mainly simply sustain with inflation. The longer your coverage lasts, the more money worth you’ll construct up.

Variable Life Insurance coverage

Variable life insurance coverage serves up an additional serving to of complication as a result of quite than supplying you with a assured charge of return, variable life means that you can determine how your money worth is invested. This could possibly be in shares or bonds, for instance. So, you’d be making the decision, and it’s a dangerous one for those who’re not all the time keeping track of your investments. Oh, and variable life insurance coverage comes with loopy excessive charges, so don’t anticipate to see a lot money worth within the first three years! One factor they do have is mounted premiums and assured minimal loss of life advantages.

Common Life Insurance coverage

Universal life insurance is completely different (and extra sophisticated) as a result of it comes with “versatile” premiums and payouts. This implies you might have some management over how a lot you pay in premiums. For those who’re feeling flush, you can “overpay” your month-to-month premium and have the distinction go into the money worth aspect of your coverage. And for those who’ve constructed up sufficient of that money worth over time, this could possibly be used to cut back your premiums (extra on this later).

Compare Term Life Insurance Quotes

How a lot your cash grows over time all is dependent upon the kind of common life insurance coverage you might have (bear in mind once we mentioned it was sophisticated?). These sorts are: variable common life, assured common life, and indexed universal life.

Listed Common Life Insurance coverage

With this kind, your funding or money worth account is tied to an index fund. The proportion of your premiums going to insurance coverage versus funding is identical because the others. If the market does properly, your money worth will go up, but when it goes down, your money worth received’t go wherever. No matter occurs, your returns will all the time be at finest barely under the index efficiency as a result of the insurance coverage corporations love their huge fats charges.

Variable Common Life Insurance coverage

What do you get while you take a part of one unhealthy factor and mix it with components from one other unhealthy factor? A extremely unhealthy factor. (Is that this apparent to anybody?) With variable universal life insurance, you get all the chance of deciding how your money worth is invested and no assured charge of return. You additionally get no mounted premiums or assured minimal loss of life profit. An actual winner.

Simply because we don’t like money worth life insurance coverage doesn’t imply we don’t like life insurance coverage! When you’ve got of us that rely in your earnings, you want some. We advocate a time period life coverage value 10–12 instances your annual earnings.

How Does Money Worth Life Insurance coverage Work?

The annoying factor about life insurance coverage is we’re paying premiums in case one thing terrible occurs—and the one means you see any of that cash once more is if one thing terrible occurs! Money worth life insurance coverage performs on that feeling by suggesting you may get a few of these premiums again, with curiosity.

(The reality is you might be getting a return on that cash even for those who by no means get the insurance coverage payout. You’re getting your loved ones’s monetary security for those who do die.)

Money worth works like this: Say you’re paying $300 a month in your money worth life insurance coverage coverage. A portion of that $300 covers the price of really insuring your life. The remaining is put into investments by the insurance coverage firm.

The breakdown of how a lot they make investments versus how a lot they put towards your coverage varies over time. Within the earlier years, they put a bigger proportion of your premiums towards the money worth, whereas within the later years, they ship extra of your premiums towards your coverage since the price of insurance coverage will increase as you age.

These investments are supposed to construct and make you cash over time. As we mentioned earlier, the charges of return in your money worth funding rely upon what sort of money worth life insurance coverage you’re shopping for. (However they have a tendency to suck.)

Insurance coverage corporations will level to the money worth as a optimistic factor. You pay your premium, a part of it will get invested, and finally you get a pile of money . . . simply so long as you’re nonetheless alive.

Wait, what?

Yep. More often than not, for those who don’t use the money worth when you’re alive, it goes again to the insurance coverage firm while you die.

And right here’s a enjoyable tidbit: For those who attempt to get your fingers on some money out of your money worth life insurance coverage after a yr, guess how a lot you’ll have? A giant fats zero. After three years? Nonetheless zero.

Throughout these first few years, you’ll see no money worth due to all of the charges, bills, commissions and prices you’re paying to the insurance coverage firm simply to have a coverage within the first place!

How Do I Entry the Money in Money Worth Life Insurance coverage?

First off, are you prepared to attend 10–15 years for some respectable money worth? As a result of that’s how lengthy it’ll take.

Let’s say you can wait 10–15 years to construct up your money worth. How will you take it out? Properly, listed below are your selections, relying on whether or not you’ve acquired entire life or common/variable life insurance coverage . . .

1. You’ll be able to take out a mortgage in opposition to the money worth.

- With entire life: Taking out a mortgage in opposition to the money worth is the worst factor you are able to do. Why? First up, you’re going into debt, which isn’t a good suggestion. Second, you’ll need to pay curiosity on the mortgage, and for those who don’t pay all of it again, your loss of life profit will lower. Take into consideration how loopy that is—you’re paying curiosity on a mortgage made up of your personal cash.

- With common or variable: The identical applies as with entire life insurance coverage. Your loss of life profit will scale back for those who take out a mortgage in opposition to your common/variable money worth. And also you’ll pay curiosity on the mortgage you’ve simply taken out too.

2. You may make a partial withdrawal.

That is the closest you’ll really get to taking out money. However for those who withdraw cash and don’t put it again into your coverage, guess what occurs? Your loss of life profit (you realize, the cash that’s paid out while you die) will lower.

- With entire life: Though you could possibly money out a portion of the dividend paid by the insurance coverage firm, you can not use the money worth you’ve amassed like an ATM with out surrendering the coverage. That’s loopy, contemplating it’s your invested cash. However it’s so laborious to get your fingers on it!

- With common or variable: A partial withdrawal is like getting a piece of the loss of life profit early. So, the quantity you withdraw is subtracted from the loss of life profit payout on the finish. You received’t get taxed in your withdrawal—as long as it’s for an quantity that provides as much as much less than what you’ve paid in premiums.

3. You’ll be able to give up the coverage.

- With entire life: This implies you inform your insurance coverage firm you wish to quit the coverage and get the whole money worth you’ve constructed up in a single lump sum. Sounds simple sufficient, proper? However you’ll need to pay a payment to the insurance coverage firm, and you’ll be taxed on the quantity you obtain if it’s greater than what you’ve paid in premiums over time!

- With common or variable: Surrendering your coverage has the identical outcomes as with entire life. Giving up the coverage and cashing in your money worth comes with charges. Oh, and don’t neglect—since you’ve surrendered the coverage, you’ve additionally ended your life insurance coverage protection.

4. You’ll be able to promote your coverage for a life insurance coverage settlement.

- With entire life: As an alternative of surrendering your coverage, you can promote it for a money settlement. Money sounds good, proper? Particularly in case your premium is excessive or your youngsters have left the nest. However there’s a catch! (There’s all the time a catch.) The dealer who units you up with the corporate shopping for your coverage will get a lower out of your settlement quantity. And in the case of the settlement, it’ll be lower than your loss of life profit quantity. The corporate shopping for your coverage (often some kind of funding firm) will attempt to swing this by saying that when you’re getting much less cash than your loss of life profit, you’re receiving greater than no matter money worth you might have. That doesn’t imply so much because it’s your cash within the first place! Take note too, in case your settlement is greater than the full you’ve paid over time in premiums, you’ll pay capital positive aspects and earnings tax on this revenue.

- With common or variable: Promoting your coverage comes with comparable points to entire life. And also you’ll pay taxes on the quantity you’ve made in money worth if it totals greater than what you’ve paid in premiums over time.

5. You’ll be able to pay your life insurance coverage premium with the money worth.

- Whether or not you might have entire life or common/variable:Some of us use their money worth to pay for the month-to-month or annual premium itself. That’s in the event that they’ve constructed up a giant pile of money, after all! However this doesn’t actually fall according to how money worth life insurance coverage is marketed. Insurance coverage corporations push the money worth account as a method to save for retirement. However actually all you’re doing is saving up cash to pay them later. If this was the one possibility, then insurance coverage would simply suck however you’d be caught with it. However it’s not (ahem, term life). So that is not good monetary planning.

Discover how all these methods of accessing the money worth include a catch? You’ll both slash your loss of life profit, face a heavy tax, or pay a payment. Getting maintain of the money worth with none penalties to you isn’t within the insurance coverage firm’s pursuits. It’s how they make their cash, and but another excuse to steer clear of money worth life insurance coverage.

Get Time period Life Insurance coverage Charges from Zander Immediately!

RamseyTrusted companion Zander Insurance coverage will get you charges from prime life insurance coverage corporations and pair you with the one that matches you finest.

Is Money Worth Life Insurance coverage a Good Technique to Increase My Retirement Revenue?

This one’s simple: No! One of many worst issues you are able to do is purchase money worth life insurance coverage with the hopes of it serving to you in retirement. The returns will barely sustain with inflation, and also you’ll get hit with tons of charges and commissions.

You’d be a lot better off shopping for a term life policy and investing 15% of your household income into good progress inventory mutual funds by a Roth IRA and/or 401(okay).

What Occurs to the Money Worth When You Die?

By now you’ve most likely gotten the trace—money worth life insurance coverage is a complete waste of cash. However we haven’t even hit the worst half! As a money worth coverage is often arrange, the one cost your loved ones will get is the loss of life profit quantity. For those who haven’t taken additional steps to ensure the money worth goes to your loved ones, any money worth you’ve constructed up will return to the insurance coverage firm.

Simply let that sink in.

You faithfully invested your entire life solely to depart all that cash to the insurance coverage firm. Doesn’t sound correct, does it? However that’s how insurance coverage corporations take advantage of cash, and that’s why they’re so fast to promote you money worth life insurance coverage.

The Distinction Between Money Worth and Time period Life Insurance coverage

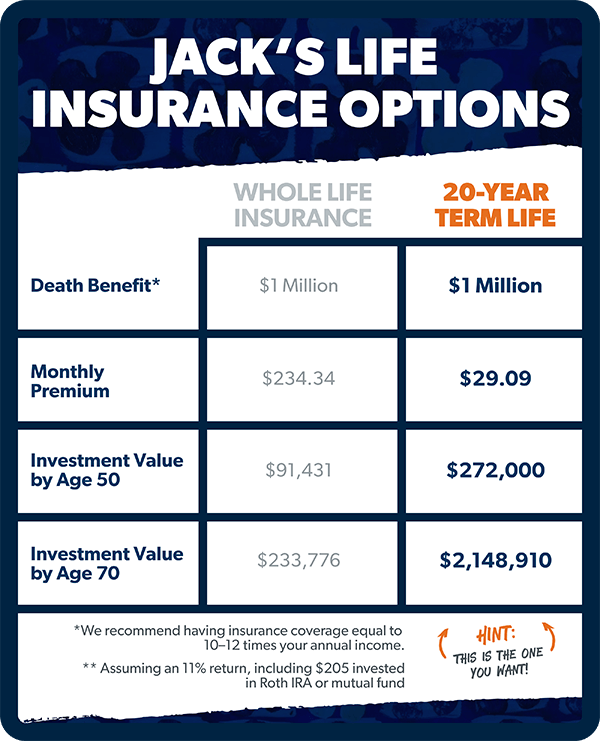

Let’s speak about Jack. He’s 25 years previous, doesn’t smoke, is fairly wholesome, and desires life insurance coverage. However he’s actually confused with all of the choices on the market. (Aren’t all of us, Jack?)

He heard {that a} term life insurance policy is completely different as a result of it solely lasts for a sure period of time (we advocate 15–20 years). He is aware of a time period life insurance coverage coverage is simply life insurance coverage and no money worth, in order that makes it cheaper. Jack ain’t no sucker! However he desires to take advantage of what he does have. So what are his choices?

With regards to Jack’s loss of life profit, time period life provides nearly 4 instances as a lot protection. However he’s solely paying $29 a month for it! If he follows our advice in the case of investing and paying off his money owed, he can be self-insured by the point he reaches retirement.

The largest distinction between a time period life insurance coverage coverage and a money value coverage is the worth he would pay each month. Although he’s placing among the $234 of his money worth premium into investments, it’s not going to make him as a lot in the long term in comparison with investing exterior of his life insurance coverage coverage.

What Life Insurance coverage Does Ramsey Suggest?

We all the time say not to purchase life insurance coverage as an funding! That’s not what it’s for—and it’s a awful method to make investments.

In recent times, extra individuals have been shopping for money worth insurance policies, so it’s much more necessary for us to say this loud and clear: With money worth life insurance coverage, you’re throwing away extra of your money when you’re nonetheless alive when you can be saving and investing it some place else for rather more return.

For those who’re in debt and suppose money worth life insurance coverage will provide help to down the road, it received’t. You (and your loved ones) shall be higher off getting a time period life coverage and placing 15% of your family earnings right into a Roth IRA or 401(okay) that gives good mutual funds as a substitute. It’s the good method to make your money give you the results you want!

For those who’re like, Heck yeah—get me a few of that now! however don’t know the place to seek out it, we advocate Zander Insurance coverage. They’ve been serving Ramsey of us like Ryan B. for 20 years. They discovered him a coverage for $19 lower than the opposite guys.

“Seeing how Zander acquired me about 30 quotes in 30 seconds, and I acquired to decide on one of the best one, I’ll roll with Zander,” Ryan mentioned on the Ramsey Child Steps Neighborhood Fb group.

Be taught the Smarter Technique to Do Life Insurance coverage

Life insurance coverage can really feel freakin’ complicated. Signal as much as get Ramsey’s no-nonsense recommendation, together with free entry to Dave’s video from Monetary Peace College (usually $80), plus guides and sources despatched proper to your inbox.