Considered one of the greatest methods to wreck your day . . . is to wreck your automobile! However scary (and costly) as collisions will be, there’s multiple approach to injury your automobile—heck, it could get broken once you’re not even driving it!

And when random automobile injury strikes, complete insurance coverage is there for you.

What Is Complete Insurance coverage?

Though the identify complete may make you suppose, Oh, this covers every little thing—suppose once more! Complete insurance coverage helps you pay for any injury to your automobile not lined by your collision insurance, and covers injury to your automobile brought on by different kinds of disasters—like fallen timber, wildfires or wildlife. (Critically, why do deer run towards visitors?).

We’ll speak all about every little thing complete insurance coverage covers, the way it works and in case you want it. (Spoiler alert: You most likely do!)

However first let’s go over a couple of key phrases you’ll have to know once you’re studying about complete protection.

Key Complete Insurance coverage Phrases

To actually perceive complete insurance coverage and what it does, it helps to know a couple of of the phrases that may pop up once you’re buying round. Right here we go!

Precise money worth: Identical to it sounds, that is the quantity you’d count on to get in your automobile in case you bought it in its present situation. In fact, that’s earlier than it will get mauled by a bear lumbering throughout the freeway.

Collision insurance coverage: Assume visitors accidents. This insurance coverage protection pays to restore or change your automobile in case you roll it, or if it’s broken in an accident with one other automobile or a stationary object, like a fence or a guardrail.

Deductible: It’s the greenback quantity you’ll have to pay out of pocket once you make a complete insurance coverage declare. The upper your deductible, the decrease your premiums—and vice versa. (Extra on that under.)

Full protection automobile insurance coverage: When you’ve collision and complete protection, together with liability insurance, then you’ve one thing lovely generally known as full coverage car insurance. Full protection insurance coverage can get costly! However in case you get a very good charge, it’s price the additional {dollars} to have peace of thoughts understanding injury to your automobile from every kind of disasters is roofed.

What Does Complete Insurance coverage Cowl?

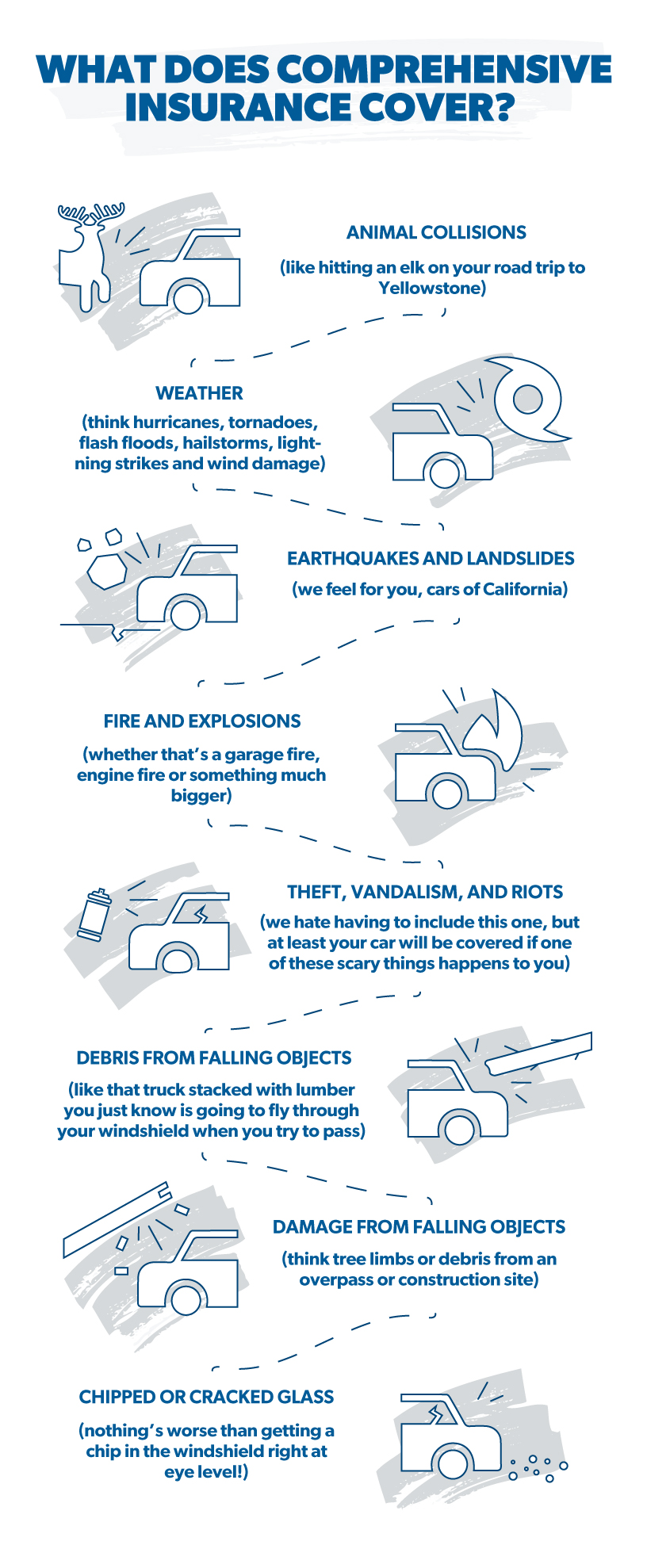

Like we already mentioned, the complete in complete insurance coverage is just a little deceptive. As a substitute of protecting all the unhealthy stuff your automobile goes by means of, it’s extra like a catch-all protection for injury not brought on by colliding with one other automobile or stationary object. Listed below are among the most typical examples of what complete protection covers:

- Animal collisions (like hitting an elk in your highway journey to Yellowstone)

- Climate (suppose hurricanes, tornadoes, flash floods, hailstorms, lightning strikes and wind injury)

- Earthquakes and landslides (we really feel for you, automobiles of California)

- Fires and explosions (whether or not that’s a storage fireplace, engine fireplace or one thing a lot greater)

- Theft, vandalism and riots (we hate having to incorporate this one, however not less than your automobile can be lined if considered one of these scary issues occurs to you)

- Particles from different automobiles (like that truck stacked with lumber you simply know goes to fly by means of your windshield once you attempt to move)

- Harm from falling objects (suppose tree limbs or particles from an overpass or development web site)

- Chipped or cracked glass (nothing’s worse than getting a chip within the windshield proper at eye degree!)

Mainly, complete insurance coverage covers the fee to restore or change your automobile if one thing actually unfortunate occurs to it.

Complete vs. Collision

There are a number of types of car insurance, so it’s comprehensible when folks combine up comprehensive vs. collision. They usually do work collectively to guard you financially in case your automobile is broken, and also you want each for full safety on the highway or in your driveway. To maintain ’em straight, let’s take a look at each sorts facet by facet and discover out the place complete insurance coverage suits in.

Don’t let car insurance costs get you down! Download our checklist for easy ways to save.

Whenever you consider your collision coverage, suppose:

- Crashes with different autos in visitors

- Collisions with objects (like a fence or lamppost)

- A single-car accident the place you find yourself rolling over (yikes!)

That’s all!

And once you consider complete? See it as a separate (however associated) protection coverage that normally doesn’t kick in for injury brought on by driving. It catches virtually another form of automotive injury you may think about—pure disasters, man-made mayhem and every little thing in between.

Right here’s one other useful approach to evaluate the 2 sorts. Consider collision as what you want when your automobile hits one thing else, and complete as what you want when one thing else hits your automobile—apart from another man’s automobile!

Though collision is a completely separate protection kind, insurance coverage corporations usually bundle it along with complete. So don’t be stunned if shopping for one kind requires you to purchase the opposite one too.

How Does Complete Insurance coverage Work?

Whenever you purchase a complete insurance coverage coverage, you’ll first want to decide on a complete deductible. Bought hail injury? (These ice balls can lower deep!) The deductible is the sum of money you’ll pay out of pocket to clean out the dents or another form of injury from an occasion the coverage covers.

After you pay the deductible, the insurance coverage firm pays as much as the coverage restrict. The coverage restrict is normally the quantity the automobile is at the moment price—not what you initially paid for it. (Sorry, however them’s the principles. That’s what gap insurance is for.)

Let’s take a look at some examples to see how that works.

Staying Underneath the Coverage Restrict

Anna’s automobile is price $7,000. She hits a deer and causes $1,500 of harm to her automobile. The price of repairs is lower than the automobile’s complete worth, so the insurance coverage firm will truly pay much less than the coverage restrict. On this case, Anna pays her $500 deductible, and the insurance coverage firm pays the opposite $1,000. (Thank goodness she has an emergency fund to cowl her a part of the repairs!)

Reaching the Coverage Restrict

Christy’s automobile is price $10,000. One morning, she heads out to her automobile to go away for work. However her it’s been stolen. She has a $1,000 complete deductible, so the insurance coverage firm writes her a examine for $9,000—the worth of the automobile minus the deductible.

Passing the Coverage Restrict

Jeff’s automobile is price $3,000. He’s driving home and a ladder falls off the development truck in entrance of him. The ladder hits him, doing critical injury beneath his automobile. Restore invoice: $3,500. For the reason that price to restore exceeds the worth of the automobile, the insurance coverage firm decides it’s a complete loss, and never price fixing.

At this level, Jeff has a option to make. If he’s like most individuals with a totaled automobile, he’ll choose to take the $2,000 payout from his complete protection (what the car is worth minus his $1,000 deductible). However possibly Jeff simply can’t let go of his beloved wreck and he’s keen to binge-watch a DIY mechanic’s YouTube channel known as “Overhaul Your Underbelly!” (Hey, these folks exist, they usually’ve acquired fairly spectacular automobile restore abilities, proper?)

In that case, Jeff could make a take care of the insurer to maintain the heap and get a salvage title—he’ll additionally get a a lot smaller payout since he’s mainly shopping for the automobile again from the insurance coverage firm. Plus, he received’t be capable of drive it till it’s repaired and issued a rebuilt title, however no matter floats his boat . . . err, automobile!

In every case, complete insurance coverage saved that particular person some huge cash. That’s why it’s so vital!

Selecting a Complete Insurance coverage Deductible

Now you may be considering, I need a low deductible like Anna so I don’t need to pay as a lot. In any case, isn’t it higher to pay $500 than $1,000?

Nicely, not all the time.

When your deductible is low, the automobile insurance coverage firm is extra more likely to lose cash serving to you pay for repairs. To offset that danger, they cost greater premiums. You’ll pay extra for protection—and the longer you go with out filing a claim, the more cash the insurance coverage firm makes out of your premiums.

However, a excessive deductible might sound unhealthy, as a result of it’s important to pay extra up entrance if it’s important to file a declare. However you’ll truly pay decrease month-to-month premiums—so the longer you go with out submitting a declare, the extra you save.

And don’t overlook about your emergency fund! In the event you’re executed with Baby Step 1, you may select a $1,000 deductible, as a result of that’s how a lot you’ve saved for emergencies. And in case you’re on Child Step 3 with a totally funded emergency fund, you may go for a fair greater deductible and decrease premiums! Selecting excessive deductibles with low premiums is likely one of the greatest methods to save money on insurance.

What are the Child Steps? They’re a step-by-step plan tens of millions of individuals have used to save cash, repay debt, and construct wealth. You’ll be able to be taught extra concerning the Child Steps—and a ton of different cash matters (like insurance coverage) in Financial Peace University.

Is Complete Insurance coverage Price It?

We expect complete insurance coverage is nearly all the time a very good addition to your auto insurance coverage. In any case, auto accidents occur—they usually don’t all the time contain one other automobile!

Complete Benefits

Complete insurance coverage protects you financially each time these random forms of accidents we talked about above occur. As a substitute of paying all the prices to restore or change your automobile from that freak mudslide or high-speed deer collision, you’ll get assist from the insurance coverage firm—saving you cash and conserving you targeted in your large monetary objectives

One other unhappy however widespread state of affairs the place you’ll need complete insurance coverage: in case you occur to be leasing or financing your car. (By the best way, that’s one thing you shouldn’t have executed anyway, since debt all the time slows your monetary progress means down.) But when that’s you proper now, your lender will most likely require you to have complete protection.

Complete Disadvantages

The one drawback we see with complete protection is that it might doubtlessly price you greater than it’s price—however that’s a fairly uncommon state of affairs. For instance, your automobile might lose a lot precise money worth that it dips under the quantity of your coverage deductible. Would your jalopy be fortunate to fetch $1,000 on Fb Market? Then a $1,000 deductible means you’re paying for a coverage that may pay you nothing even when your automobile was totaled. (By the best way—in case your automobile actually is valued beneath a supplier’s lowest deductible, they most likely received’t give you complete protection on it anyway.)

So in case you’re driving a hooptie to get by means of Child Step 2, you get a move on this . . . for now. However the second you get a automobile that’s price just a little extra, get complete insurance coverage to go along with it! And in case you’ve already acquired a automobile that qualifies, you want complete protection ASAP.

Is Complete Insurance coverage Proper for You?

Complete protection is normally proper for everybody. It’s particularly vital in case you reside in an space the place pure disasters are widespread—like wildfires in California, hurricanes in Florida or tornadoes in Oklahoma—or in case you reside in a giant metropolis the place different persons are more likely to be careless and injury your automobile (howdy, Chicago). And it’s undoubtedly vital in case you’re in Child Step 1 or Child Step 2, once you don’t have sufficient money laying round to interchange your automobile.

Discover the Finest Complete Insurance coverage Coverage

Complete automobile insurance coverage is a necessity, however that doesn’t imply it’s important to pay an arm and a leg for it (or a lung and a kidney, in case your insurance coverage firm sucks). It will probably truly be downright inexpensive! With our trusted community of insurance coverage professionals, you could find an independent insurance agent in your space to get the very best offers on complete protection.

Connect with a RamseyTrusted insurance pro to be sure to’re lined and discover out how one can save in your automobile insurance coverage.