In case you personal a apartment, you want apartment insurance coverage. Easy as that. However wait . . . doesn’t your householders affiliation (HOA) cowl you? Probably not.

Regardless that apartment insurance coverage is just like householders and renters insurance coverage, there are some massive variations. And a few of it will get fairly difficult. However keep on with us! We’ll clarify all the pieces you ever wanted to find out about apartment insurance coverage so that you may be positive you’re coated.

What Is Condominium (HO-6) Insurance coverage?

Condo insurance coverage protects your belongings if they’re stolen or broken (assume fireplace or theft). It additionally provides you legal responsibility safety if somebody is injured in your property. Condominium insurance coverage offers monetary safety for repairs to the particular apartment unit you personal.

Many apartment house owners assume their unit and private belongings are coated by their homeowners association (HOA) insurance coverage. (An HOA is a company that maintains the property in housing communities like condos, townhouses and housing subdivisions.)

Sorry to be the bearer of unhealthy information, however HOA insurance coverage solely covers the constructing and customary areas. It gained’t pay on your stuff or inside repairs if the unhealthy guys break in, steal your flat-screen and wreck your apartment.

Insurance coverage on your apartment can be known as HO-6 insurance coverage, a label that’s used for various types of property insurance. Traditional homeowners insurance policies are often known as HO-3 whereas renters insurance is known as HO-4. (And if you happen to’re nonetheless within the analysis section of shopping for a apartment, try our evaluation of whether a condo is really a good investment.)

Is Condominium Insurance coverage Required?

Normally. Most mortgage firms require you to have apartment insurance coverage. And a few HOAs require it too—even if you happen to paid for that apartment in money (good work!).

Backside line? In case you personal a apartment, you want apartment insurance coverage. The very last thing you need is to need to dip into your financial savings or retirement nest egg to pay to exchange your belongings or make repairs.

What Does Condominium Insurance coverage Cowl?

Condominium insurance coverage is loads like dwelling insurance coverage. It protects your funds from natural disasters like fireplace, hail, windstorms and theft. When you pay your deductible, your insurance coverage firm will begin reimbursing you.

Right here’s an inventory of what apartment insurance coverage sometimes covers:

Private Belongings

If a thief breaks in and steals or damages your stuff (furnishings, garments, home equipment and electronics), apartment insurance coverage will assist pay for repairs or to exchange your gadgets. Additionally, identical to householders insurance coverage, higher-end gadgets like artwork and jewellery are solely coated as much as a sure restrict. In case you want extra protection, you might wish to look into umbrella insurance.

You also needs to resolve in order for you actual cash value coverage or replacement cost coverage. Precise money worth takes under consideration depreciation, so that you gained’t get as a lot for misplaced gadgets. Substitute price protection can pay you to purchase a brand new TV.

Structural Harm

You’re additionally coated if the inside of your apartment unit is broken. This would come with issues like inside partitions, flooring, sinks, cabinetry, tiles and different fixtures.

Extra Residing Bills

If a storm destroys your apartment and it’s your main residence, you might want some assist with residing bills. Extra residing bills protection, additionally known as lack of use, will help cowl these sudden prices.

Private Legal responsibility

Let’s say you’re throwing a celebration for some family and friends at your ski resort apartment. Superior! Till your cousin Vinny falls and breaks his ankle in your steps. Good factor you’ve obtained apartment insurance coverage. Legal responsibility protection will cowl authorized and medical bills associated to accidents in your property. It even covers you in case your canine bites your neighbor down the corridor.

What Does My HOA Insurance coverage Cowl?

Your HOA insurance coverage (additionally known as a grasp coverage) does cowl a couple of issues—frequent areas (swimming swimming pools, tennis courts, foyer, and so forth.), accidents that happen in these frequent areas, and any injury to the outside of the constructing from disasters or storms.

Protect your home and your budget by working with a RamseyTrusted pro to get the right coverage!

However we’ll warn you once more. Don’t depend on HOA insurance coverage as your solely safety. It gained’t defend your unit or your stuff. That’s what apartment insurance coverage is for.

What Type of Incidents Does Condominium Insurance coverage Cowl?

Now you’re questioning, Condominium insurance coverage looks as if an ideal deal, however will it actually cowl me if my apartment’s flooded throughout a hurricane?

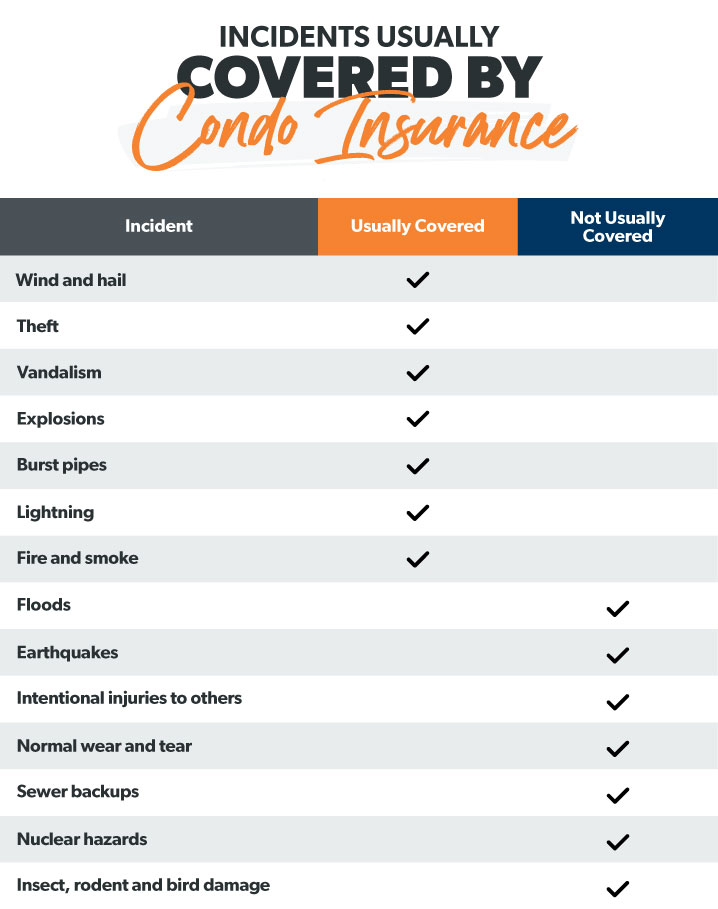

Right here’s a useful listing of what kinds of occasions are usually coated by an ordinary apartment insurance coverage coverage.

How A lot Condominium Insurance coverage Do You Want?

To determine how much condo insurance you need, right here are some things to think about. First, do a listing of all of your private belongings. Create a spreadsheet you’ll be able to preserve someplace protected (like cloud storage) so it doesn’t get misplaced or destroyed throughout a catastrophe. Take photographs and movies of all the pieces you personal so you may have a document if you happen to ever want to supply it to your insurance coverage firm in the course of the claims course of.

Subsequent, verify what your HOA insurance coverage covers so that you’re not shopping for protection you have already got. Ask your HOA for a replica of their insurance declaration page.

You’ll additionally wish to take a look at legal responsibility limits. Most plans provide a variety beginning at $100,000 as much as $300,000. Analysis how a lot you assume you’ll want based mostly on belongings that could possibly be in danger in a lawsuit. Additionally take a look at native development prices to get an thought of how a lot it will price to rebuild your apartment.

Lastly, in case your apartment is in a flood zone or an space that will get hurricanes, look into further protection. Many Individuals imagine their normal property insurance coverage insurance policies will cowl them within the occasion of flooding or earthquakes. Not true. A typical apartment insurance coverage coverage is not going to, we repeat, not pay for flood, earthquake or hurricane injury. You’ll want further flood insurance, earthquake coverage and hurricane insurance.

Elective Condominium Insurance coverage Protection

Similar to the TV commercials inform us (time and again and over . . .), you’ll be able to customise your insurance coverage. The identical is true for apartment insurance coverage. In case you’re your scenario and also you assume you want extra protection, right here are some things you’ll be able to add to your plan.

Loss Evaluation

Loss assessment (additionally known as particular evaluation protection) is an additional layer of protection that kicks in in case your HOA insurance coverage coverage hits its limits. Say there’s a serious catastrophe. Your complete apartment constructing is usually destroyed. Your HOA would possibly make every apartment proprietor pitch in to cowl prices which might be above the grasp coverage restrict. Right here’s the place loss evaluation is available in. It may possibly assist cowl some or all of those bills so that you don’t find yourself paying out of pocket.

And since we’re speaking about unhealthy issues that might occur, yet another factor. If main injury outcomes from your unit, you may be on the hook to cowl your entire HOA insurance coverage’s (giant) deductible. For instance, let’s say your toddler is taking part in with the microwave (not good) and by accident begins a hearth (even worse) that spreads to different items (ouch). Your HOA would possibly require you to pay their deductible because it was technically your fault (purpose #937 to not let children play with microwaves).

Substitute Price Protection

We talked about this above, however if you wish to be sure to’re reimbursed for the complete quantity it will price to exchange your 4K UHD 72-inch flat-screen TV, you will get substitute price protection.

Identification theft safety

Surprisingly, you’ll be able to even add identity theft protection to your apartment insurance coverage. It will assist cowl lawyer charges in case your identification is ever stolen.

Scheduled Private Property

Need to be sure that Picasso’s coated? We get it. You should buy increased limits for higher-end gadgets like artwork and jewellery.

Unoccupied (or Vacant) Protection

In case you’re away out of your apartment for a interval of over 30 days, your insurance coverage firm could not approve claims for injury that occurred whilst you have been vacant. In case you’re solely in your apartment for a part of the 12 months, it’s best to look into getting unoccupied or vacant protection.

Water Backup Protection

That is precisely what it seems like—further protection in case your sump pump explodes and water backs up in your apartment.

Okay, so we noticed there are many choices with regards to apartment insurance coverage. Your insurance coverage agent can stroll you thru which add-ons may be helpful on your scenario.

How A lot Is Condominium Insurance coverage?

The cost of condo insurance ranges dramatically. However the nationwide common yearly premium for apartment insurance coverage is $506.1

Insurance coverage firms base charges on a couple of elements: the place you reside, the worth and age of your apartment, your deductible, protection quantities, and issues like your age and credit score historical past.

Right here’s a take a look at the common prices by state so you will get a really feel for what you may be paying.

|

State |

Price of Common Yearly Premium |

|

Alabama |

$541 |

|

Alaska |

$396 |

|

Arizona |

$400 |

|

Arkansas |

$539 |

|

California |

$535 |

|

Colorado |

$417 |

|

Connecticut |

$399 |

|

Delaware |

$431 |

|

Florida |

$964 |

|

Georgia |

$493 |

|

Hawaii |

$310 |

|

Idaho |

$420 |

|

Illinois |

$398 |

|

Indiana |

$354 |

|

Iowa |

$295 |

|

Kansas |

$439 |

|

Kentucky |

$390 |

|

Louisiana |

$748 |

|

Maine |

$342 |

|

Maryland |

$310 |

|

Massachusetts |

$444 |

|

Michigan |

$369 |

|

Minnesota |

$312 |

|

Mississippi |

$600 |

|

Missouri |

$416 |

|

Montana |

$382 |

|

Nebraska |

$355 |

|

Nevada |

$424 |

|

New Hampshire |

$332 |

|

New Jersey |

$450 |

|

New Mexico |

$397 |

|

New York |

$553 |

|

North Carolina |

$456 |

|

North Dakota |

$320 |

|

Ohio |

$319 |

|

Oklahoma |

$631 |

|

Oregon |

$364 |

|

Pennsylvania |

$385 |

|

Rhode Island |

$500 |

|

South Carolina |

$500 |

|

South Dakota |

$307 |

|

Tennessee |

$473 |

|

Texas |

$790 |

|

Utah |

$269 |

|

Vermont |

$345 |

|

Virginia |

$352 |

|

Washington |

$374 |

|

Washington, D.C. |

$369 |

|

West Virginia |

$313 |

|

Wisconsin |

$280 |

|

Wyoming |

$3792 |

Save on Condominium Insurance coverage

In case you’re trying to save on apartment insurance coverage (and actually, who isn’t?), listed below are a couple of ideas.

Bundle and save. Bundle and save. Bundle and save. Yep, we’ve heard it solely one million occasions on TV. But it surely’s true! In case you bundle apartment insurance coverage together with your auto insurance coverage coverage on the similar insurance coverage firm, you may lower your expenses.

You may also be capable of save a bit by putting in higher security options at your apartment, like deadbolt locks and smoke detectors. Insurance coverage firms reward individuals with reductions in the event that they take security extra severely.

One other approach to decrease month-to-month premiums is to extend your deductible. Simply be sure to have sufficient financial savings to cowl that increased deductible if you find yourself needing to file a declare.

Get the Proper Protection

One other nice approach to save when getting apartment insurance coverage is to easily store round. And also you might do that by yourself—however actually, who has time for that? As an alternative, we advocate utilizing one in every of our insurance coverage execs who’s a part of our Endorsed Native Suppliers (ELP) program. They’re RamseyTrusted and might store so that you can get one of the best protection at one of the best value.

Like your private home, your apartment is one in every of your greatest investments. However discovering your apartment insurance coverage candy spot may be onerous. So many choices, so little time! Let a professional store for you so you’ll be able to sleep straightforward realizing your apartment’s coated.

Connect with a local ELP today!

Enthusiastic about studying extra about householders insurance coverage?

Signal as much as obtain useful steering and instruments.

Often Requested Questions

1. What’s the distinction between an HO-3 and an HO-6 coverage?

An HO-6 coverage refers to property insurance coverage that particularly covers a apartment. An HO-3 coverage is an ordinary householders insurance coverage plan and is the most typical type of protection for single-family houses. HO-6 insurance policies solely cowl the apartment proprietor’s belongings and their unit, not the constructing itself.

2. Does apartment insurance coverage cowl structural injury?

It is determined by the injury. The HOA grasp coverage can pay for exterior structural injury (just like the constructing’s roof) whereas your personal apartment insurance coverage can pay for inside structural repairs (like your flooring or partitions).

3. If my constructing has an all-in HOA coverage, do I want apartment insurance coverage?

Sure, though you won’t want as a lot dwelling protection. It’s because “all-in” HOA insurance coverage protects the apartment’s construction in addition to shared property. Nevertheless, this “all-in” coverage gained’t cowl your private belongings. So you continue to want apartment insurance coverage to be sure to’re totally protected.

4. If I get injured in my apartment, will my apartment insurance coverage cowl my medical bills?

No. Typical apartment insurance coverage legal responsibility protection (together with medical payments coverage solely pays the medical bills for another person who’s injured in your property. If you have been injured, you would need to use your personal health insurance plan.