A humble abode. Your dwelling and domicile. House candy house. There’s nothing prefer it—it’s one of the best.

However what if one thing occurred to it? Do you’ve the correct householders insurance coverage to be sure you can begin over? How have you learnt? What precisely does householders insurance coverage cowl? And what doesn’t it cowl?

Insurance coverage is likely to be sophisticated, nevertheless it’s not rocket science. Don’t let a easy lack of understanding maintain you from defending your own home and your funds. The fact is that many householders are underinsured—they usually’re taking large dangers they probably can’t afford.

On this householders insurance coverage information, I’ll break down every part you might want to find out about householders insurance coverage.

Key Sections:

What Is Householders Insurance coverage?

Householders insurance coverage is monetary safety on your house and private belongings in case of accidents, fires or different disasters. It protects you from monetary damage by transferring danger to an insurance coverage firm. Householders insurance coverage additionally protects you financially from lawsuits as a consequence of accidents in your property (suppose canine bites or different accidents).

Right here’s the way it works. By paying month-to-month premiums, you enter right into a contract together with your insurance coverage provider. Your insurance coverage firm then agrees to pay for any incidents they’ve agreed to cowl. If a type of incidents occurs, you file a claim and pay a specific amount of the damages out of pocket (your deductible), then your insurance coverage firm pays any prices above your deductible, as much as the coverage’s restrict.

The underside line? In the event you personal a house, you want householders insurance coverage. The truth is, nearly all mortgage corporations require you to have householders insurance coverage, despite the fact that it’s not required by any state legal guidelines. Even for those who hire, numerous landlords require you to have renters insurance to guard your stuff.

What a Householders Coverage Gives

Would you be okay financially if (God forbid) a twister got here alongside and destroyed your own home? If the reply’s no (and it’s for many of us), you want a householders insurance coverage coverage. Householders insurance coverage offers peace of thoughts understanding you gained’t be worn out financially in case your property is.

Listed below are the completely different areas the place a householders coverage offers peace of thoughts:

- Extra constructions: Your own home construction and indifferent constructions like a storage are coated. Every coverage differs on how a lot cash you’ll get, however your insurance coverage can pay to restore or change them in the event that they’re broken.

- Your stuff: Do you personal stuff in your own home? Except you’ve Marie Kondo’d your belongings into oblivion, you in all probability have a home filled with stuff that may price lots to exchange. You don’t have to fret—the correct householders coverage will cowl all of your belongings.

- Accidents and damages: This subsequent one isn’t as intuitive, however you’ll positive be glad it’s there in case your neighbor’s children come over and fall out of the janky tree fort in your yard. Your householders coverage has a clause for private legal responsibility to cowl issues like this. Buying legal responsibility safety in your householders insurance coverage coverage is likely one of the greatest buys within the enterprise.

Householders Insurance coverage and Mortgages

Perhaps you’re trying into shopping for your first house. (Congrats are so as, if that’s the case!) And also you’re considering, This deal is already so costly—do I have to get householders insurance coverage? Right here’s the factor about shopping for a house: Most individuals get a mortgage. And the banks that provide you with that mortgage require householders insurance coverage.

In any case, till you pay off your mortgage, the financial institution really owns your own home—they usually don’t need their collateral going up in smoke.

Now, for those who pay money for that candy bungalow, you are able to do no matter you need. However I’m nonetheless going to advocate you get householders insurance coverage that covers the total price to exchange your own home—until you’ve obtained some Scrooge McDuck-level cash and you can pay for it with out flinching. However I doubt it.

Householders Insurance coverage vs. House Guarantee

Let’s get this straight: Householders insurance coverage is not the identical factor as a house guarantee. A guaranty is a assure in opposition to one thing in the home, like a fridge, turning out to have an issue. House insurance coverage is a assure in opposition to one thing having an issue with the home—like a twister.

A house guarantee pays to restore or change a damaged equipment or HVAC system, for instance. House insurance coverage would pay to restore or change injury to your own home attributable to a hearth.

Similarities:

- You buy each from an organization, and separate from the home.

- Neither covers issues from the precise development course of like structural points.

- Neither covers rust, corrosion or regular put on and tear, deterioration from time, poor upkeep, or defective set up.

Variations:

- House warranties cowl home equipment and residential programs in the event that they break, whereas insurance coverage covers your construction and every part inside it—together with home equipment in the event that they’re broken or destroyed.

- House warranties are pointless. That’s proper, you heard it right here. Your emergency fund is supposed to cowl any points a house guarantee would—with no month-to-month premium! (But when a paid-for house guarantee is included in your house buy, don’t flip it down. Take it fortunately.) Householders insurance coverage, alternatively, is totally essential.

|

House Insurance coverage vs. House Guarantee |

|

|

House Insurance coverage |

House Guarantee |

|

Pays to restore or change home construction and contents if broken or destroyed by coated incident |

Pays to restore or change some home equipment and residential programs in the event that they break down |

|

Insurance policies final for one yr and are renewed every year |

Warranties sometimes final for one to 2 years |

|

Doesn’t cowl issues from development, put on and tear, poor upkeep, or defective set up |

Doesn’t cowl issues from development, put on and tear, poor upkeep, or defective set up |

|

Comes with various ranges of protection; greatest stage pays full price to exchange every part |

Pays partial price for repairs or replacements |

|

Vital |

Pointless |

(In the event you’re researching householders insurance coverage since you’re simply beginning to buy a house, try our free Home Buyers Guide.)

Householders Insurance coverage vs. Mortgage Insurance coverage

Relating to house possession, there’s lots to maintain observe of, so don’t really feel dangerous in case your head is spinning . . . however there’s another subject I’ve obtained to clear up. House insurance coverage and mortgage insurance are usually not the identical factor—in reality, they’re very completely different. Whereas house insurance coverage kicks in in case your precise house and stuff are broken, mortgage insurance coverage is a form of life insurance coverage that pays off your mortgage for those who die.

You undoubtedly need house insurance coverage, however if in case you have level term life insurance (the one form of life insurance coverage I like to recommend) you don’t want mortgage insurance coverage! It’s about nearly as good a deal as something you’d purchase off a TV infomercial after 1 a.m.

What Does Householders Insurance coverage Cowl?

Householders insurance coverage is lots like porridge. Hear me out.

You must be sure you’re in that Goldilocks candy spot of householders insurance coverage protection—not an excessive amount of protection and never too little. Like most types of insurance, householders insurance coverage isn’t only one blanket coverage that covers every part. It’s much more sophisticated than that (and why getting educated is so vital).

Let’s begin with what homeowners insurance covers so you’ll be able to perceive the place you’re protected. Professional tip: Your insurance declaration page will present you what coverages you at present have so you’ll be able to see the place the gaps are.

A typical householders insurance coverage coverage addresses 5 staple items.

1. Dwelling Protection

This protection pays to restore or rebuild your dwelling (aka your own home and something hooked up to it) as a consequence of damage from disasters like fireplace, windstorms, hail, lightning, theft and vandalism (also referred to as hazards). So, if a twister politely takes the lid off your own home and places it in a tree, dwelling protection will kick in and your insurance coverage firm can pay to exchange it. Nevertheless, there are just a few exceptions to householders protection, like injury from flooding and hurricanes (extra on that in a bit).

2. Different Constructions Protection

Different constructions protection applies to issues apart from your own home. Some examples are: indifferent storage, software shed, barn, gazebo, swimming pool, fence or driveway.

Mainly, any construction that could be a everlasting, worthwhile characteristic of your property falls beneath different constructions protection. But it surely does have limits—often round 10% of the whole coverage you’ve on your own home.

3. Private Property Protection

Private property protection protects what’s in your own home—the stuff you utilize day-after-day, like garments, furnishings and electronics. It additionally covers costly stuff like jewellery, artwork and collectibles. However there’s usually a greenback restrict hooked up to these high-end objects—so be sure you have sufficient insurance coverage to exchange every part. Most insurance coverage corporations cowl your belongings at round 50–70% of what your own home is price. Create an intensive stock of all of your issues so you’ve a report of your belongings and what they’re price.

4. Private Legal responsibility Protection

Personal liability protection covers you from lawsuits for bodily damage, property injury that happens in your property, and even canine bites if Rex isn’t a harmful breed (though there’s all the time the likelihood he’ll lick you to dying). Private legal responsibility protection doesn’t price a lot, so you will get loads at an inexpensive fee. You need to carry at least $500,000 in legal responsibility as a result of—let’s be actual—nobody nowadays sues for $250,000. And if in case you have a bigger web price, you must also look into umbrella insurance.

5. Extra Dwelling Bills (ALE)

Extra dwelling bills (ALE) protection helps pay for the prices of dwelling away from house when you’ll be able to’t keep there as a consequence of injury from an insured catastrophe. Whether or not it’s for just a few days and even months, ALE covers issues like lodge payments, restaurant meals, pet care, transportation and even transferring bills.

Nevertheless, ALE gained’t pay for all your bills. It covers prices over and above your standard dwelling bills (like your mortgage and common grocery finances).

Now that we’ve seen the excellent news of what a typical householders insurance coverage coverage covers, we’re prepared for the dangerous information—what’s not coated.

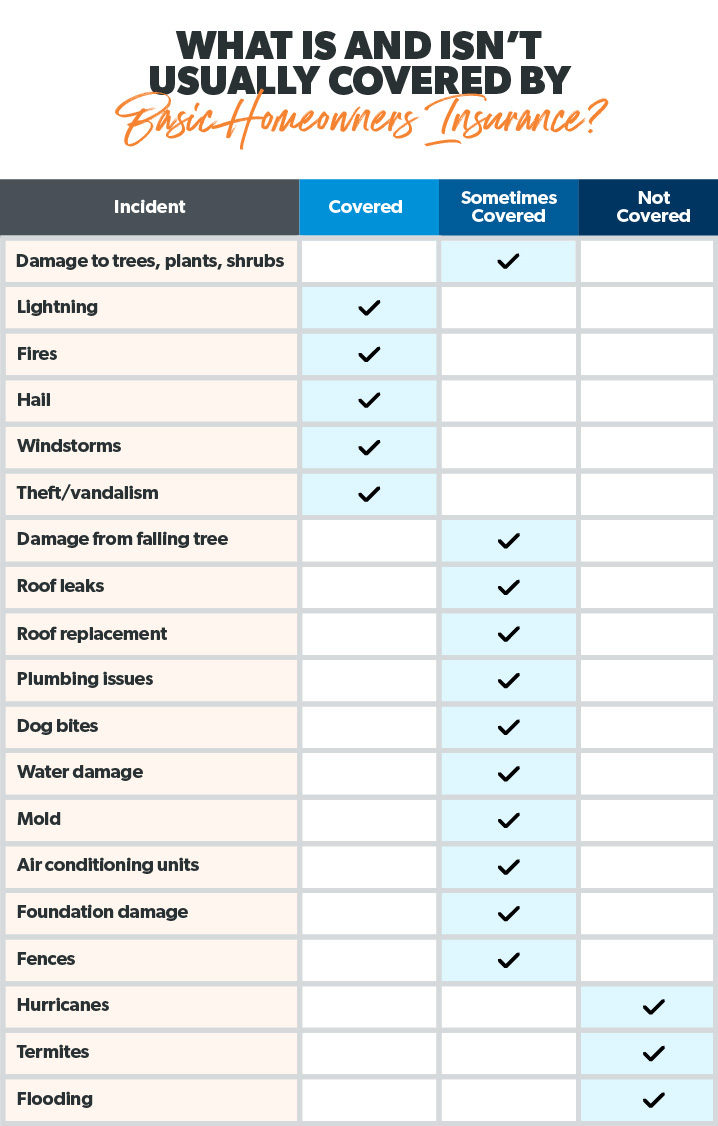

What Isn’t Coated by Householders Insurance coverage?

What’s not covered by standard homeowners insurance? And when must you contemplate shopping for further protection? Let’s have a look.

Flooding

Of all natural disasters within the U.S., 90% contain flooding.1 Solely 78% of householders who report being prone to flooding say they’ve flood insurance although.2 (Come on, individuals! Let’s flip these numbers round.)

I’m going to be as crystal clear as I can on this one: Commonplace householders insurance coverage insurance policies gained’t cowl flood injury to your own home.

And, no, you’ll be able to’t name the insurance coverage firm when you’re standing knee-deep in water (good attempt). You want flood insurance earlier than the waters begin rising. It’ll pay for injury to the construction of your own home and something hooked up to it.

Be mindful, we’re speaking flood waters from outdoors your own home. House insurance coverage will cowl some sorts of water injury like roof leaks.

In the event you dwell in a flood-prone space, get flood insurance coverage. Now.

Earthquakes and Hurricanes

Primary householders insurance coverage additionally gained’t cowl injury from earthquakes, until it’s one thing like a home fireplace attributable to an earthquake (have a look at your coverage or examine together with your insurance coverage agent for a full record of coated hazards). So for those who dwell on the San Andreas Fault or one other earthquake-prone space, you’ll need to look into including earthquake insurance.

What about hurricanes? In the event you dwell in a vulnerable coastal space, dwelling protection gained’t cowl wind or flooding injury attributable to a hurricane. You’ll want a separate policy for that.

Sinkholes

Householders insurance policies sometimes don’t cowl sinkholes—until you reside in Tennessee or Florida. Insurers in these two states are required to supply non-obligatory sinkhole safety. In the event you dwell in a state the place sinkholes are frequent—like Tennessee, Florida, Alabama, Kentucky, Missouri, Texas and Pennsylvania—you may need to contemplate this further safety.3

Upkeep Points

Typically, your householders insurance coverage gained’t cowl injury attributable to termites, mold, poorly maintained water pipes and sewage backups. As a substitute, these are thought of a part of the common upkeep of proudly owning your personal house. Similar to your car insurance doesn’t pay for oil adjustments and your canine doesn’t make his personal dinner, your householders insurance coverage firm gained’t pay to keep up your own home. (Welcome to the “joys” of maturity.)

This is the reason it’s vital to remain up on your own home upkeep. Take care of these small points earlier than they get large—and dear! It’s additionally good to save lots of up an emergency fund and get out of debt so that you’ve obtained further money to cowl issues that break (as a result of issues all the time break).

Examples of Generally Coated and Not Coated Householders Insurance coverage Conditions

Okay, we’ve coated numerous info, however these items may be fairly complicated. So let’s go over just a few frequent eventualities which are and aren’t coated by householders insurance coverage.

Coated

A nasty thunderstorm hits. The wind whips the rain up into your eaves, and it will get into your attic. Now you’ve water injury in your attic and a nook of your ceiling. House insurance coverage will cowl this.

Not Coated

A spring thunderstorm breaks unfastened over your own home, dropping three inches of rain in an hour. Your gutters are clogged with leaves as a result of enjoying pickleball with your pals sounded far more enjoyable than clearing them out. Rainwater overflows into your own home inside, damaging your ceiling and attic. Insurance coverage gained’t cowl this as a result of blocked gutters is taken into account a upkeep subject and residential insurance coverage doesn’t cowl issues attributable to poor upkeep.

Coated

You throw a load of laundry into the washer earlier than heading out to choose the youngsters up from faculty. Once you get again, the youngsters scream with pleasure as a result of the laundry room and kitchen at the moment are a shallow swimming pool. Your washer hose burst and flooded the home! That is coated by house insurance coverage.

Not Coated

It’s been an unusually moist spring, and the river is overflowing. It begins raining once more and the water creeps up larger into your own home. That is not coated by householders insurance coverage. You want flood insurance coverage for this.

How Householders Insurance coverage Works

Now, let’s discuss in regards to the several types of householders protection.

Selecting the proper of householders insurance coverage is essential. And it’s a balancing act. You need the most safety on the greatest worth—with out being underinsured or paying excessive premiums for protection you don’t want.

Let’s have a look at 4 important forms of householders insurance coverage.

Precise Money Worth (ACV)

An actual cash value (ACV) householders coverage can pay to restore or change your private belongings, minus depreciation. So, let’s say someone steals your Peloton (which might be spectacular contemplating these issues are heavy as heck). The insurance coverage firm can pay what the Peloton was price when it obtained stolen—not when it was new within the field.

In most insurance policies, ACV applies to your private property, however it may well additionally apply to how your own home construction will probably be changed as properly.

Substitute Value Worth (RCV)

Substitute price protection affords extra safety than precise money worth as a result of it doesn’t consider depreciation. It’ll pay to restore or change your own home at in the present day’s costs as much as the restrict. For instance, if in case you have $200,000 in dwelling protection and the rebuild prices $250,000, you’ll need to pay $50,000 plus your deductible.

An ordinary householders coverage often affords RCV protection for dwelling and the choice of selecting both RCV or ACV protection on your private property. I like to recommend getting RCV protection in each instances!

Assured Substitute Value

Assured substitute price protection pays the complete substitute price if your own home is destroyed—with out factoring in depreciation or dwelling protection limits. So if the rebuild prices $250,000, that’s what the insurance coverage firm can pay (minus your deductible). Easy. The one draw back is that it’s very costly and tougher to seek out than a gown shirt that doesn’t match like an precise gown on me.

Prolonged Substitute Value

One other variation on substitute price protection is prolonged substitute price protection. Any such householders insurance coverage pays the substitute worth of your own home as much as the protection restrict—plus a proportion of the protection restrict. So, following the instance of $200,000 in protection with a $250,000 price to rebuild, an prolonged substitute price coverage may cowl $200,000 plus 10% of that restrict (one other $20,000).

This protection can also be dearer. However it may be useful for those who dwell in an space the place development prices are rising rapidly (which appears to be nationwide in the last few years) and your own home is at comparatively excessive danger of being broken.

Forms of Householders Insurance coverage Insurance policies

Not all people’s obtained the identical form of house. Simply go searching. You may dwell in a contemporary ranch unfold, however the woman down the road is in a historic Tudor Revival, whereas your good friend owns a condominium and your uncle is a landlord. Good factor householders insurance coverage insurance policies come in numerous varieties!

HO-1 and HO-2: Consider these because the Speedos of house insurance coverage insurance policies. They provide solely bare-bones protection—a lot lower than what you’d usually need as a home-owner.

HO-3: That is the most typical sort of coverage householders chosen. Maintaining with the swimwear analogy, these provide Sixties-swim-trunks-length protection (, those the place you marvel, Are we positive these qualify as shorts? I’m nonetheless seeing extra leg than I ever cared to). They arrive as both a named perils coverage (you’re solely coated for what’s on an inventory of particular incidents—not nice) or an all-inclusive coverage (which covers every part besides what’s listed). Your private property is protected as much as a restrict (often 50% of your dwelling protection).

These insurance policies sometimes include precise money worth (ACV) protection for all of your stuff. This implies you receives a commission what your property is price on the time it was broken or destroyed (aka the used worth, which incorporates depreciation). Not very best.

HO-4: That is renters insurance. It covers every part the renter owns and affords private legal responsibility protection in case anybody is injured on the property.

HO-5: Together with HO-3, that is the opposite coverage that the proprietor of a single-family house would purchase. These insurance policies are your full-on, early-2000s, below-the-knee swim trunks (which I hope by no means to see once more—they swallow us little fellas. However in terms of house insurance coverage insurance policies, they appear fairly rad). They provide the very best ranges of protection and are dearer. However they’re price it as a result of if your own home and belongings are ever destroyed, you’ll be beginning over, and also you’ll want all the assistance you will get.

With this sort of coverage, you’ll get substitute price worth (RCV) protection, which implies your insurance coverage can pay no matter it prices to exchange your stuff. You might also be capable of discover a coverage that has assured substitute price worth.

HO-6: That is condo insurance. It covers your unit’s partitions, flooring and ceilings (however not the constructing itself—your condominium affiliation has a grasp coverage for that) plus every part else a typical HO-3 coverage covers, like legal responsibility and private property.

HO-7: Of us who dwell in a mobile home or manufactured house want this sort of coverage. Protection often solely applies when your own home isn’t transferring.

HO-8: This coverage is designed to cowl the proud homeowners of a historic house. They’re costly as a result of previous properties aren’t often constructed to present codes and requirements, and repairs require particular experience and supplies. (In the event you break a window George Washington appeared out of, it’s a must to change it with one other window George Washington appeared out of, and that will get costly.) It additionally offers the opposite typical coverages, like legal responsibility and private property.

How A lot Householders Insurance coverage Do I Want?

Now that we’ve discovered what’s and isn’t coated by householders insurance coverage, together with the forms of protection, you is likely to be questioning, How much homeowners insurance do I need?

Effectively, that relies on a ton of things. However one of many largest pitfalls individuals make when shopping for house insurance coverage will not be having sufficient—the payout of your householders insurance coverage will not routinely improve together with the rebuilding price of your own home. As an illustration, if a wildfire destroys your own home, it’d be terrible to seek out out your householders insurance coverage coverage solely covers half of the rebuilding prices.

However that is precisely what many individuals may face. That’s why it’s essential to routinely check out your coverage and make changes to it, if essential. Within the final a number of years, constructing and labor prices have skyrocketed, however householders aren’t ensuring their insurance coverage insurance policies are maintaining. Solely 30% of Individuals have up to date their house insurance coverage coverage to mirror the elevated prices.4

This is an excellent rule of thumb. Your householders insurance coverage ought to:

- Rebuild your own home (dwelling protection)

- Change your stuff (private property)

- Cowl accidents and damages that occur to others in your property or are attributable to you on different individuals’s property (private legal responsibility)

- Reimburse your dwelling bills after the lack of use of an insured house (further dwelling bills)

There are just a few different add-ons, or endorsements, you’ll be able to add to your coverage for those who suppose you want further protection. Listed below are just a few frequent examples:

- In case you have a very costly piece of knickknack, you will get one thing referred to as scheduled private property protection. This can cowl a particular merchandise that you simply sometimes might want to get appraised.

- Water backup protection will cowl the prices from sump pump accidents or backed-up sewer traces.

- Ordinance or regulation protection can pay to ensure your own home is as much as the newest constructing codes throughout a restore.

- Gear breakdown protection will assist in case your HVAC or main home equipment break down (over and above the same old put on and tear).

I like to recommend working with an independent insurance agent who can have a look at your scenario and discover you the correct protection whereas ensuring you don’t overpay for stuff you don’t want.

How A lot Does Householders Insurance coverage Value?

So, you’re getting nearer to determining how a lot you want, however what in regards to the price ticket? How a lot does the common homeowners insurance policy cost?

Householders insurance coverage prices range extensively relying in your scenario. Your month-to-month or annual premium is predicated on components just like the rebuilding price of your own home, your previous historical past of householders insurance coverage claims, what sort of protection you want, your credit score, for those who dwell in an space with a number of insurance coverage claims, and the way a lot your belongings are price.

That mentioned, the common U.S. householders insurance coverage annual premium in 2023 was $1,582 for $350,000 in dwelling protection, in accordance with information from Quadrant Info Providers. However once more, this quantity varies extensively relying on all these various factors.

Presently, the trade is elevating charges everywhere, and premiums are anticipated to rise extra—by as a lot as 30% this yr.5 And in terms of flood insurance, you’ll be able to count on to pay extra for that as properly. The truth is, many Individuals will see the value of flood insurance coverage double—or extra—because the Federal Emergency Administration Company (FEMA) updates charges.6

If this information has you in a tizzy, questioning the way you’ll afford house insurance coverage, don’t fear. I’ll speak about how to save cash on house insurance coverage in a minute. First, let’s have a look at the components that go into your worth.

How Are Householders Insurance coverage Charges Decided?

How a lot you pay isn’t based mostly on how the man on the insurance coverage firm felt when he awoke that morning. Like I discussed earlier, there are a lot of components that go into figuring out your fee, and understanding them might help you determine methods to cut back your fee.

Substitute Value

Your replacement cost—how a lot it might price to rebuild your own home—is an enormous a part of the price of your coverage. I’m not simply speaking dimension. There’s an enormous distinction in price to rebuild for those who’ve decked out your own home with marble slab counter tops, uncooked brass fixtures, and built-in library cabinets versus a cookie-cutter house with normal, builder-grade every part.

Location

One other big issue is the place your own home is positioned. In the event you dwell close to Dorothy and Toto the place numerous tornadoes crop up, count on larger premiums. Or for those who dwell in a higher-crime zip code, you can pay extra.

Age and Situation of Your House

If your own home is older, there’s a higher probability one thing may burst—just like the plumbing—and trigger injury. Beep, boop: larger fee.

Degree of Protection and Deductible

Your premium adjustments based mostly on how a lot protection you select, together with how large of a deductible you decide. A better deductible means a decrease month-to-month fee.

Development Kind

This might contain issues like what the home is fabricated from (brick, wooden, and so on.). The primary little piggy’s straw home can be insanely costly to insure.

Private Declare Historical past

In case you have a protracted historical past of submitting claims for each little factor, an insurer will issue this into your premium. Submitting claims on small repairs will solely price you more cash in the long term. The truth is, it may improve your premium even when your neighbors file numerous claims. (It won’t appear honest, nevertheless it’s an element.)

Your House’s Sq. Footage

The bigger the house, the dearer it’s to insure. In case you have an enormous mansion with extra loos than individuals, that’s clearly going to price extra to rebuild and insure than a one-room cabin.

How Many Stay There

In the event you, your partner, your kids and your total prolonged household are all dwelling beneath the identical roof, you’ll pay extra for legal responsibility protection as a result of there’s the next chance of incidents.

Different Elements

Insurance coverage corporations can even consider issues like the kind of roof you’ve, how shut you might be to a hearth and police station, if in case you have a sure breed of canine (I gained’t identify names), if in case you have a swimming pool or trampoline, your credit score rating, and what sort of safety and fireplace alarm programs you’ve.

Evaluate Householders Insurance coverage Charges

Now, you could be considering you’ll simply exit, seize the most cost effective insurance coverage yow will discover, and run. However this isn’t a good suggestion. Like we talked about earlier than, you need to be sure you get the proper of protection—and that gained’t be the most cost effective coverage out there. That mentioned, you continue to need to get one of the best deal for what you want, so let’s have a look at methods to evaluate householders insurance coverage charges.

This is crucial factor to recollect: Be sure to’re evaluating apples with apples!

Once you get a number of quotes, look over all of the coverages they provide. Are they each substitute price worth (RCV) or is one precise price worth (ACV)? ACV is cheaper—however you don’t actually need ACV protection.

What are the deductibles? If one has a much bigger deductible, then it ought to include a cheaper price.

What’s the protection quantity in every quote? A quote for $350,000 will price greater than a quote for $300,000. But when your own home substitute price is $350,000, that’s what you want.

Additionally, be sure you search for attainable protection gaps. Some insurance policies have further coverages included, whereas others require you to pay further for issues like protection of sewer and water backup or further dwelling bills (ALE).

Inquiries to ask when evaluating house insurance coverage quotes:

- Do all of them have ACV or RCV protection or are they completely different?

- What are the deductibles?

- Are all of the quotes for a similar protection quantity?

- How a lot legal responsibility protection does every one have?

- Are there protection gaps in any of the insurance policies quoted?

Evaluate Householders Insurance coverage Charges by State

I talked about how your location—like whether or not you’re near a hearth station or dwell in a high-crime neighborhood—impacts your own home insurance coverage premium. However the state you reside in can even have an effect on your fee. Listed below are the common householders insurance coverage premiums by state for various ranges of protection.

|

Common Householders Insurance coverage Premiums by State in 2023 |

|||||

|

State |

Complete Annual Common |

$200,000 |

$350,000 |

$500,000 |

$750,000 |

|

Alabama |

$2,293 |

$1,303 |

$1,855 |

$2,476 |

$3,537 |

|

Alaska |

$1,327 |

$769 |

$1,101 |

$1,446 |

$1,990 |

|

Arizona |

$1,473 |

$893 |

$1,197 |

$1,560 |

$2,240 |

|

Arkansas |

$2,887 |

$1,692 |

$2,363 |

$3,105 |

$4,386 |

|

California |

$1,223 |

$707 |

$995 |

$1,299 |

$1,890 |

|

Colorado |

$2,464 |

$1,469 |

$2,056 |

$2,663 |

$3,666 |

|

Connecticut |

$1,333 |

$781 |

$1,083 |

$1,438 |

$2,031 |

|

Delaware |

$1,142 |

$570 |

$872 |

$1,253 |

$1,874 |

|

Florida |

$2,390 |

$1,201 |

$1,889 |

$2,598 |

$3,870 |

|

Georgia |

$2,200 |

$1,179 |

$1,768 |

$2,394 |

$3,459 |

|

Hawaii |

$469 |

$264 |

$364 |

$498 |

$751 |

|

Idaho |

$1,291 |

$734 |

$1,040 |

$1,402 |

$1,987 |

|

Illinois |

$1,727 |

$1,066 |

$1,416 |

$1,837 |

$2,589 |

|

Indiana |

$1,614 |

$962 |

$1,321 |

$1,727 |

$2,445 |

|

Iowa |

$2,032 |

$1,106 |

$1,636 |

$2,201 |

$3,183 |

|

Kansas |

$2,938 |

$1,641 |

$2,390 |

$3,176 |

$4,543 |

|

Kentucky |

$2,607 |

$1,411 |

$2,059 |

$2,831 |

$4,125 |

|

Louisiana |

$4,477 |

$2,271 |

$3,549 |

$4,832 |

$7,255 |

|

Maine |

$1,224 |

$634 |

$962 |

$1,319 |

$1,979 |

|

Maryland |

$1,700 |

$980 |

$1,356 |

$1,829 |

$2,635 |

|

Massachusetts |

$1,417 |

$835 |

$1,138 |

$1,499 |

$2,194 |

|

Michigan |

$1,747 |

$903 |

$1,382 |

$1,940 |

$2,764 |

|

Minnesota |

$1,973 |

$1,106 |

$1,606 |

$2,162 |

$3,019 |

|

Mississippi |

$3,636 |

$1,972 |

$2,917 |

$3,930 |

$5,726 |

|

Missouri |

$2,766 |

$1,496 |

$2,221 |

$2,988 |

$4,360 |

|

Montana |

$2,087 |

$1,312 |

$1,764 |

$2,242 |

$3,031 |

|

Nebraska |

$4,166 |

$2,600 |

$3,556 |

$4,487 |

$6,019 |

|

Nevada |

$937 |

$538 |

$745 |

$998 |

$1,466 |

|

New Hampshire |

$1,055 |

$582 |

$848 |

$1,144 |

$1,647 |

|

New Jersey |

$1,042 |

$576 |

$858 |

$1,137 |

$1,596 |

|

New Mexico |

$1,724 |

$847 |

$1,368 |

$1,916 |

$2,766 |

|

New York |

$1,342 |

$718 |

$1,060 |

$1,461 |

$2,127 |

|

North Carolina |

$1,963 |

$928 |

$1,640 |

$2,199 |

$3,085 |

|

North Dakota |

$1,988 |

$1,183 |

$1,656 |

$2,139 |

$2,973 |

|

Ohio |

$1,215 |

$731 |

$995 |

$1,302 |

$1,833 |

|

Oklahoma |

$4,510 |

$2,436 |

$3,651 |

$4,967 |

$6,986 |

|

Oregon |

$992 |

$583 |

$784 |

$1,052 |

$1,550 |

|

Pennsylvania |

$1,223 |

$699 |

$977 |

$1,325 |

$1,892 |

|

Rhode Island |

$1,532 |

$899 |

$1,271 |

$1,649 |

$2,307 |

|

South Carolina |

$1,756 |

$930 |

$1,394 |

$1,881 |

$2,819 |

|

South Dakota |

$2,564 |

$1,434 |

$2,069 |

$2,818 |

$3,935 |

|

Tennessee |

$1,972 |

$1,147 |

$1,563 |

$2,127 |

$3,052 |

|

Texas |

$2,983 |

$1,632 |

$2,396 |

$3,196 |

$4,709 |

|

Utah |

$868 |

$553 |

$691 |

$898 |

$1,329 |

|

Vermont |

$1,032 |

$566 |

$845 |

$1,145 |

$1,571 |

|

Virginia |

$1,306 |

$710 |

$1,021 |

$1,405 |

$2,089 |

|

Washington |

$1,355 |

$773 |

$1,088 |

$1,446 |

$2,111 |

|

West Virginia |

$1,583 |

$875 |

$1,280 |

$1,717 |

$2,461 |

|

Wisconsin |

$1,246 |

$677 |

$1,013 |

$1,346 |

$1,947 |

|

Wyoming |

$1,505 |

$748 |

$1,145 |

$1,623 |

$2,502 |

Knowledge from Quadrant Info Providers

Save on Householders Insurance coverage

When you undoubtedly don’t need to lower corners on householders insurance coverage, there are just a few methods it can save you some cash.

- Bundle! We’ve all seen the TV advertisements: “Bundle and save!” Though it will get previous, it’s true. You can lower your expenses in your householders insurance coverage by bundling it with one other coverage. Attempt it together with your auto, commercial or umbrella insurance policies!

- Enhance security options. By merely putting in issues like burglar alarms, smoke detectors or deadbolt locks, you’ll be able to typically rating a reduction.

- Be sparing with claims. In the event you file too many claims, it may improve your premium. Assume via what number of claims you make, particularly on small incidents you can pay for your self.

- Improve your deductible. You may avoid wasting cash on a decrease premium for those who increase your deductible. However solely do that for those who can afford to cowl the larger deductible out of your financial savings.

- Verify for higher charges. By not buying round every now and then, or having your unbiased insurance coverage agent examine for you, you is likely to be leaving cash on the desk.

Get the Greatest Householders Insurance coverage

So, now all of the details, however how do you get one of the best house insurance coverage coverage? A method is to buy round and purchase it instantly from a provider. However this could take numerous time and nonetheless go away you with out one of the best safety in place. With so many various coverages and add-ons, it’s straightforward to overlook one you want or by chance purchase one you don’t want.

What if there was an professional who may do all of the grunt be just right for you, with out lacking any particulars? Effectively, there’s!

They’re referred to as unbiased insurance coverage brokers—they usually be just right for you, not a particular insurance coverage firm. There are numerous them on the market, although. To make it straightforward to know you’re working with somebody you’ll be able to belief, our workforce at Ramsey has vetted and gathered one of the best from across the nation beneath one roof: RamseyTrusted.

These trade specialists can store for you and get you one of the best safety at one of the best worth. They saved Adam D. from the Ramsey Child Steps Fb Group $700 a yr—with higher protection!

“Severely, our man gave a 20-minute video explaining line by line the protection of what we’ve versus what he was proposing and the way 1) it was cheaper and a pair of) was higher than what we had,” Adam mentioned.

I’ve thrown numerous information at you. In the event you’re feeling a bit overwhelmed, that’s comprehensible. So, let’s break it down. What are your subsequent steps to getting householders insurance coverage?

Often Requested Questions

-

How do I file a householders insurance coverage declare?

-

Most insurance coverage corporations will can help you file a declare on-line or via an app, or you are able to do it over the telephone with an agent. Be sure to present any images you took of the injury and your record of issues needing changed.

Right here’s a guidelines to comply with as you file an insurance coverage declare:

- As quickly because it’s secure, take footage of the injury.

- Fill out a proof of loss assertion and record of all of the broken or stolen objects, together with how a lot it’ll price to exchange them (that is the place making an inventory of all of your stuff and updating it often is useful!).

- Be sure to have the main points of the incident (fireplace, storm, and so on.) prepared to inform your insurer.

-

What’s the significance of making a house stock for insurance coverage functions?

-

If your own home will get burnt to a crisp or swept away in a flood, do you actually suppose you’ll be capable of bear in mind every part you had? Perhaps much more vital, will you need to take a seat down within the midst of that chaos and attempt to bear in mind each sweater, guide and digital machine you owned? To be sure you’re getting the correct quantity of protection and the correct fee out of your provider, it’s tremendous vital to maintain an up-to-date record of your stuff. It is as straightforward as taking images of your stuff!

-

What’s the main distinction between householders insurance coverage and renters insurance coverage?

-

The large distinction between householders insurance coverage and renters insurance coverage is that householders insurance coverage consists of protection for the construction (referred to as dwelling protection) that pays to rebuild the home if it’s destroyed, whereas renters doesn’t—since you’re renting! The home doesn’t belong to you, so that you don’t have to pay for insurance coverage on it (your landlord has a coverage for that). Each of them cowl your private belongings, although.

-

How does householders insurance coverage work if somebody will get harm in your property?

-

There are lots of methods somebody may get injured in your property (suppose slippery sidewalk, unfastened handrail, damaged steps, an unsecure pool, and the record goes on). Householders insurance coverage comes with legal responsibility insurance coverage, which pays for medical payments, lawyer and court docket charges (in the event that they sue), and different injury-related prices as much as the restrict set in your coverage. It’s among the finest buys in insurance coverage—we advocate you’ve not less than $500,000.

-

What occurs to my mortgage if my householders insurance coverage is cancelled?

-

It’s attainable to lose your mortgage for those who don’t keep householders insurance coverage protection. So sustain together with your funds! However typically your protection can get cancelled and it’s not your fault—like in case your insurance coverage provider reevaluates and decides your space is just too dangerous to insure.

If that occurs, get in contact together with your mortgage lender instantly and allow them to know the scenario. Attempt to get new insurance ASAP as a result of your lender might purchase it for you in the event that they resolve you’re not performing quick sufficient—and that stuff is often round 5 instances as costly as insurance coverage you purchase by yourself.