- BTC has just lately hit one other ATH.

- There was extra scramble to get BTC, driving up its demand.

Bitcoin has surged to a brand new all-time excessive of $106,000, pushed by an unprecedented surge in institutional demand and a tightening provide throughout OTC desks.

On-chain information reveals a major decline in OTC desk balances, whereas obvious demand has continued to outpace provide during the last month. This mix has created a provide squeeze that has fueled Bitcoin’s sharp worth momentum.

Bitcoin institutional accumulation grows

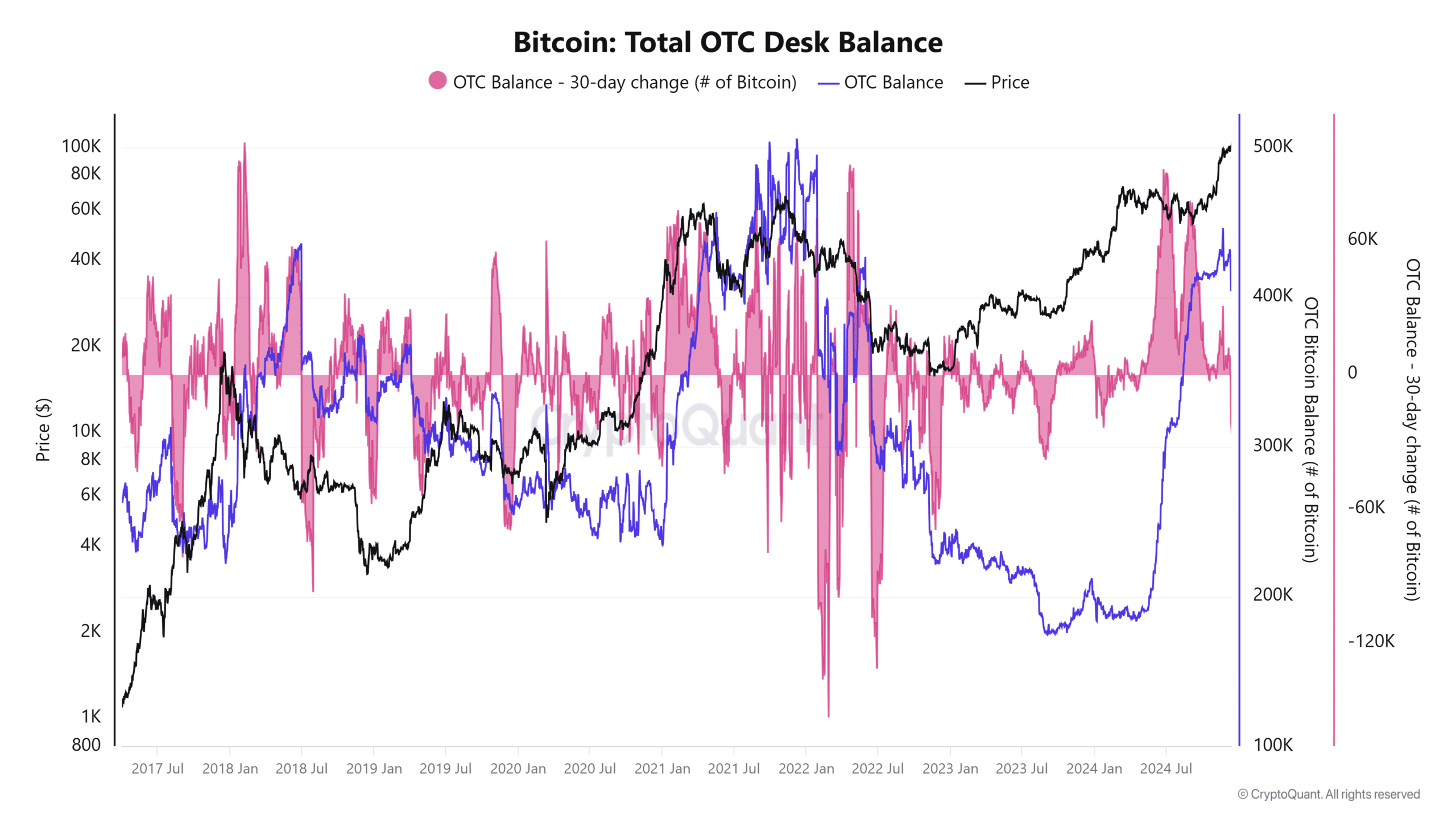

Evaluation of the Bitcoin OTC Desk Steadiness chart, per CryptoQuant, reveals a pointy decline in OTC balances, marking the steepest drop this 12 months. Previously 30 days alone, OTC desk balances have fallen by 25,000 BTC, whereas a complete of 40,000 BTC has left these desks since November 20.

Institutional buyers and high-net-worth people sometimes use OTC desks to buy massive quantities of Bitcoin with out impacting spot market costs. This depletion alerts that establishments are aggressively accumulating, decreasing the accessible provide for broader market individuals.

The dwindling OTC reserves coincide with Bitcoin’s rally to new highs, illustrating how institutional demand has fueled upward momentum whereas making a provide scarcity out there.

Demand outpaces provide, fueling worth momentum

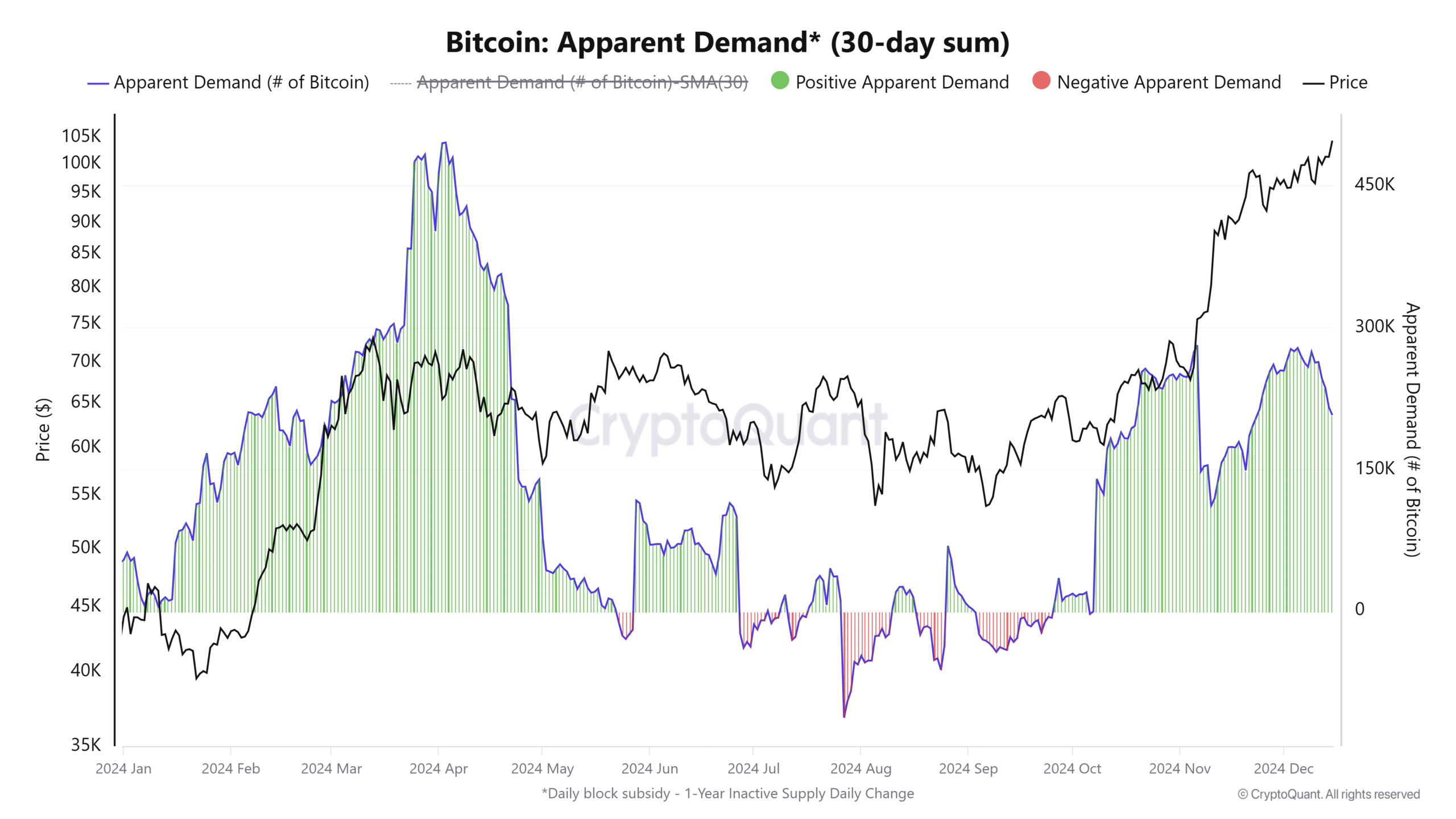

Evaluation of the Bitcoin Obvious Demand chart reinforces the narrative of accelerating demand. Obvious demand, which tracks web Bitcoin absorption, has surged since November, exhibiting constant progress because the market rally gained momentum.

Constructive obvious demand has dominated, reflecting a market atmosphere the place BTC inflows considerably outpace outflows.

As demand surged, Bitcoin broke by way of vital resistance ranges, reaching its present excessive of $106,000.

The decline in OTC balances, mixed with this rise in demand, triggered a provide squeeze, creating the proper atmosphere for BTC’s record-breaking efficiency.

Bitcoin worth motion confirms robust bullish sentiment

The worth chart confirms Bitcoin’s bullish momentum. The worth has fashioned a transparent uptrend, characterised by increased highs and better lows, indicating market energy. Bitcoin stays comfortably above its 50-day and 200-day transferring averages, signaling ongoing assist for the rally.

Moreover, buying and selling volumes have elevated throughout key upward actions, indicating that worth beneficial properties are supported by robust participation from each institutional and retail buyers.

The Relative Energy Index (RSI) is at the moment close to 70, reflecting robust momentum. Nevertheless, it additionally suggests the opportunity of short-term consolidation because the market absorbs current beneficial properties.

Institutional demand and provide squeeze drive BTC increased

Bitcoin’s surge to $106,000 instantly outcomes from rising institutional demand and tightening provide. The depletion of OTC desk balances highlights aggressive accumulation by massive buyers, whereas obvious demand continues to exceed accessible provide.

These elements have created the situations for a major provide squeeze, pushing Bitcoin to new all-time highs.

– Learn Bitcoin (BTC) Price Prediction 2024-25

Whereas short-term consolidation might happen, the long-term outlook stays firmly bullish as institutional confidence and demand for Bitcoin present no indicators of slowing.