Open enrollment for medical insurance received you feeling confused? We hear you!

You’ve received dates to recollect, plans to match and typically larger prices to funds for. Worse—the knowledge you want is normally scattered all around the web.

But it surely’s additionally a terrific alternative to search out the best medical insurance plan on the proper worth. So earlier than you leap straight into the deep finish, let’s kind some issues out.

We included every little thing you have to know in a single place, so you possibly can bookmark and reference it any time. That means, you possibly can really feel assured about your 2025 medical insurance selections.

- Open enrollment for federal market protection throughout 2025 begins November 1 and runs by way of January 15. Open enrollment dates for insurance coverage by way of an employer fluctuate however typically begin in November.

- Open enrollment is a window of time you should purchase medical insurance by way of your employer or on the open market.

- You don’t need to miss open enrollment. The one different time you should purchase medical insurance is when you will have a qualifying life occasion (getting married, having a child, dropping protection and some extra).

- The later you join throughout open enrollment, the later your protection begins.

- Getting medical insurance by way of your employer is normally cheaper, however you’ll have extra plan choices by way of the federal or state market.

What Is Open Enrollment?

First issues first: What’s open enrollment? Open enrollment is the once-a-year window of time when you possibly can join your worker advantages like medical insurance. It additionally refers back to the interval when you should purchase market medical insurance run by the federal or state authorities.

Open enrollment is a giant deal as a result of it’s the one time you possibly can join this stuff below regular circumstances and it occurs simply every year. The one exceptions are when you have what’s referred to as a qualifying occasion (aka you lose protection, have a child, get married, or begin a job—hopefully not in that order).

You don’t need to miss it!

Keep in mind, you want medical insurance. With out it, you’re probably one hospital go to away from monetary catastrophe.

Matthew T. can attest to that from his personal private expertise he shared with the Ramsey Child Steps Fb Neighborhood.

“I spent the final 20 years of my life with out medical insurance,” he mentioned. On April 1 of this yr, at age 40, Matthew signed up for a high-deductible, low-premium well being plan.

“Quick-forward 30 days (you learn that proper), I started experiencing ache in my neck, which radiated up the again left aspect of my head.”

After a number of checks, docs identified Matthew with a severe mind situation that required speedy therapy and a three-day hospital keep. Whole value: $169,912!

“Insurance coverage kicked in and I’m answerable for $8,550,” he mentioned. What an enormous distinction!

How Lengthy Is Open Enrollment for Well being Insurance coverage?

That is such an necessary season—so mark your calendar! How lengthy do you will have? Effectively that depends upon who you’re getting your medical insurance by way of.

- For those who’re going by way of your employer, your open enrollment interval can be set by them and the provider they select—most likely someplace round two weeks.

- For those who’re going to the federal-run open market, you’ll have two-and-a-half months (November 1–January 15).

- For those who’re getting market medical insurance, however your state runs it, your window can be totally different relying on the state you reside in. However they are usually an identical size to the federal open enrollment interval.

- For those who’re getting Medicare, your open enrollment goes from October 15 by way of December 7.

Do You Need to Apply for Well being Insurance coverage Each 12 months?

What if you happen to actually love your medical insurance and don’t need to make any modifications—do it’s important to apply once more? Not likely. Usually, if you happen to don’t take any motion throughout open enrollment by December 15, {the marketplace} will robotically renew your protection to begin January 1.

However hold on! We don’t advocate this. Issues can change yr to yr, each within the market and with you: New carriers would possibly’ve entered the market, current ones would possibly’ve expanded their service areas, or your qualification for a premium tax credit score might’ve modified. You need to be sure you’re getting the most effective protection attainable.

Open enrollment is the most effective time to reevaluate your scenario and actively reapply. That means you already know you’re profiting from every little thing accessible for the upcoming yr.

For those who get your medical insurance by way of your employer, you’ll most likely want to enroll yearly. Test along with your employer to verify!

When Is 2024 Open Enrollment for 2025 Well being Insurance coverage Protection?

Earlier than we dive into particular dates and deadlines, you have to know the place you’ll be getting your protection from. For those who’re not getting it by way of your employer, you’ll must discover your well being protection choices by way of a medical insurance market. Relying in your revenue, household dimension and different components, you would qualify for reductions on protection you get by way of these marketplaces. Let’s hope so!

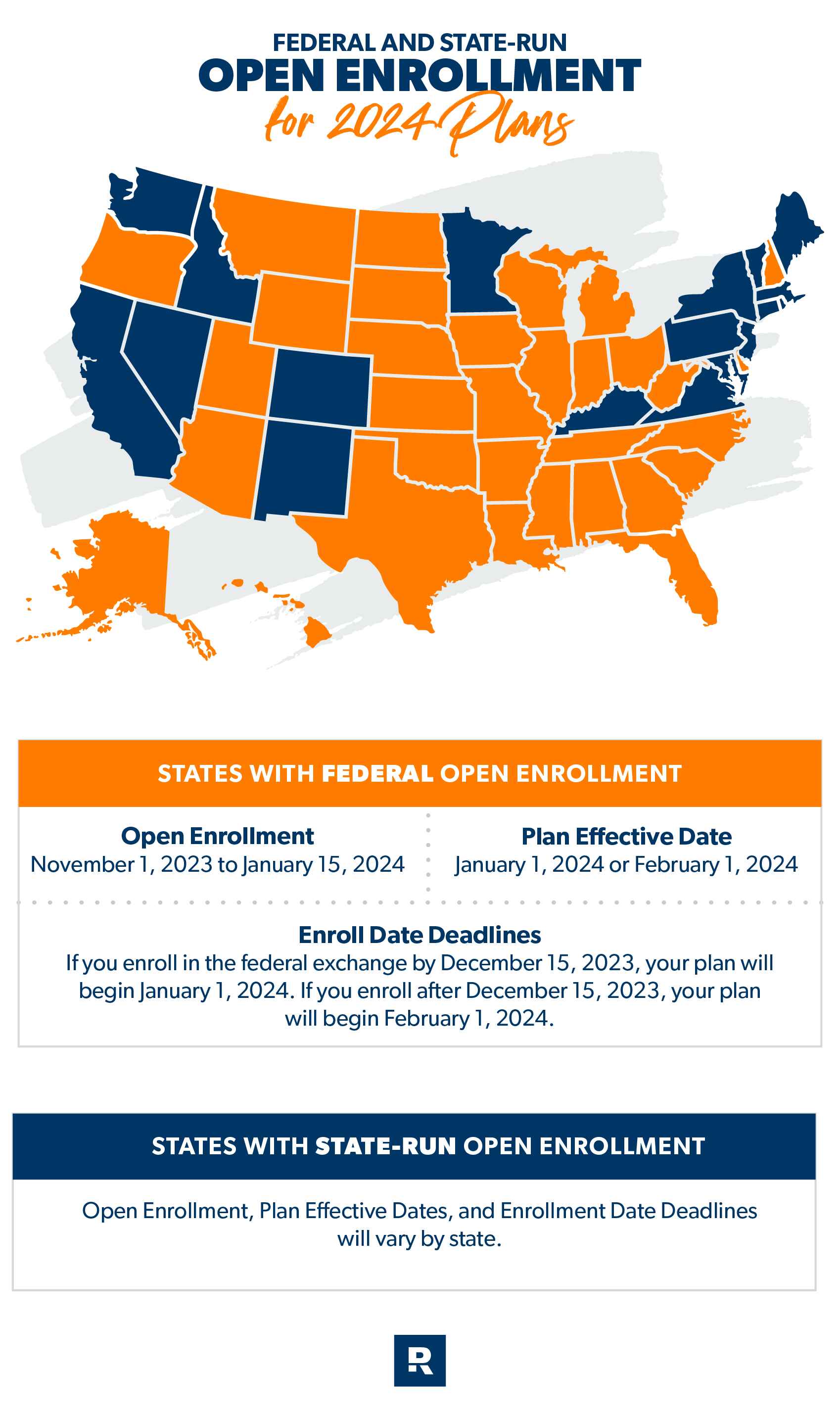

Since most states depend on the federal market (aka trade) to supply medical insurance plans, it’s a well-liked possibility. However there are presently 18 states plus Washington, D.C., that run their very own medical insurance exchanges, so that you’ll need to take a look at our map under to determine which market your state makes use of.

First, let’s discuss open enrollment deadlines for the states that use the federal market. For the final couple years, the U.S. authorities prolonged the enrollment deadline. They usually’re doing it for 2025 as effectively, pushing the deadline out from December 15, 2024, to January 15, 2025. That offers you an additional month to enroll! Simply remember that in case your objective is to get lined in time for January 1, you have to enroll by December 15. Any enrollments between December 16 and January 15 will start protection on February 1.

Subsequent, the states that run their very own medical insurance exchanges have particular person enrollment deadlines and plan efficient dates. Let’s take a look at these dates intimately together with the states that use the federal market.

Dates and Deadlines for 2025 Well being Insurance coverage Protection

The map and chart under present the open enrollment and plan efficient dates for all 50 states and Washington, D.C.

Supply: Kaiser Household Basis1 State-run trade plan data topic to vary.

For those who’re nonetheless not sure about your state-run trade’s plan efficient date, check with your state’s marketplace for further details.

State-Run Open Enrollment for 2025 Plans

|

State |

Open Enrollment Dates |

Plan Efficient Dates |

|

California New Jersey |

November 1, 2024–January 31, 2025 |

Your protection will begin on the primary day of the subsequent month after the month you enroll in. So if you happen to enroll in a state-run trade on December 31, 2024, your protection will begin January 1, 2025. |

|

Rhode Island |

November 1, 2024–January 31, 2025 |

For those who enroll by December 31, 2024, your protection will start January 1, 2025. For those who enroll in January 2025, your protection will start February 1, 2025. |

|

Colorado Connecticut Kentucky Maine Minnesota New Mexico Pennsylvania Vermont Virginia Washington |

November 1, 2024–January 15, 2025 |

For those who enroll by December 15, 2024, your protection will begin January 1, 2025. After that, protection bought by January 15, 2025, begins February 1, 2025. |

|

Nevada |

November 1, 2024–January 15, 2025 |

For those who enroll by December 31, 2024, your protection will begin January 1, 2024. Protection bought after that by January 15, 2025, will begin February 1, 2025. |

|

Idaho |

October 15, 2024–December 15, 2024 |

For everybody who enrolls throughout open enrollment, protection will begin January 1, 2025. |

|

Massachusetts |

November 1, 2024–January 23, 2025 |

For protection that begins January 1, 2025, enroll by December 23, 2024. Protection for individuals who enroll after December 23 by January 23, 2025, will begin February 1, 2025. |

|

New York |

November 1, 2024 (November 16 for renewals)–January 15, 2025 |

For those who enroll by December 15, your protection will begin January 1, 2025. After that, anybody who enrolls by January 15, 2025, will get protection that begins February 1, 2025. |

|

Washington, D.C. |

November 1, 2024–January 31, 2025 |

For those who enroll by December 15, your protection will begin January 1, 2025. For those who enroll by January 15, 2025, your protection will begin February 1, 2025. For those who enroll after January 15, your protection will begin March 1, 2025. |

Supply: healthinsurance.org.1 State-run trade plan data topic to vary.

For those who’re nonetheless not sure about your state-run trade’s plan efficient date, check with your state’s marketplace for further details.

Get the medical insurance you want from Well being Belief Monetary at the moment!

When RamseyTrusted associate Well being Belief Monetary is in your nook, you’ll have peace of thoughts realizing you will have the best medical insurance that gained’t break the financial institution.

Well being Insurance coverage Modifications for 2025?

For people already signed up for medical insurance, the open enrollment interval can convey up some anxiousness. You’re pondering, Will issues change for the brand new yr and disturb my completely ironed-out well being plan? Most likely the most important fear on everybody’s thoughts is a price hike. We will relate!

Throughout the board, charges are anticipated to extend. Premiums for Inexpensive Care Act market plans are predicted to go up between 2% and 10%, with a median of seven%.2

However even with that enhance, skipping medical insurance is just too massive a danger for you and your loved ones to take. Check out your funds and see the place you possibly can save a little to cowl the additional value. And don’t overlook about wanting right into a premium tax credit!

What Data Do I Have to Enroll in a 2025 Well being Plan?

Now that you already know when you have to enroll, let’s go over what you have to know earlier than you enroll.

Don’t fear. You gained’t need to be taught something sophisticated or dig up historic paperwork. You’ll simply must observe some easy pointers earlier than signing up for a year-long dedication. We’re going to interrupt every one down.

Identification

You’ll want some fundamental private data for everybody you need to embody in your plan:

- First and final identify

- E mail deal with

- Delivery date

- State of residence

- Social Safety quantity

- Estimated revenue for the yr you need protection (embody all family members even when they don’t want medical insurance)

Price

Whether or not you’re enrolling in a plan only for your self or to your whole household, you’ll want to grasp some fundamental medical insurance trade jargon. It’ll assist you choose the most effective plan for the most effective worth. Earlier than you signal something, be sure you’re clear on these phrases.

- Premium: A premium is the greenback quantity you pay to an insurance coverage firm for an insurance coverage coverage. Premiums are normally paid on a month-to-month or yearly foundation, however quarterly and each six months aren’t extraordinary. For employer plans, your premiums are normally deducted out of your pay.

- Deductible: A deductible is the greenback quantity you could pay out of pocket earlier than your insurance coverage firm begins chipping in.

- Copay: The copay is the greenback quantity you pay every time you want a selected medical service (copays don’t normally contribute to your deductible).

- HMO or PPO: HMO and PPO are sorts of insurance coverage—HMO stands for well being upkeep group and PPO stands for most well-liked supplier group.

- Coinsurance: Coinsurance is the share of the associated fee you pay after you attain your deductible.

- HSA: HSA stands for Well being Financial savings Account. Basically, it’s a tax-advantaged financial savings account devoted to well being care prices.

The extra you perceive these phrases, the better it’ll be to decrease your insurance coverage invoice. For instance, understanding the connection between premiums and deductibles might prevent a boatload of cash. Why? As a result of selecting to pay the next deductible normally knocks your month-to-month premiums down.

However earlier than you join a $10,000 deductible, let’s discuss when this works and when it doesn’t.

Protection

Whereas medical insurance is a necessary a part of your monetary plan, the best medical insurance coverage seems to be totally different for various households. Go over all of your choices to see what is sensible for you, your loved ones and your cash objectives.

For those who’re wholesome with a wholesome emergency fund to match, you would go for that high-deductible well being plan (HDHP) that qualifies you for an HSA to save lots of on premiums. Then again, if you happen to or your loved ones members want extra common care, a decrease deductible would possibly make sense for you.

Spend a while on this resolution and do your analysis. Keep in mind, you’ll have to stay with the plan you select for a full yr.

What Are My Well being Insurance coverage Choices?

You may get medical insurance by way of an employer or the open market. For those who’re utilizing the final possibility, you’ll get it by way of the federally run market—except you reside in a type of particular states that runs their very own medical insurance market.

From there, you select between totally different plans like a HDHP or a PPO. For those who’re going through your employer, it is best to have a number of plans to select from. Shopping for from the open market means you will have all choices accessible. Right here they’re:

- Well being upkeep group (HMO): HMO plans restrict you to docs inside a sure network. They’re normally the strictest plans however can have decrease premiums.

- Most popular supplier group (PPO): PPO plans are much like HMOs however provide you with just a little extra flexibility. You’ll pay much less for medical care if you happen to use a supplier inside the plan’s community. You are allowed to entry out-of-network suppliers, however they’re costlier.

- Unique supplier group (EPO): EPO plans restrict you to in-network suppliers, aside from emergencies.

- Level of service (POS): POS plans provide advantages like decrease medical payments if you happen to use docs, hospitals and well being care suppliers within the plan’s community. Consider, although, you’ll want a referral out of your major care physician so as to see a specialist.

- Excessive-deductible well being plan (HDHP): HDHP plans are precisely what they sound like. You pay a higher-than-normal deductible, however you get a lot decrease premiums. An HDHP additionally makes you eligible to economize in a pretax HSA.

- Quick-term plan: Quick-term plans are momentary medical insurance insurance policies that bridge the hole once you’re between jobs. They normally final from three months to simply below a yr.

- Catastrophic plans: Catastrophic plans have decrease premiums and excessive deductibles, so that you’d foot the invoice for many of your medical bills. However you’d be protected if, for instance, you had sudden, enormous medical payments from being injured in a automotive accident. These plans are sometimes restricted to these aged 30 and below, however age-limit exceptions can be made for monetary hardship candidates.

In the case of market well being care plans, there are 5 totally different ranges of protection—catastrophic, bronze, silver, gold and platinum. These tiers provide you with totally different choices for a way a lot your plan can pay out versus how a lot you’ll pay. They do not have an effect on the standard of care you will have accessible.

With a catastrophic plan, you pay probably the most out of pocket, and with a platinum plan on the opposite finish of the spectrum, insurance coverage pays for 90% of your prices. As you would possibly guess, the platinum plans have the costliest premiums. Most folk go for the bronze, silver or gold.

What Occurs if I Miss the Open Enrollment Deadline?

For those who don’t join medical insurance throughout the regular enrollment interval (November 1, 2024–January 15, 2025), it’s attainable you gained’t have the ability to enroll or change your medical insurance plan till the next yr’s enrollment interval.

Actually? Sure, actually.

As we touched on earlier, the one time you may make modifications or join after the deadline is if you happen to expertise a serious life occasion (marriage, beginning, job loss, and so forth.). Occasions like that set off nervous tics. No, wait—they set off a particular enrollment interval (SEP—pronounced as a phrase, identical to it’s spelled) the place you possibly can replace your medical insurance selections for the yr. How handy!

However to enroll exterior the traditional timeline, you first must qualify. The medical insurance trade calls these occasions qualifying life events. One other qualifying issue could possibly be distinctive circumstances like a pure catastrophe.3 Let’s go over the life modifications that qualify for a SEP.

Lack of Prior Well being Protection

Shedding your medical insurance might be scary, however the excellent news is that any of the next occasions will qualify you for a SEP:

- Shedding your job

- Turning 26 years previous

- Getting canceled by a non-public provider

- Shedding your eligibility for government-funded protection

Transferring

Whether or not you’re transferring out of state or to a distinct city in the identical state, you would qualify for a SEP in case your transfer is everlasting. When you’ve got questions, the U.S. Division of Well being and Human Providers (HHS) maintains up-to-date pointers for using a everlasting transfer for SEP eligibility.

Marriage

Congrats! Discovering the love of your life is trigger for celebration. Even higher? You would possibly qualify for a SEP so you possibly can formally add your partner to your medical insurance.

Family Change

A cheerful household occasion like giving beginning or adopting a toddler qualifies for a SEP. Extra celebrations are so as! Now you can add your new member of the family to your current medical insurance plan.

A not-so-happy occasion like demise or divorce can even set off a SEP. However provided that the occasion ends in a lack of protection.

Timing

For those who’re enrolled in a federal market well being care plan, and you qualify for a SEP, you will have 60 days earlier than and 60 days after the qualifying occasion to enroll or change your medical insurance particulars.4 As soon as that window closes, the SEP is over and also you’ll must submit an utility for a brand new SEP.

Let’s say you’re enrolled in a state-run plan. In your case, the SEP timing necessities are managed by your particular person state. For those who’re not sure about your state’s SEP dates, check with your state’s marketplace for further details.

Job-based well being care plans have their very own SEP timing necessities which might be additionally totally different from the federal market. Corporations should present a SEP of no less than 30 days.5

Our recommendation? No matter the place you get your medical insurance, don’t postpone a SEP utility. For those who qualify for a SEP, join or make modifications to your plan as quickly as attainable. The longer you wait, the longer you’ll be with out the medical insurance you want, and the longer you’ll be risking monetary catastrophe.

Inquiries to Ask Your Employer

We collected questions staff most frequently ask about employer-sponsored well being plans. We will’t present particular particulars about your employer’s well being plan, however we can information you towards the questions it is best to ask to get the solutions you want.

1. What are the plan’s enrollment and efficient dates?

Most enrollment intervals for company-sponsored medical insurance plans are scheduled in November, and the plan efficient date is normally January 1 of the next yr. However corporations do have some wiggle room right here. You should definitely ask your organization’s plan administrator what the particular enrollment/efficient dates are for your firm.

2. How does the plan handle prescription drug prices?

Modifications in medical insurance supplier drug protection occur on a regular basis. Earlier than you enroll in or change your well being plan, discover out in case your employer has added or excluded protection that might have an effect on how a lot you pay to your prescriptions.

3. What’s the associated fee for overlaying my partner and youngsters?

For those who beforehand had protection for a working partner, ask your organization’s plan administrator in the event that they’re including or rising a surcharge to your partner’s protection. Additionally, corporations could make modifications in worker premium contributions to cowl dependent youngsters. Ask about that too.

4. Can I’m going to my most well-liked physician and hospital?

Some employers change medical insurance corporations, plans or supplier networks to maintain prices down. This could imply that your most well-liked docs and hospitals may not be accessible in your plan anymore. Ask your plan administrator about this so you possibly can alter if wanted.

5. Does this firm do something to assist staff lower your expenses on well being care prices?

Everybody is anxious about well being care prices. Corporations too. Actually, some corporations have made changes particularly designed to decrease well being care prices for his or her staff, together with decrease out-of-pocket prices, decrease premiums for low-wage employees, and a few have even made contributions to worker HSAs. Ask your organization’s plan administrator in case your employer has taken any actions like this that can assist you save money.

Selecting the Greatest Well being Insurance coverage for You

That was a variety of information! And if you happen to’re feeling a bit overwhelmed, we get it. Medical health insurance is sophisticated. There are such a lot of totally different choices that it may be laborious to determine which one is your finest wager. And also you need to be sure you get the best protection.

That can assist you accomplish that, we have put collectively a listing of sensible subsequent steps you possibly can take instantly to get medical insurance finished now.

- Learn extra about why health insurance is a necessary a part of a wise monetary plan.

- Go deeper to be taught extra about how to get health insurance.

- To decide on the proper sort of medical insurance for you and your loved ones, speak to our RamseyTrusted® medical insurance associate Well being Belief Monetary. Their impartial brokers actually know their stuff. Actually, they have been serving Ramsey prospects for over 20 years. If you work with Well being Belief Monetary, they can set you up with the most effective medical insurance quotes and insurance policies to your scenario and clarify all of the insurance coverage jargon to you. Plus they will by no means attempt to promote you one thing you do not want. Connect with them now!

Eager about studying extra about medical insurance?

Signal as much as obtain useful steerage and instruments.

Continuously Requested Questions

-

How do I do know if I can enroll within the market as a self-employed individual?

-

You’re eligible to enroll within the market if you happen to’re a freelancer, marketing consultant or an impartial contractor who doesn’t have any staff.

-

Are there enrollment exceptions if I missed the cutoff date?

-

Sure. For those who qualify for a particular enrollment interval (SEP), you can enroll in a medical insurance plan exterior of the traditional enrollment dates. However provided that you’ve skilled what the medical insurance trade calls a qualifying life occasion. Qualifying life events might be issues like marriage, beginning and transferring.