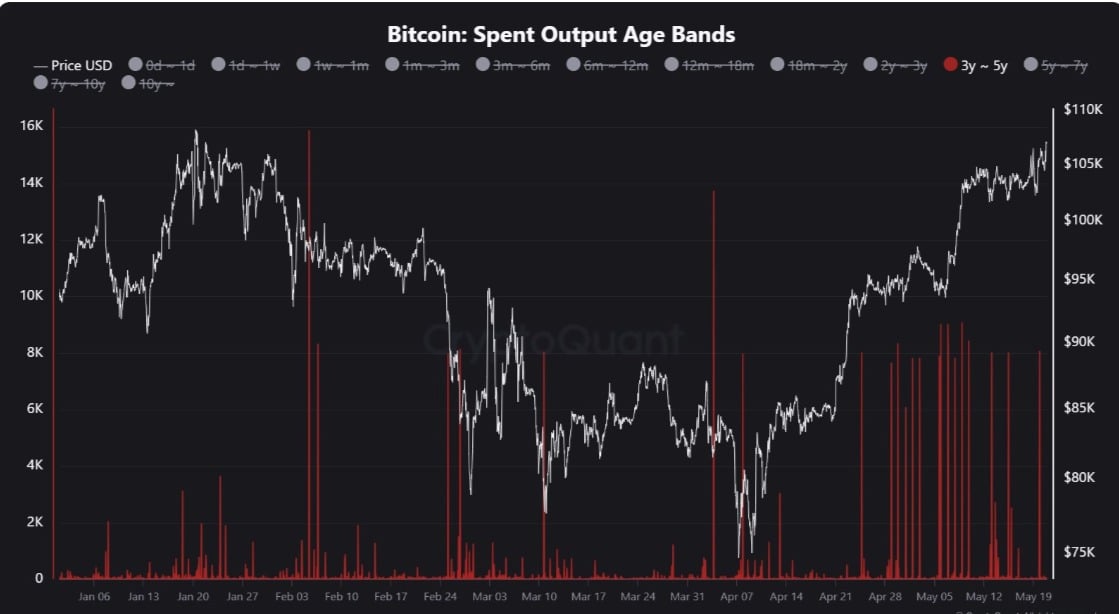

- 8.511 BTC, held for 3-5 years, was on the transfer.

- Bitcoin was experiencing a robust bullish momentum, setting the crypto up for extra positive aspects.

Amid Bitcoin’s [BTC] worth surge, long-term holders are beginning to transfer their cash.

In response to CryptQuant analyst Maartunn, 8,511 BTC from the 3-5 yr age band moved on-chain during the last day.

The newest transfer marked the twenty second occasion this yr during which over 5k BTC from this cohort has been reactivated.

The reactivation led to an increase within the 90-day Coin Days Destroyed (CDD). This means that, as Bitcoin’s worth climbs, older cash are being redistributed, probably reaching new market contributors.

Prior to now day, CDD spiked from 5 million to 29 million, signaling recent demand. Moreover, common dormancy fell from 42 to 33, indicating that new consumers are actively coming into the market.

Assessing Grayscale’s Bitcoin switch

In response to Maartunn, the newest motion of previous Bitcoin seems to have originated from Grayscale, which transferred the BTC to newly created addresses.

Nonetheless, it stays unsure whether or not this quantity displays precise possession adjustments or an inner adjustment.

Traditionally, Grayscale’s ETF flows have typically been unfavourable, and these actions could also be linked to imminent or current outflows.

Nonetheless, Change Netflow information suggests this switch is probably going an inner reshuffling, which means the reactivated BTC has not been deposited into exchanges.

Change Netflow exhibits that Bitcoin has recorded three consecutive days of unfavourable worth. A sustained interval of unfavourable netflow signifies markets are seeing extra withdrawals than deposits, which is often a bullish sign.

CDD, it at the moment sits at 23.8 million, a decline from 29 million. This marked a 6 million drop during the last day. A drop right here suggests that enormous holders have began to scale back their expenditure after the current surge.

That is usually interpreted as bullish, as long-term holders are beginning to take a step again out there.

Influence on BTC

Whereas the motion of previous cash can increase considerations, this current switch was in a roundabout way deposited into the exchanges.

The reactivated Bitcoin stays in non-public wallets, which means it has not negatively affected worth motion. Accumulators nonetheless dominate the market, reinforcing a bullish outlook.

Nonetheless, if Grayscale decides to promote these cash, it might set off outflows and push BTC right down to $104K. Alternatively, if present situations persist, Bitcoin’s uptrend is prone to proceed, probably surpassing $107K and reaching $108K.