We’ve all seen footage of coastal areas devastated by hurricanes—possibly you’ve even skilled that personally. However the reality is, it doesn’t take a hurricane to your residence to flood. Of all of the pure disasters—together with hurricanes—that the U.S. faces, 90% of them contain flooding.1

It doesn’t take a hurricane to your residence to flood.

Pure disasters aren’t the one explanation for a flood both—flooding can come from nearly wherever. So how do you defend your house? The straightforward reply is flood insurance. However flood insurance coverage isn’t precisely easy! So let’s dig in and kind out the completely different sorts of flood insurance coverage, the way it works, and why it’s an vital piece in your recreation plan to cut back your monetary danger.

Associated: For those who’ve already been a flood sufferer, see: My House Flooded . . . Now What?

How Do You Know if You’re at Risk for a Flood?

Does Homeowners Insurance Cover Flooding?

What Does Flood Insurance Cover?

What Doesn’t Flood Insurance Cover?

When Is it Too Late to Buy Flood Insurance?

How Much Does Flood Insurance Cost?

Saving Money on Flood Insurance

Did You Know? Flood Info

Did You Know? Flood Info

Hurricanes can dump 10 inches or extra of rain, but it surely solely takes one inch of water to trigger $25,000 in injury to your house.2

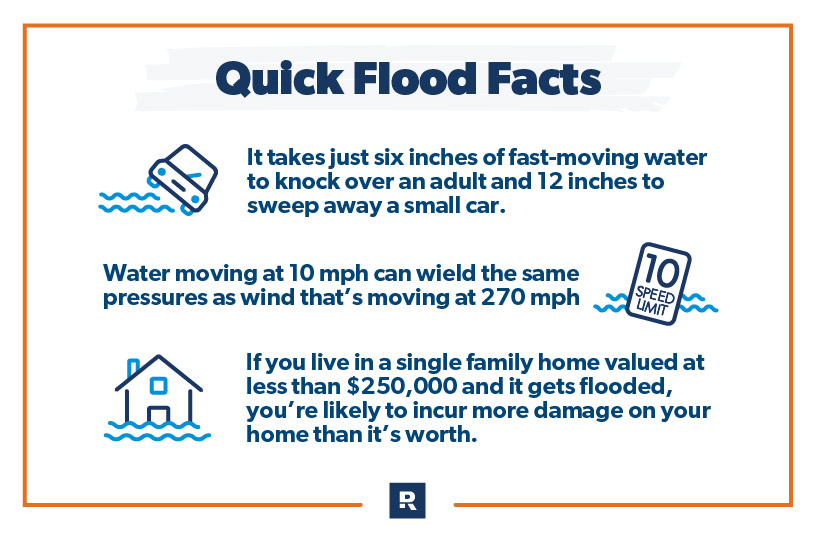

Listed below are a number of extra fast information about floods you would possibly discover shocking.

- Flash floods sometimes carry water between 10 and 20 ft excessive.3

- It takes simply six inches of fast-moving water to knock over an grownup and 12 inches to brush away a small automobile.4

- Water shifting at 25 mph can wield the identical pressures as wind that’s shifting at 790 mph—sooner than the velocity of sound.5

- For those who reside in a 100-year flood plain, your house has a 1% likelihood of flooding yearly. Within the final three years, Houston alone has seen not less than three 500-year floods.6

- For those who reside in a flood plain or a high-risk space, your lender would require flood insurance coverage protection to approve you for a federally backed mortgage.

How Do You Know if You’re at Danger for a Flood?

Don’t get confused—a low-risk flood zone doesn’t imply no-risk flood zone. So even should you’re in a low-risk space, a flood may nonetheless occur to you. And flood danger of some zones adjustments on a regular basis.

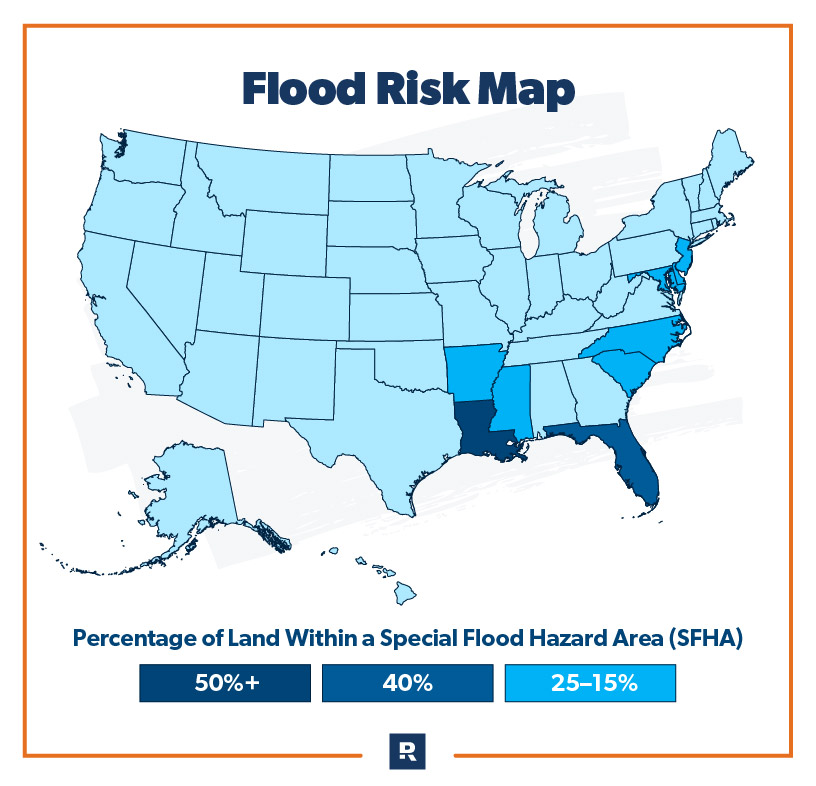

So many elements play a component in evaluating the flood danger to your residence. For instance, a change in climate patterns or the addition of a seawall or dam may trigger the property your own home sits on to go from a high-risk flood zone (particular flood hazard space or SFHA) to a low-risk flood zone. And it really works the opposite means too: A brand new neighborhood getting in down the road may take your house from a low-risk zone to a high-risk zone as a result of it’ll have an effect on the way in which water absorbs and drains in that space. For those who’re unsure if your house is at excessive or low danger, take a look at a flood map. The Federal Emergency Administration Company (FEMA) updates their flood maps (referred to as flood insurance coverage fee maps or FIRMs) yearly by means of in-house research and community-initiated map revisions. The maps give every neighborhood an up-to-date danger class.

For those who’re unsure if your house is at excessive or low danger, take a look at a flood map. The Federal Emergency Administration Company (FEMA) updates their flood maps (referred to as flood insurance coverage fee maps or FIRMs) yearly by means of in-house research and community-initiated map revisions. The maps give every neighborhood an up-to-date danger class.

These maps additionally assist mortgage corporations resolve in the event that they’ll require flood insurance coverage for a house mortgage, they usually inform your insurer what to cost you for flood insurance coverage. And, like we talked about, FIRMs change over time to account for adjustments in land use, neighborhood improvement, climate patterns, wildfires and different elements.

Protect your home and your budget with the right coverage!

Ask your local insurance agent the place your neighborhood ranks for flood danger or go to FEMA’s Flood Map Service Center and put in your handle to view it your self.

The injury from only one inch of water can value a house owner greater than $20,000.

Methods to Put together for Flooding

Perhaps you reside in a flood-prone space or possibly a freak storm is headed your means. Both means, you’ll be able to take steps to arrange your house earlier than the waters rise.

Get Flood Insurance coverage

That’s proper. As soon as the soiled, debris-churned water is lapping at your door, it’s going to be too late. Keep on high of your flooding danger by doing a yearly checkup together with your unbiased insurance coverage agent or by yourself.

Stock Your Home

You need to do that anyway to your common homeowners insurance coverage, however earlier than a flood is a wonderful time to reevaluate what you personal (you bought that new TV after you inventoried, bear in mind?). Footage and even video are a straightforward technique to catalog all the pieces. Seize the value tag, serial quantity or different figuring out marker should you can.

Flood-Proof Necessary Paperwork and Gadgets

The weatherman could also be infamous for getting it fallacious, however he normally can predict a flood a number of days upfront (until it’s a flash flood). If you realize a giant climate occasion is headed your means, put your vital paperwork (suppose delivery certificates, Social Safety playing cards, passports, medical data, and insurance coverage papers and data) and any transportable valuables in a water-resistant, safe location.

Elevate Utilities

For those who reside in a flood-prone space, placing your utilities (suppose HVAC air handlers, electrical panels, propane tanks, and so forth.) on a second ground or on stilts can stop quite a lot of costly injury.

Put together Your Basement

If your own home has a basement, purchase a sump pump and set up a water alarm to maintain it from changing into an underground swimming pool. Contemplate getting a battery-operated pump in case the ability goes out.

Put together Your Home

Sandbags could make the distinction between catastrophic injury and an annoying restore. They gained’t maintain all of the water out, however they’ll maintain most of it out by redirecting it. Sandbags are particularly useful at blocking water from storage doorways, basement home windows, sliding doorways, gaps in partitions, a shallow trench or a door that’s decrease than the others.

Preserve your gutter and downspouts clear to allow them to do their job of directing water away from your house’s basis. Transfer your furnishings and anything you’ll be able to as much as increased floor, like your second ground.

To forestall any electrical shorts, unplug your home equipment and gadgets. Additionally shut off any propane tanks.

Safe any out of doors furnishings or gear, and don’t overlook the trash cans and gear shed.

Make a Plan to Get to Security

Work out the place and methods to get to increased floor if wanted and take into consideration what you’ll depart behind and what you’ll take with you.

Free Flood Preparedness Guidelines

For those who’re able to be ready in case of a flood, this is a free guidelines that can assist you keep on monitor.

Floods After Fires

Hearth and water? These don’t combine! You in all probability wouldn’t suppose it, however wildfires could make flooding extra extreme. Flash floods and mudflows spike after fires as a result of scorched earth can’t take up water very properly. Fires additionally change the panorama, eradicating forests and floor cowl that might usually direct water elsewhere or take up it.

A wildfire can improve a area’s danger of flooding for as much as 5 years—till crops and bushes have an opportunity to develop again.

Does Householders Insurance coverage Cowl Flooding?

For those who suppose you’re lined for flooding by your homeowners insurance policy, suppose once more.

In 2020, 27% of individuals surveyed by the Insurance coverage Data Institute (III) stated that they had flood insurance coverage. However the Nationwide Flood Insurance coverage Program (the federal authorities’s public insurance coverage) estimates the precise variety of of us with flood insurance coverage insurance policies is far decrease. III suggests the explanation these numbers aren’t matching up is as a result of individuals suppose they’ve flood insurance coverage once they don’t.7 (Hopefully after studying this text, that gained’t be you!)

Many individuals mistakenly imagine they’re lined for floods underneath their common homeowners insurance policy. Your private home insurance coverage will solely cowl flooding that comes from inside your own home—like a burst washer hose. If water comes into your own home from the skin, that’s an entire completely different ball recreation and also you’ll want flood insurance coverage to cowl injury from that.

What Is Flood Insurance coverage?

Flood insurance coverage pays to restore or rebuild your house and change your stuff should you get hit by a flood. FEMA defines flooding as “an extra of water on land that’s usually dry, affecting two or extra acres of land or two or extra properties.”8 For those who reside underneath the specter of water coming into your own home from a storm or overflowing river, you ought to get flood insurance coverage.

You should buy flood insurance coverage from the federal authorities or by means of a non-public flood insurance coverage provider.

The Two Sorts of Flood Insurance coverage

There are two varieties of flood insurance coverage. That’s proper—it couldn’t be straightforward and simply be one. However that is excellent news for you as a result of two varieties means there are alternatives—choices that might prevent cash!

One type is offered by means of FEMA and the opposite is offered by means of personal insurers. Each varieties have completely different protection choices and prices. However what’s the distinction between the 2, which one is greatest for you, and what do they every cowl? Let’s break ’em down so you’ll be able to perceive your choices.

Nationwide Flood Insurance coverage Program (NFIP)

The Nationwide Flood Insurance coverage Program, or NFIP, provides flood insurance coverage by means of FEMA. So long as your neighborhood is in one of many almost 21,000 communities that take part in this system, it is best to be capable to get NFIP protection.

Professionals:

- Simple to get: NFIP insurance coverage is bought by means of non-federal, unbiased insurance coverage brokers who can write up flood insurance coverage instantly from the federal government or from personal insurance coverage corporations. (Not all insurance coverage corporations supply NFIP.) Contact your local insurance agent to see if they provide it or can advocate somebody who does.

- Decrease premiums: Usually, NFIP is cheaper than personal flood insurance coverage, however not at all times. Forty p.c of annual premiums for single-family properties common out to $673 and the following 31% common out to $1,416. The highest 1% pays a mean of $8,439. Total, the common premium is available in at about $900.9 For those who can’t afford your annual premium up entrance, you may as well pay for it in month-to-month installments.

- Can’t be canceled: You gained’t lose your protection as a result of your danger rises and your insurer thinks it’s now too excessive.

- Federally backed: With an NFIP coverage, you’re lined by the federal authorities, so you realize you’ll get your cash.

Cons:

- Takes longer to kick in: It takes 30 days for NFIP protection to enter impact. Though there are a number of exceptions, don’t wait till the final minute to get protection should you want it!

- Decrease protection limits: NFIP will cowl as much as $250,000 for injury to your house (constructing protection) and as much as $100,000 to your belongings (private property protection).

- Takes longer to receives a commission: Relying on the sort of declare you’re making and the way rapidly your insurance coverage firm responds to it, getting the complete payout could take as much as a 12 months—so be ready to be affected person. In some circumstances, you might need to make repairs earlier than your insurance coverage firm pays you or they might ask for a quote first. Additionally they could have your contractor invoice them instantly for any repairs.As soon as an adjuster has evaluated the injury, you’ll be able to request an advance or partial cost to get began on repairs that may’t wait.

Associated: Saving cash shouldn’t imply sacrificing protection. Individuals who have labored with a RamseyTrusted native insurance coverage professional saved over $700 and obtained 50% extra protection. Find out how much you could save.

Personal Flood Insurance coverage

Only some insurers supply personal flood insurance coverage—flood insurance coverage not funded by means of the federal authorities. Presently, about 10% of flood insurance policies are by means of a non-public firm.

As a result of personal flood insurance coverage insurance policies differ (rather a lot!) by the insurance coverage corporations that provide them, you’ll wish to ask your local insurance agent to provide you flood insurance coverage quotes on each NFIP and personal flood insurance policies to see what every will cowl for you.

Under are some execs and cons of personal flood insurance coverage that can assist you get a really feel for whether or not personal flood insurance coverage may give you the results you want.

Professionals:

- Greater protection: Personal flood insurance coverage sometimes provides the next stage of protection than NFIP’s $250,000 restrict on your house and $100,000 restrict in your belongings.

- Shorter wait: With some personal insurers your protection may go into impact in lower than every week, whereas NFIP usually takes 30 days to kick in.

- Further advantages: If you need to quickly relocate, personal insurance coverage could present for short-term housing. Relying on the coverage, you could possibly additionally doubtlessly purchase protection for gadgets or areas not lined by means of NFIP.

- Backed by the state: Relying on the insurer and state, your coverage could also be backed by one thing referred to as a warranty fund. This implies the state pays the protection if the insurer folds.

- Actual-time danger evaluation: A non-public insurer could have a extra up-to-date danger evaluation in your property than the NFIP’s, which may aid you higher perceive and put together for any flood-related hazards.

- Prices much less: As a result of their danger evaluation is extra correct, a non-public insurer could decide your property is in a decrease danger space than FEMA’s flood maps at present point out, saving you a ton of cash in your premium!

Cons:

- Greater premiums: With personal insurance coverage, you’re prone to pay a heftier premium, particularly should you reside in a high-risk space.

- Not backed by all banks: As a result of banks are likely to view personal insurance coverage corporations as the next danger than insurance coverage by means of FEMA, they might not settle for personal flood insurance coverage should you carry a mortgage with them.

- Not accessible in your space: For those who reside in a high-risk space, a non-public insurer could deny you protection in the event that they deem you too excessive of a danger.

- Protection will be canceled: Personal insurers can cancel your coverage or select to not renew it in case your danger ranking goes up or they resolve you’re too excessive of a danger.

Do I Want Each Sorts?

If your house is price greater than $250,000 and also you’re in a high-risk space, you may very well want each varieties of protection. Since NFIP insurance policies are sometimes (however not at all times) cheaper, think about carrying the utmost quantity of protection by means of NFIP mixed with protection by means of a non-public insurer. That means, damages that exceed the boundaries of your NFIP coverage will nonetheless be lined.

However, in case your property is taken into account low danger and NFIP doesn’t supply the protection you want, you’ll be able to streamline your protection with a coverage by means of a non-public insurer that’s backed by a warranty fund. This might doubtlessly offer you a sooner turnaround with the processing and cost of your declare. Ask your insurance coverage agent if both or each is the appropriate match for you!

Flash floods sometimes carry water between 10 and 20 ft excessive.

Wish to be certain your loved ones is roofed on all bases? Verify in your protection earlier than it turns into an emergency by taking our 5-Minute Coverage Checkup to be sure you have what you want.

|

NFIP vs. Personal Flood Insurance coverage |

||

|

NFIP Coverage |

Personal Coverage |

|

|

Protection Restrict |

$250,000 constructing $100,000 contents |

$1 million+ |

|

Ready Interval |

30 days |

7+ days |

|

Monetary Backing |

Federally backed |

State backed (typically) |

|

Premiums |

Are usually decrease |

Are usually increased |

|

Availability |

In every single place |

Restricted |

|

Substitute Value Constructing Protection |

Sure |

Sure |

|

Substitute Value Contents Protection |

No |

Sure |

|

Further Dwelling Bills (ALE) |

No |

Sure |

What Does Flood Insurance coverage Cowl?

For those who’ve been studying up on insurance coverage in any respect, you’ve in all probability discovered that it’s by no means easy. There are at all times exceptions and hoops to leap by means of. So, what does flood insurance coverage cowl?

Nicely, there are two completely different sorts of protection you should purchase: constructing and contents. Similar to it sounds, building coverage covers the construction of your own home (or enterprise) whereas contents protection covers what’s inside. Understand that each constructing protection and private property protection have their very own deductibles.

Let’s check out what they cowl:

Constructing Protection

- Insured constructing and basis

- Electrical and plumbing techniques

- Furnaces and water heaters

- Fridges, cooking stoves and built-in home equipment

- Completely put in carpeting

- Completely put in cupboards, paneling and bookcases

- Window blinds

- Basis partitions, anchoring techniques and staircases

- Indifferent garages

- Gasoline tanks, properly water tanks and pumps, and photo voltaic vitality gear

- Particles elimination

Contents Protection

- Private belongings, like clothes, furnishings and digital gear

- Curtains

- Washer and dryer

- Transportable and window air conditioners

- Microwave ovens

- Meals freezers (and the meals inside)

- Carpets not included in constructing protection (aka carpet put in over wooden floors)

- Worthwhile gadgets, equivalent to unique paintings and furs (With an NFIP coverage, the restrict is as much as $2,500. With a non-public provider, it’ll differ.)

Coverage limits will differ with a non-public supplier, however NFIP has very particular limits. As with each insurance coverage coverage, take a look at the declarations web page of your insurance coverage coverage or speak to your native insurance coverage agent to search out out what your protection contains.

What Doesn’t Flood Insurance coverage Cowl?

Like we talked about earlier, insurance coverage isn’t easy. Right here’s the place we get into the exclusions.

Some frequent issues not lined by NFIP flood insurance coverage are:

- Water injury or moisture leading to mold growth (and extra injury) that the house owner may have prevented

- ALE (extra residing bills), as within the prices to cowl a lodge or meals whereas your house is being repaired

- Most automobiles like vehicles, boats, and so forth.

- Stuff saved in a basement or finishings (like carpeting, drywall, and so forth.)

- Something exterior the constructing that’s insured (suppose landscaping, swimming pools, patios, fencing, septic techniques, and so forth.)

- Misplaced revenue or different monetary losses from having to shut your online business or not with the ability to use your insured property (suppose farms or rental properties)

- Harm from water flowing underneath the bottom

- Any additional expense that comes from having to adjust to new legal guidelines, rules or code as you rebuild or restore from flood injury

In the case of personal flood insurance coverage, the exclusions might be related however can differ. Remember, flood insurance policies can differ rather a lot, so be sure you know what’s in yours.

How Flood Insurance coverage Works

Flood insurance coverage covers you financially in case a flood occasion damages your house. Your own home getting flooded is devastating, but when a hurricane is headed to your hometown and you’ve got flood insurance coverage, you’ll be able to have peace of thoughts understanding your funds gained’t be swept away too.

Relying on what type you get, your flood insurance coverage pays you some or the entire value to interchange your house and possessions. Similar to with homeowners insurance, flood insurance coverage insurance policies are available in two sorts of coverages: substitute value worth (RCV) and precise money worth (ACV).

Substitute Value Worth Flood Insurance coverage

With RCV protection, the insurance coverage firm provides you with sufficient cash to restore or change your constructing and stuff at what it prices within the present market. So if it value $300,000 to construct your house seven years in the past however it might value $415,000 now, you’ll get $415,000. Similar goes to your stuff inside.

With NFIP insurance policies, constructing property protection is at all times RCV coverage. This implies it covers what it might value to restore or change your house as much as $250,000 (so long as your coverage covers not less than 80% of the complete substitute value of your own home and you carry the max quantity of protection).

Precise Money Worth Flood Insurance coverage

Lots of people select ACV protection as a result of it comes with a less expensive premium. But it surely solely pays out what your construction or private property is price minus depreciation. In different phrases, you’ll be paid for the worth of your stuff right this moment—not what it might value to interchange it with new stuff. So quite a lot of what’s used to complete out your own home—like carpeting—wouldn’t get totally paid for by insurance coverage with ACV. Similar factor goes to your stuff—you’d get the used value (not the brand new value) to your TVs, fridge, dishwasher, garments, gadgets and so forth.

With an NFIP coverage, ACV is the one sort of protection you will get to your private property. Private property (contents) protection replaces as much as $100,000 in gadgets and contains depreciation worth. So, should you paid $2,000 for that TV three years in the past, private property protection would pay what it’d be price right this moment as a substitute of what you paid for it initially or what it might value to interchange it.

With a non-public flood insurance coverage supplier, you’ve extra choices relating to the sort of private property protection you will get.

Methods to File a Flood Insurance coverage Declare

If your own home has turned into a retention pond, you’ll have to contact your personal insurer or an agent with the NFIP instantly that can assist you begin your declare. Professional tip: Ask for an advance cost that can assist you get began with cleanup. This’ll be deducted out of your last protection complete.

It’d take some time for an agent to make it out to examine your own home. In the meantime, you’ll want to start out cleansing up the mess, and that may have an effect on how seen the injury is. So, each time it’s protected to take action, doc all of the injury to your house. Use video and photos to file in all places the water went, together with floodwater strains on partitions.

Subsequent comes cleanup. It’s vital to do that ASAP as a result of relating to mildew injury from a flood, should you haven’t finished all you’ll be able to to forestall mildew progress, insurance coverage could not cowl it.

Whenever you meet together with your insurance coverage adjuster, they’ll aid you submit an estimate of your losses and reply any questions. Bear in mind to double-check the adjuster’s written report to verify they obtained all the pieces.

Subsequent up, it is best to get cost. How a lot you get will rely in your coverage sort, the adjuster’s analysis, and the way properly you documented and represented the injury your house suffered.

When Is it Too Late to Purchase Flood Insurance coverage?

Usually, a flood insurance coverage coverage takes seven to 30 days from buy to kick in. So . . . after the water is in your house is unquestionably too late. When the storm is brewing off the coast, that’s additionally too late. When your house is smack in the course of the cone of uncertainty, that’s—you guessed it—too late. And when the river is rising an inch an hour, that’s well past too late.

For those who’re planning on getting a coverage with the NFIP, there’s normally a ready interval of 30 days earlier than it goes into impact. With personal flood insurance coverage, your ready interval could possibly be a lot shorter—someplace between seven to 17 days. However which means you continue to should plan forward.

For those who wait till hazard is looming to consider flood insurance coverage, you’ll should depend on sandbags and prayer. It may be sunny and dry exterior, however now could be the time to determine should you want monetary safety in opposition to a flood.

How A lot Does Flood Insurance coverage Value?

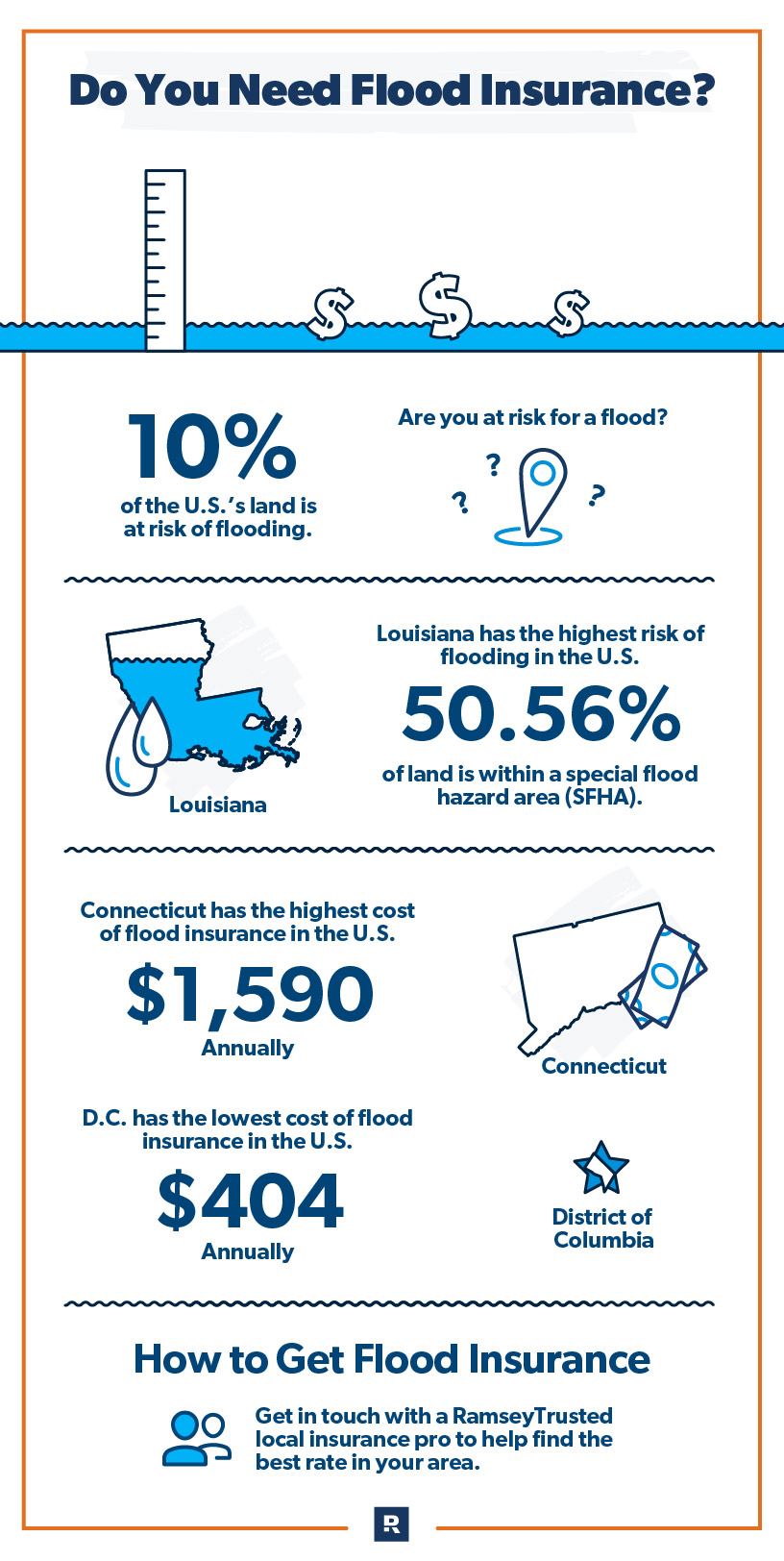

Like with different varieties of insurance coverage, how much flood insurance costs hinges in your scenario. Whereas the common flood insurance coverage fee from NFIP is about $900 a 12 months, many elements go into your particular fee together with your house’s location, your neighborhood’s flood danger, and whether or not you’ve finished any flood-proofing.

Your fee will change relying on:

- Whether or not you’re shopping for constructing or contents protection (or each)

- How massive of a deductible you select and the boundaries in your protection

- The place your construction is situated in your property (Is it downhill or in an space the place water would gather?)

- How your constructing is designed (Is it on stilts?)

- How outdated your own home is

- The place your greatest (aka costliest) stuff is saved (Are your utilities on the second ground or on stilts?)

As a result of location performs such a giant position in charges, you’ll be able to think about they differ a bit from state to state.

Flood Insurance coverage Charges by State

Questioning the place your state sits within the lineup? Usually, Northeastern states are likely to see the best charges for flood insurance coverage. Many are near the ocean and have a community of waterways which are vulnerable to flooding from snowmelt and heavy rain.

Locations like Hawaii and Florida additionally high the record as a result of they’re hurricane magnets.

|

Prime 10 States for Highest Danger-Primarily based Annual Premium From NFIP |

|

|

State |

Common Annual Danger-Primarily based Price |

|

Hawaii |

$3,653 |

|

West Virginia |

$3,074 |

|

Connecticut |

$3,000 |

|

Maine |

$2,700 |

|

New Hampshire |

$2,545 |

|

Vermont |

$2,248 |

|

Florida |

$2,213 |

|

Kentucky |

$2,201 |

|

New York |

$2,197 |

|

Mississippi |

$2,137 |

Information From FEMA11

Residents in lots of flood-prone areas don’t truly pay a flood insurance coverage premium that displays the chance of residing the place they do. For these with NFIP insurance policies, the federal authorities subsidizes some charges so owners don’t get priced out by up to date flood zones (and skyrocketing charges). However annually, their premium will increase till they finally attain the risk-based fee. If you buy a flood coverage now although, you’ll pay the complete fee.

|

What Prime 10 Lowest Price States Pay vs. Danger-Primarily based Annual Premium From NFIP |

||

|

State |

Common Annual Sponsored Price |

Common Annual Danger-Primarily based Price |

|

District of Columbia |

$404 |

$407 |

|

Alaska |

$454 |

$543 |

|

Maryland |

$608 |

$742 |

|

Utah |

$645 |

$953 |

|

Nevada |

$715 |

$1,031 |

|

Virginia |

$743 |

$1,077 |

|

Texas |

$776 |

$1,405 |

|

Georgia |

$791 |

$1,332 |

|

North Carolina |

$791 |

$1,363 |

|

North Dakota |

$798 |

$1,342 |

Information From FEMA12

Whereas most individuals get their flood insurance coverage by means of the NFIP, personal insurers can typically be cheaper (oh yeah!). A local independent insurance agent can evaluate flood insurance coverage quotes for you and discover you the best choice. However there are different methods to save cash too.

Saving Cash on Flood Insurance coverage

What’s extra of a bummer than discovering out you have to purchase one thing that’s actually costly? Not a lot. However don’t get too bummed out—there are methods to save lots of on this spendy necessity.

As with most insurance coverage insurance policies, whether or not you want flood insurance coverage—and what you’ll pay for it—is predicated on the diploma of danger you at present face. So, how are you going to lower your danger and decrease your premium?

The Fundamentals

Examine Charges

When deciding on flood insurance coverage, don’t assume one supply might be less expensive than the opposite. You’ll want to get flood insurance coverage quotes out of your agent for each personal and NFIP insurance policies to search out out which one will work greatest for you.

Enhance Your Deductible

As of 2022, a $10,000 deductible would end in as much as a 40% low cost in your base premium.13 Don’t overlook—you may possible have two deductibles, one on the constructing and one on the contents.

Keep Your Protection

Whether or not it’s your personal residence or a home you’re trying to purchase, do your greatest to keep away from any lapses in protection. In case your property occurs to be grandfathered (see under) right into a decrease danger class than FEMA’s newest flood maps replicate, that’ll assist your premium keep on the decrease fee.

Going the Additional Mile

Wish to maximize your financial savings? Listed below are a number of methods to doubtlessly decrease your flood insurance coverage premium much more and scale back your danger of flooding. Talk with your insurance agent to see which steps may be an excellent match for you.

Scale back Your Doable Harm

In accordance with FEMA, properties in-built compliance with NFIP requirements expertise about 80% much less injury than properties that aren’t.14 Check out these methods to guard your house:

- Moist flood-proofing: This may occasionally sound somewhat loopy. Is that this like preventing fireplace with fireplace—solely it’s water with water? Form of! If the underside a part of your house sits under base flood elevation—the peak floodwater has not less than a 1% likelihood of reaching throughout the 12 months—moist flood-proofing would be the repair for you.

To fulfill NFIP requirements, the a part of your house that’s underneath the bottom flood elevation would must be an area you’re not residing in, like a basement, storage or perhaps a crawl area. To flood-proof the area, you’d have to assemble or rebuild it with supplies which are immune to floodwaters. You’d additionally wish to be certain to place in flood openings—small openings constructed into the bottom of the partitions—to permit the floodwaters that are available in to additionally stream out and not using a pump.

- Dry flood-proofing: This one makes extra sense proper off the bat. Dry flood-proofing retains floodwaters from moving into the house with flood-proof sealants and boundaries. You too can add a drainage system to divert water away from the home.

- Repositioning home equipment: Jack ’em up! One possibility to assist stop flood injury is to maneuver any heating or cooling techniques, in addition to electrical panels, as far-off from the bottom flood elevation as attainable.

- Elevating your house: For max safety, some owners select to both relocate their residence to an space of their property that’s increased or elevate their residence on stilts so it’s above the bottom flood elevation.

Switch Over Earlier Proprietor’s Flood Coverage

For those who’re buying a house in a flood zone and the vendor has a flood coverage, they’ll switch that present coverage to you—serving to you to keep away from the complications of attempting to get a brand new coverage. This additionally permits you to keep away from the 30-day ready interval with NFIP for brand spanking new insurance policies.

Ask About Grandfathering

As FEMA updates its flood maps, your house may go from a low-risk zone to a high-risk zone, elevating your premium (no thanks). If that occurs, look into getting grandfathered in at your earlier flood zone ranking. So long as your house was constructed to code with its flood zone at the moment, you could possibly qualify for the decrease fee—and this might prevent a ton of cash!15 Remember, if the brand new maps put your property in a decrease danger flood zone, this in all probability isn’t a cheap answer for you.

Right the Map

If the present flood maps present you in a high-risk space however you’re in a low-risk flood zone, you’ll be able to apply for a Letter of Map Change (LOMC)—an official revision to the FEMA’s flood map—and never have to attend for the map to be bodily modified by FEMA.

Methods to Get Flood Insurance coverage

It pays to take a look at your flood danger and look into insurance coverage as a result of, as we’ve seen, it doesn’t take Noah’s flood to wipe out your house and funds. By understanding the hazards chances are you’ll face and what your protection choices are, you’ll be able to sleep tight at night time understanding you made the very best determination for you and your house.

But when the thought of figuring all this out by yourself has you feeling such as you’re Noah with out an ark, right here’s a lifeline: Get in contact with a RamseyTrusted local insurance pro.

These of us are consultants of their subject and might help you determine your house’s danger stage, how a lot flood insurance coverage chances are you’ll want, and whether or not an NFIP or personal coverage would greatest suit your scenario. On high of that, they’ll store round to be sure you’re getting the very best deal!

Don’t wait till the water is at your door. Reach out to a local insurance pro today.